-

Table of Contents

- Introduction

- Understanding the Basics of LLC Formation in the USA

- Step-by-Step Guide to Registering an LLC in the USA

- Key Considerations for LLC Formation Process in the USA

- Exploring the Benefits of Forming a Limited Liability Company (LLC)

- Common Mistakes to Avoid during the LLC Formation Process

- Navigating the Legal Requirements for LLC Formation in the USA

- Choosing the Right State for LLC Formation: Factors to Consider

- Step-by-Step Guide to Drafting an LLC Operating Agreement

- Exploring Different Options for LLC Registration in the USA

- Essential Steps for Successfully Starting a Business through LLC Formation

- Q&A

- Conclusion

Your guide to LLC formation in the USA, step-by-step.

Introduction

The process of forming a limited liability company (LLC) in the United States involves several steps that need to be followed in a specific order. This step-by-step guide will provide you with a clear understanding of the LLC formation process in the USA.

Understanding the Basics of LLC Formation in the USA

The formation of a limited liability company (LLC) in the United States is a popular choice for entrepreneurs and small business owners. This business structure offers the benefits of both a corporation and a partnership, providing liability protection for its owners while allowing for flexibility in management and taxation. Understanding the basics of LLC formation in the USA is crucial for anyone considering starting their own business.

The first step in the LLC formation process is to choose a name for the company. The name must comply with the state’s regulations and should not be too similar to any existing business names. It is advisable to conduct a thorough search to ensure that the desired name is available and not already in use. Once a name is chosen, it is important to reserve it with the appropriate state agency to prevent others from using it.

After selecting a name, the next step is to prepare and file the necessary documents with the state. Each state has its own requirements, but generally, the formation documents include the Articles of Organization or Certificate of Formation. These documents typically require basic information about the LLC, such as its name, address, and the names of its members or managers.

Once the formation documents are prepared, they must be filed with the state agency responsible for business registrations. This is usually the Secretary of State’s office or a similar agency. Filing fees are typically required, and the LLC is not considered officially formed until the documents are accepted and approved by the state.

After the LLC is officially formed, it is important to create an operating agreement. While not required by all states, an operating agreement is a crucial document that outlines the rights and responsibilities of the LLC’s members, as well as the rules for operating the business. This agreement helps to establish clear expectations and can prevent disputes among members in the future.

In addition to the operating agreement, it is also necessary to obtain any required licenses and permits. The specific licenses and permits needed vary depending on the nature of the business and the location. It is important to research and comply with all federal, state, and local regulations to ensure legal compliance.

Another important step in the LLC formation process is obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This unique nine-digit number is used to identify the LLC for tax purposes. It is required for opening a business bank account, hiring employees, and filing tax returns.

Finally, once all the necessary paperwork is completed, it is important to keep accurate records and maintain compliance with ongoing requirements. This includes filing annual reports, paying taxes, and renewing licenses and permits as required by the state and local authorities.

In conclusion, understanding the basics of LLC formation in the USA is essential for anyone looking to start their own business. From choosing a name to filing the necessary documents and obtaining licenses, each step in the process is important for ensuring legal compliance and setting the foundation for a successful business. By following this step-by-step guide, entrepreneurs can navigate the LLC formation process with confidence and start their business on the right foot.

Step-by-Step Guide to Registering an LLC in the USA

Starting a business can be an exciting and rewarding venture. One of the first steps in establishing a business is choosing the right legal structure. For many entrepreneurs, forming a limited liability company (LLC) is an attractive option. An LLC provides the benefits of both a corporation and a partnership, offering liability protection for its owners while maintaining a flexible management structure. If you’re considering forming an LLC in the USA, this step-by-step guide will walk you through the process.

The first step in forming an LLC is choosing a name for your business. It’s important to select a name that is unique and not already in use by another business. You can check the availability of your desired name by searching the database of the Secretary of State’s office in the state where you plan to form your LLC. Once you’ve confirmed that your chosen name is available, you can reserve it for a small fee.

After selecting a name, the next step is to prepare and file the necessary paperwork. Each state has its own requirements for LLC formation, so it’s important to research the specific requirements of the state where you plan to form your LLC. Generally, you will need to file Articles of Organization with the Secretary of State’s office. These articles typically include basic information about your LLC, such as its name, address, and the names of its members.

Once you’ve filed the Articles of Organization, you will need to create an Operating Agreement. While not required by all states, an Operating Agreement is a crucial document that outlines the ownership and management structure of your LLC. It also establishes the rights and responsibilities of its members. Even if your state doesn’t require an Operating Agreement, it’s highly recommended to have one in place to avoid potential disputes in the future.

After completing the necessary paperwork, you will need to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). An EIN is a unique nine-digit number that identifies your LLC for tax purposes. You can apply for an EIN online through the IRS website, and the process is typically quick and straightforward.

Once you’ve obtained your EIN, you will need to fulfill any additional state-specific requirements. This may include obtaining any necessary licenses or permits for your specific industry. It’s important to research and comply with all applicable regulations to ensure your LLC is operating legally.

Finally, you will need to open a business bank account for your LLC. Keeping your personal and business finances separate is essential for maintaining the liability protection offered by an LLC. To open a business bank account, you will typically need to provide your LLC’s formation documents, EIN, and any other required identification.

Forming an LLC in the USA may seem like a complex process, but by following these steps, you can navigate the process with ease. Remember to research the specific requirements of your state and consult with a legal professional if needed. By taking the time to properly form your LLC, you can set a solid foundation for your business and enjoy the benefits of limited liability and flexibility in management.

Key Considerations for LLC Formation Process in the USA

Starting a business can be an exciting and rewarding endeavor. One of the first decisions you’ll need to make is what type of legal structure to choose for your business. In the United States, one popular option is the limited liability company, or LLC. Forming an LLC offers many benefits, including personal liability protection and flexibility in taxation. However, before you jump into the LLC formation process, there are a few key considerations to keep in mind.

First and foremost, it’s important to understand the legal requirements for forming an LLC in the USA. Each state has its own specific rules and regulations, so it’s crucial to research the requirements in the state where you plan to operate your business. Generally, you’ll need to file articles of organization with the state’s Secretary of State office and pay the required filing fee. Additionally, some states may require you to publish a notice of your intent to form an LLC in a local newspaper.

Another important consideration is choosing a name for your LLC. The name you select must comply with your state’s naming requirements, which typically include including the words “limited liability company” or an abbreviation like “LLC” in the name. It’s also important to ensure that the name you choose is not already in use by another business. Conducting a thorough search of existing business names can help you avoid potential legal issues down the road.

Once you’ve chosen a name and completed the necessary paperwork, you’ll need to designate a registered agent for your LLC. A registered agent is a person or entity that is responsible for receiving legal documents on behalf of your business. This can be an individual within your company or a professional registered agent service. Regardless of who you choose, it’s important to select someone who is reliable and can fulfill the responsibilities of a registered agent.

In addition to these considerations, you’ll also need to determine the management structure of your LLC. LLCs can be managed by either the members or by managers. If you choose member-managed, all members have the authority to make decisions on behalf of the LLC. On the other hand, if you choose manager-managed, you’ll need to appoint one or more managers to handle the day-to-day operations of the business. This decision will depend on the size and complexity of your business, as well as the level of involvement you want to have in its operations.

Finally, it’s important to consider the tax implications of forming an LLC. By default, LLCs are considered pass-through entities for tax purposes, meaning that the profits and losses of the business are passed through to the individual members and reported on their personal tax returns. However, LLCs also have the option to elect to be taxed as a corporation if it is more advantageous for their specific situation. Consulting with a tax professional can help you determine the best tax structure for your LLC.

In conclusion, forming an LLC in the USA involves several key considerations. Understanding the legal requirements, choosing a name, designating a registered agent, determining the management structure, and considering the tax implications are all important steps in the LLC formation process. By carefully considering these factors and seeking professional guidance when needed, you can ensure that your LLC is set up for success.

Exploring the Benefits of Forming a Limited Liability Company (LLC)

Exploring the Benefits of Forming a limited liability company (LLC)

When it comes to starting a business in the United States, one of the most popular options is to form a limited liability company (LLC). An LLC offers a number of benefits that make it an attractive choice for entrepreneurs. In this article, we will explore the advantages of forming an LLC and provide a step-by-step guide to the formation process.

One of the primary benefits of forming an LLC is the limited liability protection it provides. Unlike a sole proprietorship or partnership, where the owners are personally liable for the company’s debts and legal obligations, an LLC separates the personal assets of the owners from the business. This means that if the company faces a lawsuit or incurs significant debt, the owners’ personal assets, such as their homes or cars, are generally protected.

Another advantage of an LLC is the flexibility it offers in terms of management and taxation. Unlike a corporation, which has a rigid management structure and is subject to double taxation, an LLC allows for a more informal management style and offers the option of pass-through taxation. Pass-through taxation means that the profits and losses of the LLC are passed through to the owners’ personal tax returns, avoiding the double taxation that corporations face.

Forming an LLC is a relatively straightforward process, and it can be done in a few simple steps. The first step is to choose a name for your LLC. The name must comply with the state’s rules and regulations, and it should not be too similar to the name of an existing business. Once you have chosen a name, you will need to file the necessary paperwork with the state. This typically involves filing articles of organization and paying a filing fee.

After the paperwork has been filed and approved, the next step is to create an operating agreement. While an operating agreement is not required by law in most states, it is highly recommended. An operating agreement outlines the ownership and management structure of the LLC, as well as the rights and responsibilities of the owners. It is an important document that helps prevent disputes and provides clarity in the event of disagreements.

Once the operating agreement has been created, the next step is to obtain any necessary licenses and permits. The requirements vary depending on the type of business and the location, so it is important to research and comply with all applicable regulations. This may include obtaining a business license, registering for state and local taxes, and obtaining any industry-specific permits.

Finally, after completing all the necessary steps, it is important to keep up with ongoing compliance requirements. This includes filing annual reports, paying taxes, and maintaining proper records. Failure to comply with these requirements can result in penalties and may jeopardize the limited liability protection that an LLC provides.

In conclusion, forming an LLC offers numerous benefits for entrepreneurs in the United States. From limited liability protection to flexibility in management and taxation, an LLC provides a solid foundation for a successful business. By following the step-by-step guide outlined in this article, entrepreneurs can navigate the LLC formation process with ease and set themselves up for long-term success.

Common Mistakes to Avoid during the LLC Formation Process

Common Mistakes to Avoid during the LLC formation Process

Forming a limited liability company (LLC) can be an exciting and rewarding endeavor. However, it is important to approach the process with caution and avoid common mistakes that can lead to unnecessary complications and delays. In this article, we will discuss some of the most common mistakes to avoid during the LLC formation process in the USA.

One of the first mistakes to avoid is failing to conduct thorough research and planning. Before starting the LLC formation process, it is crucial to understand the legal requirements and obligations associated with forming an LLC in your state. Each state has its own specific rules and regulations, and it is important to familiarize yourself with them to ensure compliance.

Another common mistake is choosing the wrong business name. Your LLC’s name should be unique and not infringe on any existing trademarks or copyrights. It is advisable to conduct a thorough search to ensure that your chosen name is available and does not conflict with any existing businesses. Additionally, some states have specific requirements regarding the use of certain words or phrases in the LLC’s name, so it is important to be aware of these restrictions.

Failing to draft a comprehensive operating agreement is another mistake that many people make during the LLC formation process. An operating agreement is a legal document that outlines the ownership structure, management responsibilities, and operating procedures of the LLC. While some states do not require an operating agreement, it is highly recommended to have one in place to avoid potential disputes and conflicts among members in the future.

Inadequate record-keeping is another common mistake that can lead to complications down the line. It is essential to maintain accurate and up-to-date records of all financial transactions, contracts, and important documents related to the LLC. This includes keeping track of income and expenses, maintaining copies of contracts and agreements, and documenting any changes or amendments made to the operating agreement.

Many people also make the mistake of commingling personal and business finances. It is important to keep your personal and business finances separate to maintain the limited liability protection that an LLC offers. This means opening a separate bank account for the LLC and using it exclusively for business transactions. Mixing personal and business finances can not only jeopardize the limited liability protection but also create confusion during tax filing.

Lastly, failing to comply with ongoing compliance requirements is a mistake that can have serious consequences. Once your LLC is formed, there are certain ongoing obligations that must be met, such as filing annual reports, paying taxes, and maintaining any necessary licenses or permits. Failure to comply with these requirements can result in penalties, fines, or even the dissolution of the LLC.

In conclusion, forming an LLC can be a complex process, but by avoiding common mistakes, you can ensure a smoother and more successful formation. Thorough research and planning, choosing the right business name, drafting a comprehensive operating agreement, maintaining accurate records, separating personal and business finances, and complying with ongoing requirements are all essential steps to take during the LLC formation process. By being diligent and proactive, you can set your LLC up for long-term success.

Navigating the Legal Requirements for LLC Formation in the USA

Navigating the Legal Requirements for LLC formation in the USA

Forming a limited liability company (LLC) in the United States can be a complex process, but with the right guidance, it can be a smooth and straightforward endeavor. This step-by-step guide will walk you through the legal requirements for LLC formation in the USA, ensuring that you have all the necessary information to successfully establish your business.

The first step in forming an LLC is to choose a name for your company. It is important to select a name that is unique and not already in use by another business. You can check the availability of your desired name by conducting a search on the website of the Secretary of State in the state where you plan to form your LLC.

Once you have chosen a name, the next step is to file the necessary paperwork with the Secretary of State. This typically involves submitting Articles of Organization, which outline the basic details of your LLC, such as its name, address, and the names of its members. The filing fee for this paperwork varies by state, so be sure to check the specific requirements in your jurisdiction.

After filing the Articles of Organization, you may need to publish a notice of your intent to form an LLC in a local newspaper. This requirement is only applicable in certain states, so again, it is important to research the regulations in your specific jurisdiction. Failure to comply with this requirement could result in delays or even the rejection of your LLC formation.

Once the paperwork has been filed and any necessary publication requirements have been met, the next step is to create an Operating Agreement for your LLC. While this document is not required by law in all states, it is highly recommended as it outlines the internal workings of your company and helps to establish clear guidelines for decision-making and profit distribution among members.

With the paperwork and agreements in place, the next step is to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This unique identifier is necessary for tax purposes and is used to identify your LLC when filing federal tax returns. You can apply for an EIN online through the IRS website, and the process is typically quick and straightforward.

Once you have obtained an EIN, you will need to register for any necessary state and local taxes. This may include sales tax, payroll tax, or other applicable taxes depending on the nature of your business and the state in which you are operating. It is important to research and comply with all tax obligations to avoid penalties or legal issues down the line.

Finally, it is important to maintain compliance with ongoing requirements for your LLC. This may include filing annual reports, paying annual fees, and adhering to any other regulations set forth by the state in which your LLC is registered. Staying up to date with these requirements will help ensure that your LLC remains in good standing and avoids any unnecessary legal complications.

Forming an LLC in the USA may seem daunting, but by following this step-by-step guide and seeking professional advice when needed, you can navigate the legal requirements with ease. Remember to research the specific regulations in your state and consult with an attorney or business advisor to ensure that you are meeting all necessary obligations. With proper planning and attention to detail, you can successfully establish your LLC and embark on your entrepreneurial journey.

Choosing the Right State for LLC Formation: Factors to Consider

Choosing the Right State for LLC formation: Factors to Consider

When it comes to forming a limited liability company (LLC) in the United States, one of the first decisions you need to make is choosing the right state for your LLC formation. While you can form an LLC in any state, each state has its own set of laws and regulations that govern LLCs. Therefore, it is crucial to carefully consider several factors before making your decision.

One of the most important factors to consider is the state’s tax laws. Some states have more favorable tax structures for LLCs than others. For example, states like Delaware, Nevada, and Wyoming are known for their business-friendly tax laws, including no state income tax and low annual fees. On the other hand, states like California and New York have higher taxes and fees, which may not be ideal for small businesses or startups.

Another factor to consider is the state’s legal system and business regulations. Some states have a reputation for having a more business-friendly legal environment, with efficient court systems and favorable business laws. Delaware, for instance, is known for its well-established and business-friendly legal system, making it a popular choice for LLC formation. Other states, such as California, have more complex regulations and stricter compliance requirements, which may not be suitable for all businesses.

Additionally, you should consider the state’s proximity to your target market or industry. If your business primarily operates locally, it may be beneficial to form your LLC in the state where your customers are located. This can help you establish a stronger presence in your target market and potentially save on transportation costs. On the other hand, if your business operates nationally or internationally, you may want to consider forming your LLC in a state with more favorable tax or legal advantages, regardless of its proximity to your target market.

Furthermore, it is important to consider the state’s reputation and credibility. Some states, such as Delaware and Nevada, have a long history of being business-friendly and have established themselves as popular choices for LLC formation. Forming your LLC in one of these states can give your business a sense of credibility and legitimacy, which may be beneficial when dealing with clients, investors, or lenders.

Lastly, you should consider the cost and ease of forming an LLC in each state. While the process of forming an LLC is generally straightforward, each state has its own filing fees and requirements. Some states have lower filing fees and simpler paperwork, making the formation process more affordable and less time-consuming. It is important to carefully review the requirements and costs associated with forming an LLC in each state to ensure that it aligns with your budget and timeline.

In conclusion, choosing the right state for LLC formation is a crucial step in the process of starting a business in the United States. Factors such as tax laws, legal environment, proximity to your target market, reputation, and cost should all be carefully considered before making your decision. By taking the time to evaluate these factors, you can ensure that your LLC is formed in a state that best suits your business needs and goals.

Step-by-Step Guide to Drafting an LLC Operating Agreement

A limited liability company (LLC) is a popular business structure in the United States due to its flexibility and liability protection. If you are considering forming an LLC, it is important to understand the step-by-step process involved. One crucial step in this process is drafting an LLC operating agreement, which outlines the rights and responsibilities of the LLC’s members and provides a framework for the company’s operations.

The first step in drafting an LLC operating agreement is to gather the necessary information. This includes the names and addresses of all the LLC’s members, as well as their respective ownership percentages. Additionally, you will need to determine the initial capital contributions made by each member and any specific roles or responsibilities they may have within the company.

Once you have gathered this information, you can begin drafting the actual operating agreement. It is important to note that an operating agreement is not required by law in most states, but it is highly recommended as it helps establish clear guidelines for the LLC’s operations and can help prevent disputes among members.

The operating agreement should start with a preamble that states the LLC’s name, the date of its formation, and the purpose for which it was created. This section should also include a statement indicating that the LLC is being formed in accordance with the laws of the state in which it is being registered.

Next, the operating agreement should outline the LLC’s management structure. This can be either member-managed or manager-managed. In a member-managed LLC, all members have the authority to make decisions on behalf of the company. In a manager-managed LLC, one or more members are designated as managers and have the authority to make decisions on behalf of the company.

After establishing the management structure, the operating agreement should address the voting rights and decision-making process within the LLC. This section should outline how voting will take place, what decisions require a majority vote, and any specific voting rights or restrictions that may apply to certain members.

The operating agreement should also address the LLC’s financial matters. This includes how profits and losses will be allocated among members, how distributions will be made, and how additional capital contributions will be handled. It is important to clearly outline these financial provisions to avoid any confusion or disputes in the future.

Additionally, the operating agreement should include provisions regarding the transfer of membership interests. This section should outline the process for transferring ownership interests, including any restrictions or requirements that may apply. It is important to carefully consider these provisions to ensure that the LLC remains in the hands of its intended members.

Finally, the operating agreement should include provisions regarding the dissolution of the LLC. This section should outline the process for winding up the company’s affairs and distributing its assets in the event of dissolution. It is important to address these provisions to ensure a smooth and orderly dissolution process.

Once the operating agreement has been drafted, it should be reviewed by all members of the LLC. It is advisable to seek legal counsel during this process to ensure that the operating agreement complies with state laws and adequately addresses the needs and goals of the LLC and its members.

In conclusion, drafting an LLC operating agreement is an important step in the formation process. By carefully considering the needs and goals of the LLC and its members, and seeking legal counsel when necessary, you can create an operating agreement that provides a solid foundation for your LLC’s operations.

Exploring Different Options for LLC Registration in the USA

Exploring Different Options for LLC Registration in the USA

When it comes to starting a business in the United States, one of the most popular options is to form a limited liability company (LLC). An LLC provides the benefits of both a corporation and a partnership, offering limited liability protection for its owners while also allowing for flexibility in management and taxation. However, before diving into the LLC formation process, it is important to understand the different options available for registration.

The first option is to register your LLC in the state where your business will be physically located. This is the most common choice for small businesses, as it allows for easy access to local resources and services. Each state has its own set of rules and regulations for LLC formation, so it is important to research the specific requirements of the state in which you plan to register. Some states may require a minimum number of members or have specific naming conventions, so it is crucial to be aware of these details before proceeding.

Another option is to register your LLC in a state other than where your business will be physically located. This is known as “foreign qualification” and can be a good choice if you plan to operate your business in multiple states. By registering your LLC as a foreign entity in each state where you plan to do business, you can ensure that you are compliant with local laws and regulations. However, it is important to note that this option may come with additional fees and paperwork, so it is important to weigh the benefits against the costs.

For those looking for even more flexibility, there is the option of forming an LLC in Delaware or Nevada. These states are known for their business-friendly laws and regulations, making them attractive options for entrepreneurs. Delaware, in particular, is a popular choice due to its well-established legal system and favorable tax laws. However, it is important to consider the potential drawbacks of forming an LLC in a state other than where your business will be physically located. This includes the need to appoint a registered agent in the state of formation and the potential for increased administrative and compliance requirements.

Regardless of which option you choose, the LLC formation process typically involves several key steps. First, you will need to choose a name for your LLC that complies with the rules and regulations of the state in which you plan to register. This may include checking for name availability and avoiding any prohibited words or phrases. Once you have chosen a name, you will need to file the necessary paperwork with the appropriate state agency, typically the Secretary of State’s office. This paperwork will include the Articles of Organization, which outline the basic details of your LLC, such as its name, address, and purpose.

After filing the necessary paperwork, you will need to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This unique nine-digit number is used to identify your LLC for tax purposes and is required if you plan to hire employees or open a business bank account. Finally, you may need to obtain any necessary licenses or permits for your specific industry or location. This may include state or local business licenses, professional licenses, or permits for specific activities, such as selling alcohol or operating a food establishment.

In conclusion, forming an LLC in the USA offers many benefits for entrepreneurs, including limited liability protection and flexibility in management and taxation. However, it is important to carefully consider the different options available for LLC registration, including registering in the state where your business will be physically located, foreign qualification, or forming an LLC in Delaware or Nevada. Regardless of which option you choose, it is crucial to follow the necessary steps in the LLC formation process, including choosing a name, filing the necessary paperwork, obtaining an EIN, and obtaining any necessary licenses or permits. By understanding the different options and following the proper procedures, you can successfully navigate the LLC formation process and set your business up for success.

Essential Steps for Successfully Starting a Business through LLC Formation

Starting a business can be an exciting and rewarding endeavor. One of the most popular ways to structure a business in the United States is through the formation of a limited liability company (LLC). An LLC offers many benefits, including personal liability protection and flexibility in taxation. If you are considering starting a business through LLC formation, it is important to understand the essential steps involved in the process.

The first step in forming an LLC is to choose a name for your business. It is important to select a name that is unique and not already in use by another business. You can check the availability of your desired name by conducting a search on the website of the Secretary of State in the state where you plan to form your LLC. Once you have chosen a name, you may need to file a name reservation form to secure the name for a certain period of time.

After selecting a name, the next step is to prepare and file the necessary documents with the Secretary of State. These documents typically include the Articles of Organization, which outline the basic information about your LLC, such as its name, address, and purpose. Some states may also require additional forms or fees to be submitted along with the Articles of Organization. It is important to carefully review the requirements of the state where you plan to form your LLC to ensure that you comply with all necessary filings.

Once the necessary documents have been filed and accepted by the Secretary of State, the next step is to create an Operating Agreement. While an Operating Agreement is not required by all states, it is highly recommended as it outlines the ownership and management structure of your LLC. This document is important as it helps to establish the rights and responsibilities of the members and provides a framework for decision-making within the company.

After creating an Operating Agreement, the next step is to obtain any necessary licenses and permits. The requirements for licenses and permits vary depending on the type of business you plan to operate and the location of your LLC. It is important to research and understand the specific requirements for your industry and location to ensure that you are in compliance with all applicable laws and regulations.

Once all necessary licenses and permits have been obtained, the final step in the LLC formation process is to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). An EIN is a unique nine-digit number that is used to identify your LLC for tax purposes. This number is required if you plan to hire employees or if you plan to open a business bank account.

In conclusion, forming an LLC is a multi-step process that requires careful planning and attention to detail. By following these essential steps, you can successfully start a business through LLC formation in the USA. Remember to choose a unique name, file the necessary documents with the Secretary of State, create an Operating Agreement, obtain any necessary licenses and permits, and obtain an EIN from the IRS. With proper preparation and execution, you can set your business up for success and enjoy the benefits of operating as an LLC.

Q&A

1. What is an LLC?

A limited liability company (LLC) is a legal business structure that combines the limited liability protection of a corporation with the flexibility and tax benefits of a partnership.

2. Why should I form an LLC?

Forming an LLC provides personal liability protection for the owners, known as members, and offers flexibility in management and taxation options.

3. How do I choose a name for my LLC?

Choose a unique name that complies with your state’s naming requirements, including the use of “LLC” or a similar designation. Check for name availability with your state’s Secretary of State office.

4. What are the steps to form an LLC?

The general steps include choosing a name, filing articles of organization with the Secretary of State, creating an operating agreement, obtaining necessary licenses and permits, and obtaining an Employer Identification Number (EIN) from the IRS.

5. How much does it cost to form an LLC?

The cost varies by state, but typically includes filing fees for the articles of organization and any additional state-specific requirements. It can range from $50 to a few hundred dollars.

6. Do I need an attorney to form an LLC?

While not required, consulting with an attorney can ensure compliance with state laws and help with complex legal matters. It is recommended to seek legal advice, especially if you have specific needs or concerns.

7. What is an operating agreement?

An operating agreement is a legal document that outlines the ownership, management, and operating procedures of the LLC. It is not required in all states, but it is highly recommended to have one to establish clear guidelines for the business.

8. How long does it take to form an LLC?

The processing time varies by state, but it typically takes a few weeks to a few months to complete the LLC formation process.

9. Can a foreigner form an LLC in the USA?

Yes, foreigners can form an LLC in the USA. However, additional requirements may apply, such as appointing a registered agent and obtaining an Individual Taxpayer Identification Number (ITIN) or Social Security Number (SSN).

10. What ongoing requirements are there for an LLC?

Ongoing requirements may include filing annual reports, paying state fees, maintaining proper records, holding meetings, and complying with tax obligations. The specific requirements vary by state.

Conclusion

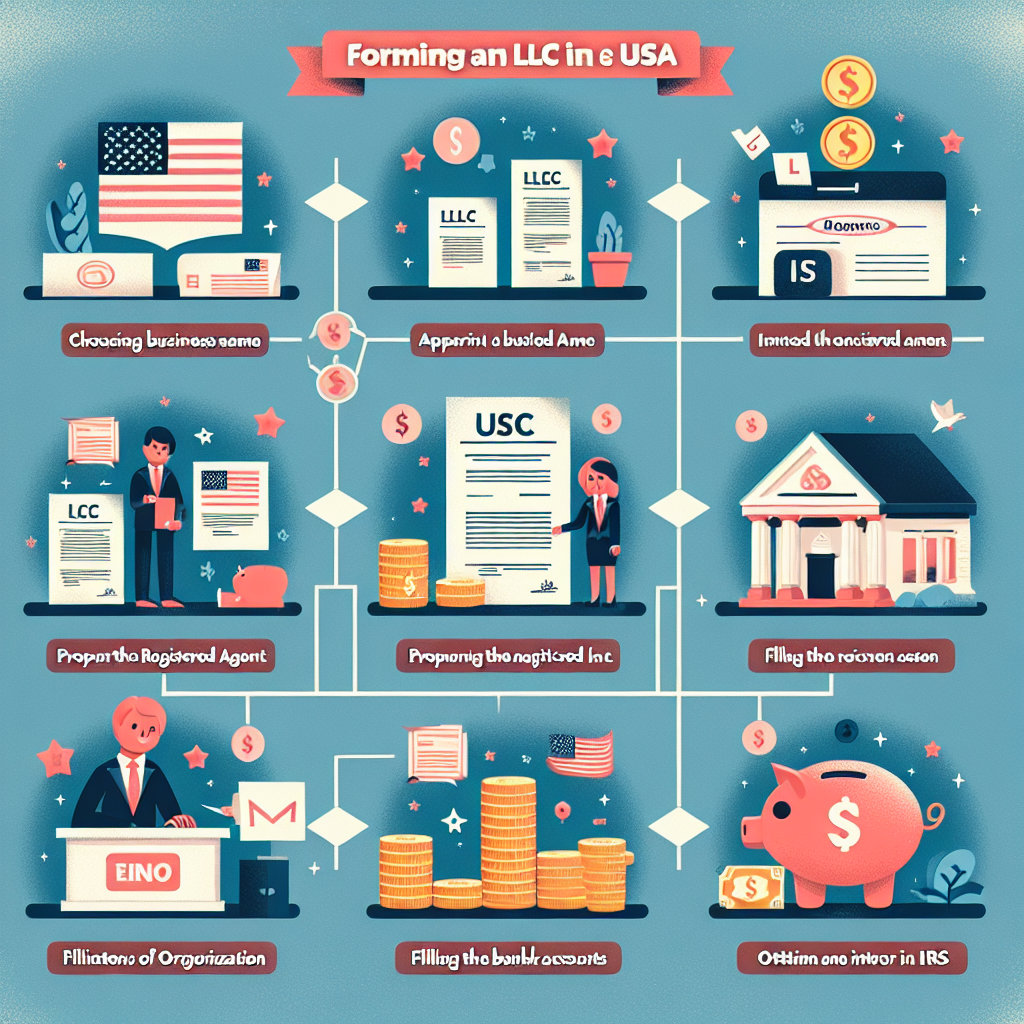

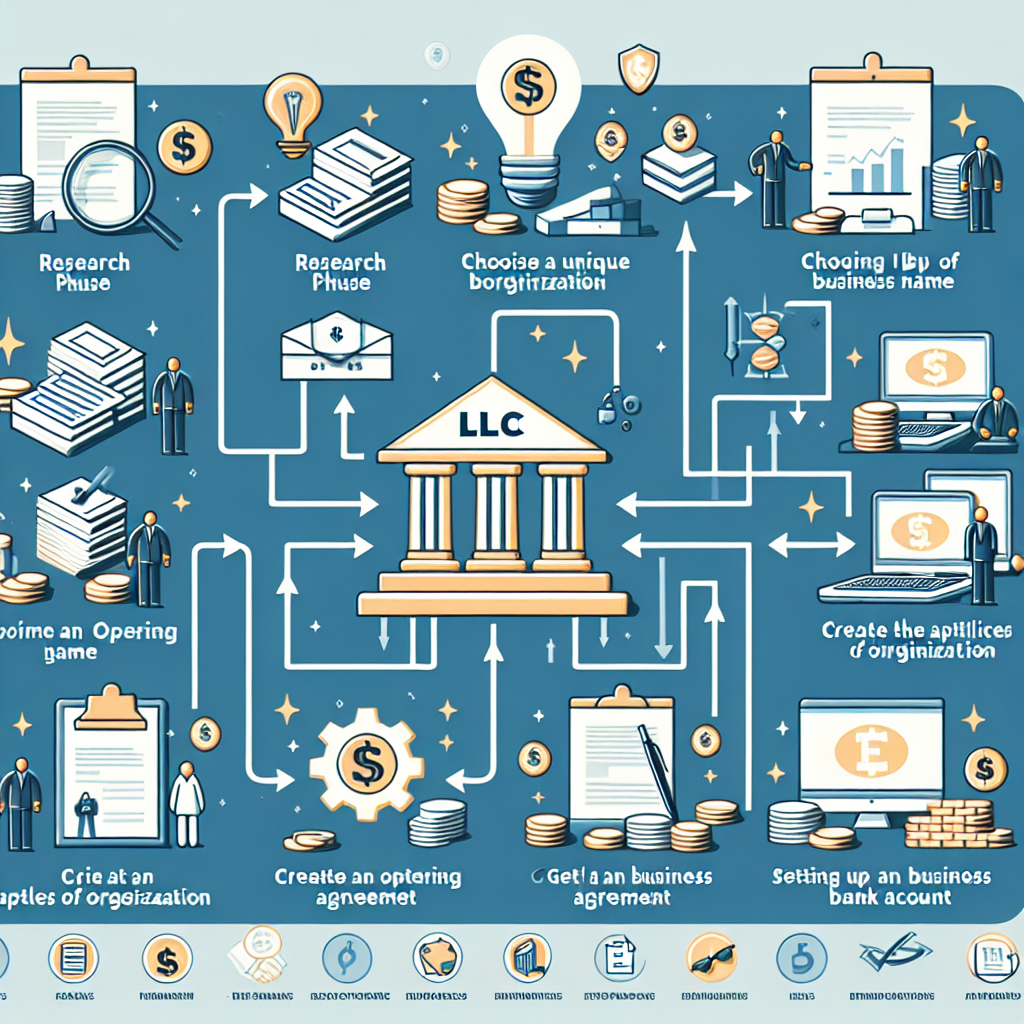

In conclusion, the step-by-step guide to LLC formation process in the USA involves several key steps. These include choosing a business name, filing the necessary documents with the state, obtaining an Employer Identification Number (EIN), creating an operating agreement, and fulfilling any additional state-specific requirements. It is important to carefully follow each step to ensure a smooth and legally compliant LLC formation process.