Top Stories

Stay Connected

Tag: Business Formation and Entity Types in USA

Introduction

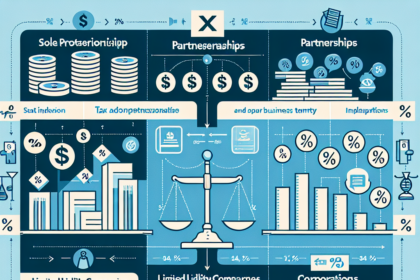

Starting a business in the United States involves several key decisions, one of the most crucial being the choice of business entity. The entity type you choose will impact your legal liability, tax obligations, fundraising capabilities, and management structure. This comprehensive guide explores the various business formation options available in the USA, including their legal requirements, advantages, and disadvantages. By understanding these factors, entrepreneurs can make informed decisions that best suit their business goals and needs.

Chapter 1: Sole Proprietorship

1.1 Overview

A sole proprietorship is the simplest and most common form of business entity in the USA. It is owned and operated by a single individual, with no distinction between the owner and the business.

1.2 Legal Requirements

- Registration: Typically, no formal registration with the state is required, though a “Doing Business As” (DBA) registration might be necessary.

- Licenses and Permits: Depending on the nature of the business, specific local, state, and federal licenses or permits may be required.

- Tax Identification Number: Sole proprietors may need to obtain an Employer Identification Number (EIN) from the IRS, especially if they have employees.

1.3 Advantages

- Ease of Formation: Minimal paperwork and cost.

- Control: Full control over business decisions.

- Tax Benefits: Income is reported on the owner’s personal tax return, potentially benefiting from lower personal tax rates.

1.4 Disadvantages

- Unlimited Liability: Personal assets are at risk if the business incurs debt or legal liabilities.

- Funding Difficulties: Harder to raise capital since it cannot issue stock.

- Limited Life: The business does not survive the owner’s death or incapacitation.

Chapter 2: Partnership

2.1 General Partnership

A general partnership involves two or more individuals who share ownership and management responsibilities.

2.2 Legal Requirements

- Partnership Agreement: While not legally required, it’s highly recommended to outline each partner’s contributions, roles, profit-sharing, and dispute resolution methods.

- Registration: Depending on the state, general partnerships may need to register their business name.

- Licenses and Permits: Required as per the business type and location.

2.3 Advantages

- Ease of Formation: Simple to establish with minimal paperwork.

- Shared Resources: Combining resources and expertise of multiple partners.

- Tax Benefits: Pass-through taxation, where income is reported on partners’ personal tax returns.

2.4 Disadvantages

- Unlimited Liability: Each partner is personally liable for the business debts and obligations.

- Disputes: Potential for conflicts between partners.

- Shared Profits: Profits must be shared among partners, which can lead to disagreements.

2.5 Limited Partnership (LP)

An LP includes both general and limited partners. General partners manage the business and bear unlimited liability, while limited partners contribute capital and have liability only up to their investment.

2.6 Legal Requirements

- Certificate of Limited Partnership: Must be filed with the state.

- Partnership Agreement: Should clearly define the roles and responsibilities of general and limited partners.

2.7 Advantages

- Limited Liability for Limited Partners: Limited partners’ personal assets are protected.

- Attracts Investors: Easier to raise capital by attracting limited partners.

2.8 Disadvantages

- Complex Formation: More paperwork and legal formalities than a general partnership.

- Limited Control for Limited Partners: Limited partners cannot be involved in management without risking their limited liability status.

Chapter 3: Corporation

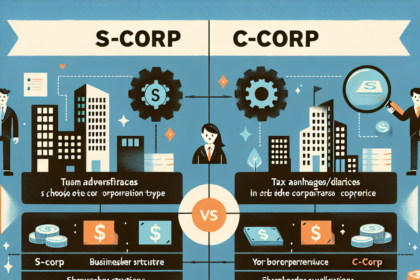

3.1 C Corporation (C Corp)

A C Corporation is a legal entity separate from its owners, providing the strongest protection against personal liability.

3.2 Legal Requirements

- Articles of Incorporation: Must be filed with the state.

- Bylaws: Internal rules governing the corporation’s management.

- Board of Directors: Required to oversee management.

- Annual Meetings: Must hold annual shareholder and director meetings.

- Licenses and Permits: Required as per business type and location.

- EIN: Must obtain an Employer Identification Number from the IRS.

3.3 Advantages

- Limited Liability: Shareholders’ personal assets are protected.

- Unlimited Life: The corporation continues to exist beyond the life of its owners.

- Raising Capital: Can issue stocks to attract investors.

- Tax Benefits: Potential deductions and benefits not available to other entity types.

3.4 Disadvantages

- Double Taxation: Profits are taxed at the corporate level and again as shareholder dividends.

- Complexity and Cost: More regulations, paperwork, and higher formation and maintenance costs.

- Management Structure: More formal management structure required.

3.5 S Corporation (S Corp)

An S Corporation provides the benefits of incorporation while allowing income to pass through to shareholders, avoiding double taxation.

3.6 Legal Requirements

- Articles of Incorporation: Must be filed with the state.

- Bylaws: Internal rules governing the corporation’s management.

- Board of Directors: Required to oversee management.

- Annual Meetings: Must hold annual shareholder and director meetings.

- EIN: Must obtain an Employer Identification Number from the IRS.

- Election of S Corp Status: Must file Form 2553 with the IRS.

3.7 Advantages

- Limited Liability: Shareholders’ personal assets are protected.

- Pass-Through Taxation: Income passes through to shareholders’ personal tax returns, avoiding double taxation.

- Tax Savings: Potential for reduced self-employment taxes on distributions.

3.8 Disadvantages

- Ownership Restrictions: Limited to 100 shareholders, all of whom must be U.S. citizens or residents.

- Complexity and Cost: Similar complexity and cost to a C Corp.

- Profit and Loss Allocation: Must be distributed based on ownership percentage, limiting flexibility.

Chapter 4: Limited Liability Company (LLC)

4.1 Overview

An LLC combines the liability protection of a corporation with the tax benefits and flexibility of a partnership.

4.2 Legal Requirements

- Articles of Organization: Must be filed with the state.

- Operating Agreement: Highly recommended to outline management and operating procedures.

- Licenses and Permits: Required as per business type and location.

- EIN: Must obtain an Employer Identification Number from the IRS.

4.3 Advantages

- Limited Liability: Owners’ personal assets are protected.

- Pass-Through Taxation: Profits and losses pass through to owners’ personal tax returns.

- Flexibility: Fewer compliance requirements and more management flexibility.

- No Ownership Restrictions: Unlike S Corps, no restrictions on the number and type of owners.

4.4 Disadvantages

- Self-Employment Taxes: Members may be subject to self-employment taxes.

- Complexity in Formation: More paperwork and legal formalities compared to sole proprietorships and partnerships.

- State-Specific Regulations: Varying requirements and fees by state.

Chapter 5: Nonprofit Corporation

5.1 Overview

A nonprofit corporation is formed for charitable, educational, religious, or scientific purposes and enjoys tax-exempt status under IRS code section 501(c)(3).

5.2 Legal Requirements

- Articles of Incorporation: Must be filed with the state.

- Bylaws: Internal rules governing the nonprofit’s operations.

- Board of Directors: Required to oversee the organization.

- Tax-Exempt Status: Must apply for federal tax-exempt status with the IRS using Form 1023.

5.3 Advantages

- Tax Exemption: Exempt from federal and state income taxes.

- Limited Liability: Directors and officers are protected from personal liability.

- Grants and Donations: Eligible to receive public and private grants and donations.

5.4 Disadvantages

- Compliance and Reporting: Strict compliance and reporting requirements to maintain tax-exempt status.

- Restrictions on Earnings: Profits cannot be distributed to members, directors, or officers.

- Dissolution Constraints: Assets must be distributed to another nonprofit upon dissolution.

Chapter 6: Choosing the Right Business Entity

6.1 Factors to Consider

- Liability Protection: Level of personal liability protection required.

- Taxation: Desired tax treatment and implications.

- Cost and Complexity: Formation and ongoing administrative costs.

- Control and Management: Degree of control and management flexibility.

- Funding Needs: Ability to attract investors and raise capital.

- Future Plans: Long-term business goals and scalability.

6.2 Case Studies

- Example 1: Tech Startup: Analyzing why a tech startup might choose an LLC for flexibility and tax benefits.

- Example 2: Family-Owned Business: Understanding why a family business might opt for an S Corporation to avoid double taxation.

- Example 3: Charitable Organization: Discussing why a nonprofit corporation is the best choice for a charity or educational organization.

Chapter 7: Legal and Tax Considerations

7.1 State-Specific Regulations

Each state has its own set of regulations regarding business formation, taxation, and compliance. Key considerations include:

- Filing Requirements: Differences in filing documents and fees.

- Taxation: Varying state income tax rates and exemptions.

- Annual Reporting: Requirements for annual reports and fees.

7.2 Federal Tax Obligations

Businesses in the USA must comply with federal tax laws and regulations, including:

- Income Tax: Filing annual returns with the IRS.

- Employment Taxes: Withholding and remitting payroll taxes.

- Excise Taxes: Applicable to certain types of businesses and transactions.

7.3 Employment Laws

Compliance with federal and state employment laws is crucial. Key areas include:

- Wages and Hours: Minimum wage, overtime, and child labor laws.

- Safety and Health: Occupational Safety and Health Administration (OSHA) regulations.

- Non-Discrimination: Equal Employment Opportunity (EEO) laws.

Chapter 8: Formation Process for Each Entity Type

8.1 Sole Proprietorship

- Step 1: Choose a business name.

- Step 2: Obtain necessary licenses and permits.

- Step 3: Register the business name if using a DBA.

- Step 4: Obtain an EIN if required.

8.2 Partnership

- Step 1: Choose a partnership structure (general or limited).

- Step 2: Draft and sign a partnership agreement.

- Step 3: Register the business name.

- Step 4: Obtain necessary licenses and permits.

- Step 5: File for an EIN.

8.3 Corporation (C Corp and S Corp)

- Step 1: Choose a business name.

- Step 2: File Articles of Incorporation with the state.

- Step 3: Create corporate bylaws.

- Step 4: Appoint a board of directors.

- Step 5: Hold initial board meeting and issue stock certificates.

- Step 6: Apply for an EIN.

- Step 7: File for S Corp status (if applicable) with the IRS.

8.4 Limited Liability Company (LLC)

- Step 1: Choose a business name.

- Step 2: File Articles of Organization with the state.

- Step 3: Draft an operating agreement.

- Step 4: Obtain necessary licenses and permits.

- Step 5: Apply for an EIN.

8.5 Nonprofit Corporation

- Step 1: Choose a business name.

- Step 2: File Articles of Incorporation with the state.

- Step 3: Draft bylaws.

- Step 4: Appoint a board of directors.

- Step 5: Apply for an EIN.

- Step 6: File for tax-exempt status with the IRS.

Chapter 9: Ongoing Compliance and Maintenance

9.1 Annual Reporting

Businesses must file annual reports with the state, which may include:

- Financial Statements: Balance sheets, income statements, and cash flow statements.

- Corporate Governance: Records of shareholder and board meetings.

- State Fees: Payment of annual fees.

9.2 Tax Filings

Regular tax filings are essential for compliance, including:

- Federal Taxes: Income, payroll, and excise taxes.

- State Taxes: Varies by state but often includes income and sales taxes.

- Local Taxes: May include property and business license taxes.

9.3 Licenses and Permits

Renewal of licenses and permits is required to maintain legal operations. This includes:

- Business Licenses: General business licenses from local authorities.

- Industry-Specific Licenses: Required for certain professions and industries.

- Health and Safety Permits: Compliance with health and safety regulations.

9.4 Corporate Governance

Maintaining good corporate governance is crucial for corporations and LLCs, including:

- Board Meetings: Regular meetings of the board of directors or members.

- Record Keeping: Detailed minutes of meetings and resolutions.

- Compliance Audits: Periodic reviews to ensure compliance with laws and regulations.

Conclusion

Choosing the right business entity is a critical decision that impacts every aspect of your business, from legal liability and tax obligations to fundraising capabilities and management structure. By understanding the various business formation options available in the USA, including their legal requirements, advantages, and disadvantages, entrepreneurs can make informed decisions that best suit their business goals and needs. Whether you opt for a sole proprietorship, partnership, corporation, LLC, or nonprofit, thorough planning and compliance with legal requirements are essential for long-term success.

FAQs

- What is the simplest form of business entity in the USA?

- The sole proprietorship is the simplest and most common form of business entity, requiring minimal paperwork and costs.

- What are the main advantages of forming a corporation?

- Corporations offer limited liability protection, the ability to raise capital through stock issuance, and an unlimited lifespan.

- How does an LLC differ from a corporation?

- An LLC combines the liability protection of a corporation with the tax benefits and flexibility of a partnership, without the formal management structure required by corporations.

- What are the benefits of choosing an S Corporation?

- S Corporations provide limited liability protection and pass-through taxation, avoiding double taxation on corporate profits.

- Why might a business choose to form a nonprofit corporation?

- Nonprofit corporations can obtain tax-exempt status, limiting tax liabilities and making them eligible for grants and donations while focusing on charitable, educational, or scientific purposes.

By understanding these aspects of business formation and entity types in the USA, entrepreneurs can better navigate the legal landscape and ensure they operate within the bounds of the law