-

Table of Contents

- Introduction

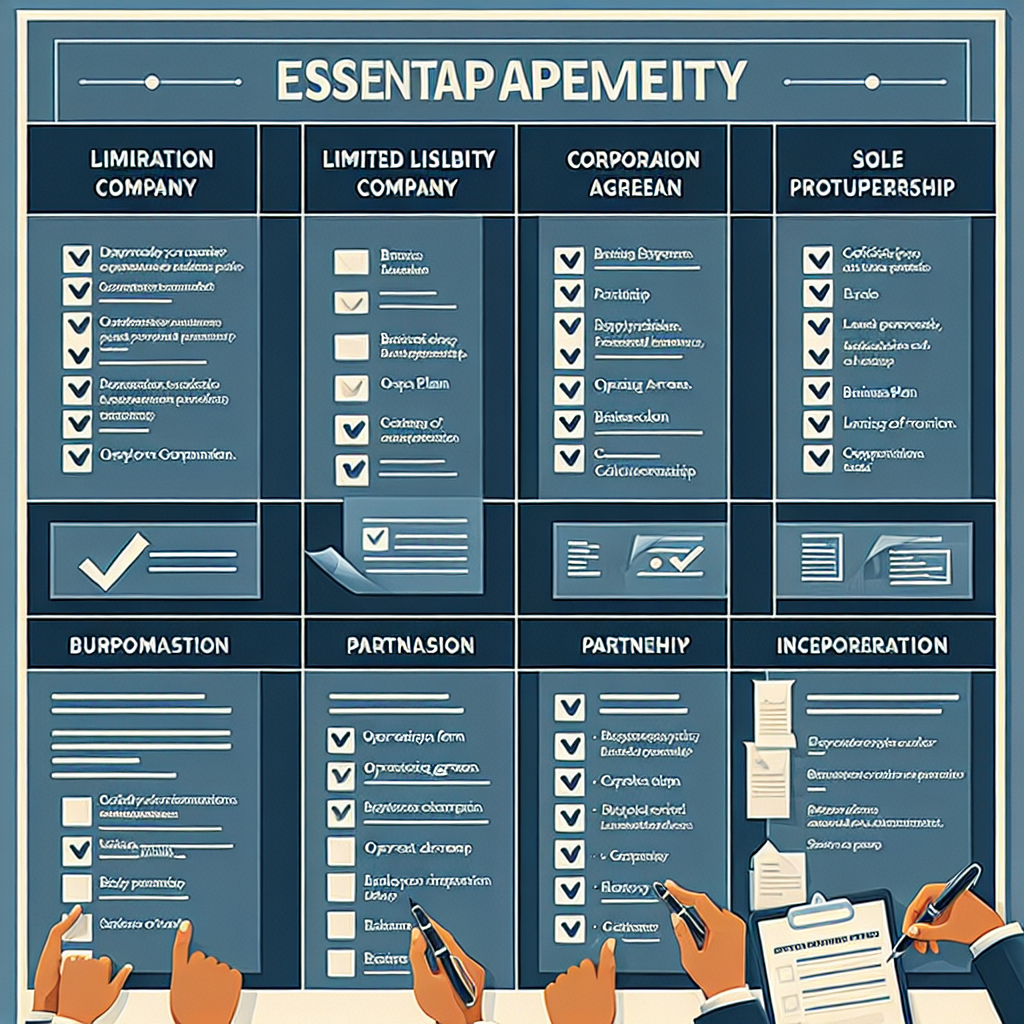

- The Ultimate Document Checklist for Registering a Business Entity

- Essential Paperwork for Forming Business Entities: A Comprehensive Checklist

- Streamlining the Registration Process: Document Checklist for Business Entities

- Ensuring Legal Compliance: Must-Have Paperwork for Business Entity Formation

- Document Checklist for Registering Different Types of Business Entities

- Simplifying the Paperwork: Essential Documents for Forming Business Entities

- Navigating the Registration Process: Document Checklist for Business Entity Formation

- Legal Compliance Made Easy: Document Checklist for Business Entity Registration

- The Importance of a Document Checklist in Forming Business Entities

- Mastering the Paperwork: Document Checklist for Smooth Business Entity Formation

- Q&A

- Conclusion

Streamline your business formation with our comprehensive document checklist.

Introduction

Introduction:

A document checklist is a crucial tool for individuals or groups looking to form a business entity. It outlines the essential paperwork required to establish a legally recognized business structure. This checklist serves as a guide to ensure that all necessary documents are prepared and submitted accurately, helping to streamline the formation process and avoid potential legal complications. By following a comprehensive document checklist, aspiring entrepreneurs can navigate the complexities of forming a business entity with confidence and efficiency.

The Ultimate Document Checklist for Registering a Business Entity

Starting a business can be an exciting and rewarding venture. However, before you can officially launch your business, there are several essential documents that you need to have in order. These documents are crucial for registering your business entity and ensuring that you comply with all legal requirements. In this article, we will provide you with the ultimate document checklist for forming a business entity.

First and foremost, you will need to have a clear and concise business plan. This document outlines your business goals, strategies, and financial projections. It serves as a roadmap for your business and is essential for securing funding and attracting potential investors. A well-written business plan demonstrates your commitment and professionalism to potential stakeholders.

Next, you will need to choose a business name and register it with the appropriate authorities. Your business name is an important part of your brand identity, so it is crucial to choose a name that is unique and memorable. Once you have chosen a name, you will need to register it with the appropriate government agency, such as the Secretary of State’s office. This registration ensures that no other business can use the same name and helps protect your brand.

In addition to registering your business name, you will also need to obtain the necessary licenses and permits. The specific licenses and permits required vary depending on the nature of your business and your location. Common licenses include a business license, sales tax permit, and professional licenses for certain industries. It is important to research and understand the licensing requirements for your specific business to ensure compliance.

Another crucial document is the Articles of Incorporation or Articles of Organization. These documents are required for forming a corporation or limited liability company (LLC), respectively. The Articles of Incorporation or Organization outline the basic information about your business, such as its name, purpose, and registered agent. Filing these documents with the Secretary of State’s office officially establishes your business entity.

Additionally, you will need to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). An EIN is a unique nine-digit number that identifies your business for tax purposes. It is necessary for opening a business bank account, hiring employees, and filing tax returns. Applying for an EIN is a straightforward process and can be done online through the IRS website.

Furthermore, you should consider drafting a partnership agreement or operating agreement, depending on the type of business entity you have formed. These agreements outline the rights and responsibilities of the business owners and help prevent disputes in the future. While not legally required, having a well-drafted agreement can provide clarity and protection for all parties involved.

Lastly, it is essential to keep accurate and organized financial records. This includes maintaining records of income, expenses, and any business transactions. Good record-keeping is not only necessary for tax purposes but also helps you track the financial health of your business and make informed decisions.

In conclusion, starting a business requires careful planning and attention to detail. By ensuring that you have all the necessary documents in order, you can establish your business entity with confidence. From a comprehensive business plan to the appropriate licenses and permits, each document plays a crucial role in the success of your business. By following this ultimate document checklist, you can navigate the process of forming a business entity smoothly and efficiently.

Essential Paperwork for Forming Business Entities: A Comprehensive Checklist

Starting a business can be an exciting and rewarding endeavor. However, it also requires careful planning and attention to detail. One crucial aspect of forming a business entity is ensuring that all the necessary paperwork is in order. This article will provide a comprehensive checklist of essential documents that you need to have when forming a business entity.

First and foremost, you will need to have a clear and concise business plan. This document outlines your goals, strategies, and financial projections for your business. It serves as a roadmap for your company’s success and is essential for attracting investors and securing financing.

Next, you will need to register your business with the appropriate government authorities. This typically involves filing articles of incorporation or organization, depending on the type of business entity you are forming. These documents establish your business as a legal entity and provide important information such as the company’s name, address, and purpose.

In addition to the articles of incorporation or organization, you will also need to obtain an employer identification number (EIN) from the Internal Revenue Service (IRS). This unique nine-digit number is used to identify your business for tax purposes and is necessary if you plan to hire employees or open a business bank account.

Once you have registered your business and obtained an EIN, you will need to draft and execute a comprehensive operating agreement or bylaws. These documents outline the internal rules and regulations of your business, including how decisions are made, how profits and losses are allocated, and how the business can be dissolved. Having a well-drafted operating agreement or bylaws is crucial for avoiding disputes among business partners and ensuring the smooth operation of your company.

Another essential document to have is a shareholder agreement, especially if your business is structured as a corporation. This agreement outlines the rights and responsibilities of the shareholders, including voting rights, dividend distributions, and restrictions on the transfer of shares. It helps protect the interests of the shareholders and provides a framework for resolving any conflicts that may arise.

In addition to these foundational documents, you will also need to have various licenses and permits depending on the nature of your business. These may include a business license, professional licenses, zoning permits, and health and safety permits. It is important to research and comply with all the necessary regulations to avoid legal issues and penalties.

Furthermore, you should consider having contracts and agreements in place to protect your business interests. This may include contracts with suppliers, customers, and employees, as well as non-disclosure agreements and intellectual property assignments. These documents help establish clear expectations and protect your business’s assets and proprietary information.

Lastly, it is crucial to keep accurate and organized records of all your business transactions. This includes financial statements, tax returns, payroll records, and any other relevant documentation. Maintaining proper records not only ensures compliance with legal and regulatory requirements but also provides valuable information for making informed business decisions.

In conclusion, forming a business entity requires careful attention to detail and the completion of essential paperwork. This comprehensive checklist of documents, including a business plan, articles of incorporation or organization, operating agreement or bylaws, shareholder agreement, licenses and permits, contracts and agreements, and accurate record-keeping, will help ensure that your business is legally compliant and well-positioned for success. By taking the time to gather and organize these essential documents, you are setting your business up for a solid foundation and a bright future.

Streamlining the Registration Process: Document Checklist for Business Entities

When it comes to forming a business entity, there are several essential documents that need to be prepared and filed. These documents are crucial for streamlining the registration process and ensuring that the business is legally recognized. In this article, we will provide a comprehensive document checklist for forming business entities.

The first document on the checklist is the Articles of Incorporation. This document is required for forming a corporation and includes important information such as the name of the corporation, its purpose, and the names and addresses of the initial directors. It is important to ensure that the Articles of Incorporation comply with the laws of the state in which the business is being formed.

Next on the checklist is the Certificate of Formation. This document is used for forming a limited liability company (LLC) and includes similar information as the Articles of Incorporation. The Certificate of Formation also needs to comply with state laws and should be filed with the appropriate state agency.

Another important document is the Operating Agreement. This document is specific to LLCs and outlines the rights and responsibilities of the members, as well as the management structure of the company. While an Operating Agreement is not always required by law, it is highly recommended as it helps to establish clear guidelines for the operation of the business.

For partnerships, the Partnership Agreement is a crucial document. This agreement outlines the rights and responsibilities of the partners, as well as the profit-sharing arrangements and the management structure of the partnership. Like the Operating Agreement, a Partnership Agreement is not always required by law, but it is highly recommended to avoid any potential disputes in the future.

In addition to these formation documents, there are several other important paperwork that need to be prepared. These include the Employer Identification Number (EIN) application, which is required for tax purposes, and any necessary state and local business licenses and permits. It is important to research and understand the specific requirements for your industry and location to ensure compliance.

Furthermore, it is important to keep accurate and up-to-date records of all business transactions. This includes financial records such as income statements, balance sheets, and cash flow statements, as well as any contracts, agreements, and leases. These records are not only important for tax purposes but also for monitoring the financial health of the business and making informed decisions.

Lastly, it is important to have a registered agent for your business entity. A registered agent is a person or entity designated to receive legal documents on behalf of the business. This ensures that important legal notices and correspondence are properly received and handled.

In conclusion, forming a business entity requires several essential documents. From the Articles of Incorporation to the Partnership Agreement, each document plays a crucial role in streamlining the registration process and ensuring that the business is legally recognized. By following this document checklist and staying organized, you can ensure a smooth and efficient formation process for your business entity.

Ensuring Legal Compliance: Must-Have Paperwork for Business Entity Formation

When it comes to forming a business entity, there are several essential documents that need to be prepared and filed. These documents are crucial for ensuring legal compliance and establishing the foundation of the business. In this article, we will discuss the must-have paperwork for business entity formation and why each document is important.

The first document on the checklist is the Articles of Incorporation or Articles of Organization. This document is filed with the state and establishes the existence of the business entity. It includes important information such as the name of the entity, its purpose, and the names and addresses of the initial directors or members. The Articles of Incorporation or Organization are essential for legally creating the business entity and are often required by banks and other institutions when opening a business bank account.

Next on the checklist is the Operating Agreement or Bylaws. This document outlines the internal rules and regulations of the business entity. It specifies how the entity will be managed, how decisions will be made, and how profits and losses will be allocated among the members or shareholders. The Operating Agreement or Bylaws are crucial for establishing the governance structure of the business and ensuring that all members or shareholders are on the same page.

Another important document is the Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This unique nine-digit number is used to identify the business entity for tax purposes. It is required for filing tax returns, opening a business bank account, and hiring employees. Obtaining an EIN is a necessary step in the business entity formation process and is essential for complying with federal tax laws.

In addition to the EIN, businesses may also need to obtain other licenses and permits depending on the nature of their operations. These licenses and permits vary by industry and location and are necessary for ensuring legal compliance. Examples include a business license, professional license, health permit, or liquor license. It is important to research and identify the specific licenses and permits required for the business entity and to obtain them before commencing operations.

Lastly, businesses should consider having a written agreement between the owners or shareholders. This agreement, often referred to as a Shareholders’ Agreement or Partnership Agreement, outlines the rights and responsibilities of each owner or shareholder. It covers important topics such as ownership percentages, decision-making processes, dispute resolution mechanisms, and buyout provisions. Having a written agreement in place can help prevent conflicts and provide a clear framework for the operation of the business.

In conclusion, forming a business entity requires several essential documents to ensure legal compliance and establish the foundation of the business. These documents include the Articles of Incorporation or Organization, Operating Agreement or Bylaws, EIN, licenses and permits, and a written agreement between owners or shareholders. Each document serves a specific purpose and is crucial for the successful formation and operation of the business entity. By completing the necessary paperwork, businesses can establish a solid legal foundation and set themselves up for success.

Document Checklist for Registering Different Types of Business Entities

When it comes to forming a business entity, there are several essential documents that need to be prepared and filed. These documents vary depending on the type of business entity you are forming, whether it be a sole proprietorship, partnership, limited liability company (LLC), or corporation. In this article, we will provide a document checklist for registering different types of business entities, ensuring that you have all the necessary paperwork in order.

For a sole proprietorship, the paperwork required is relatively straightforward. You will need to obtain the necessary licenses and permits for your specific industry or profession. Additionally, you may need to register your business name with the appropriate state or local government agency. It is also recommended to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) for tax purposes.

If you are forming a partnership, there are a few additional documents that need to be prepared. First and foremost, you will need to draft a partnership agreement. This agreement outlines the rights and responsibilities of each partner, as well as the terms of the partnership. It is crucial to have this agreement in writing to avoid any potential disputes or misunderstandings down the line. Additionally, you will need to obtain any necessary licenses and permits, register your business name, and obtain an EIN.

For those forming an LLC, the document checklist becomes a bit more extensive. The first document you will need to prepare is the Articles of Organization. This document officially establishes your LLC and includes important information such as the name of the LLC, its purpose, and the names and addresses of the members. Additionally, you will need to draft an Operating Agreement, which outlines the management and operation of the LLC. This agreement is not required in all states, but it is highly recommended to have one in place to protect the interests of the members. Like the other business entities, you will also need to obtain any necessary licenses and permits, register your business name, and obtain an EIN.

Lastly, for those forming a corporation, there are several documents that need to be prepared and filed. The first document is the Articles of Incorporation, which officially establishes your corporation. This document includes important information such as the name of the corporation, its purpose, and the number and type of shares of stock authorized. Additionally, you will need to draft Bylaws, which outline the internal rules and regulations of the corporation. Like the other business entities, you will also need to obtain any necessary licenses and permits, register your business name, and obtain an EIN.

In conclusion, when forming a business entity, it is crucial to have all the necessary paperwork in order. This document checklist provides a comprehensive guide for registering different types of business entities, ensuring that you have all the essential paperwork prepared and filed. By following this checklist, you can ensure that your business entity is properly established and compliant with all legal requirements.

Simplifying the Paperwork: Essential Documents for Forming Business Entities

Starting a business can be an exciting and rewarding venture. However, it also involves a lot of paperwork and legal requirements. To ensure a smooth and successful formation of your business entity, it is crucial to have all the necessary documents in order. In this article, we will discuss the essential paperwork that you need to have when forming a business entity.

First and foremost, you will need to have a business plan. This document outlines your goals, strategies, and financial projections for your business. It serves as a roadmap for your business and is essential for attracting investors and securing financing. A well-written business plan demonstrates your understanding of the market and your ability to execute your ideas.

Next, you will need to register your business with the appropriate government authorities. This typically involves filing the necessary forms and paying the required fees. The specific requirements vary depending on the type of business entity you are forming and the jurisdiction in which you are operating. Common types of business entities include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations.

For a sole proprietorship, you will need to obtain any necessary licenses or permits required for your specific industry. This may include professional licenses, health permits, or zoning permits. It is important to research and comply with all applicable regulations to avoid any legal issues down the line.

If you are forming a partnership, you will need to have a partnership agreement in place. This document outlines the rights and responsibilities of each partner, as well as the terms of the partnership. It is crucial to have a clear and comprehensive partnership agreement to avoid any misunderstandings or disputes in the future.

For an LLC or corporation, you will need to draft and file articles of organization or articles of incorporation, respectively. These documents establish the legal existence of your business entity and provide important information such as the name of the business, its purpose, and the names of its owners or shareholders. Additionally, you may need to draft and adopt bylaws or an operating agreement, which outline the internal rules and procedures of your business.

In addition to these foundational documents, you may also need to obtain an employer identification number (EIN) from the Internal Revenue Service (IRS). An EIN is a unique nine-digit number that identifies your business for tax purposes. It is required if you plan to hire employees, open a business bank account, or file certain tax returns.

Depending on the nature of your business, you may also need to have contracts, leases, or other legal agreements in place. These documents govern your relationships with customers, suppliers, landlords, and other parties. It is important to consult with an attorney to ensure that these agreements are properly drafted and protect your interests.

In conclusion, forming a business entity involves a significant amount of paperwork. To simplify the process and ensure compliance with legal requirements, it is essential to have all the necessary documents in order. From a well-crafted business plan to the appropriate registration forms and legal agreements, each document plays a crucial role in the formation and success of your business. By taking the time to gather and organize these essential documents, you can set your business up for long-term growth and prosperity.

Navigating the Registration Process: Document Checklist for Business Entity Formation

When it comes to forming a business entity, there are several important documents that need to be prepared and filed. These documents are essential for the registration process and will help ensure that your business is legally recognized and protected. In this article, we will provide a comprehensive document checklist to guide you through the process of forming a business entity.

The first document on the checklist is the Articles of Incorporation or Articles of Organization. This document is the foundation of your business entity and contains important information such as the name of the business, its purpose, and the names and addresses of the owners or shareholders. It is typically filed with the Secretary of State or a similar state agency.

Next on the checklist is the Operating Agreement or Bylaws. This document outlines the internal rules and regulations of your business entity. It covers important topics such as the roles and responsibilities of the owners or shareholders, voting rights, and procedures for making decisions. While not all states require an Operating Agreement or Bylaws, it is highly recommended to have one in place to avoid any potential disputes or conflicts in the future.

Another important document to include in your checklist is the Employer Identification Number (EIN) application. An EIN is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify your business for tax purposes. This number is necessary for opening a business bank account, hiring employees, and filing tax returns. You can easily apply for an EIN online through the IRS website.

In addition to the EIN application, you should also include any necessary state and local tax registration forms in your checklist. Depending on the nature of your business and its location, you may be required to register for sales tax, use tax, or other types of taxes. It is important to research and understand the specific tax requirements for your business entity to ensure compliance.

Another document to consider is a Business License or Permit. Depending on the type of business you are forming and its location, you may need to obtain a license or permit to operate legally. This could include a general business license, professional license, or specific permits for certain industries or activities. Research the requirements for your specific business entity and make sure to include any necessary licenses or permits in your checklist.

Lastly, it is important to include any additional documents that may be required for your specific business entity. This could include contracts, leases, intellectual property registrations, or any other legal documents that are relevant to your business. Consulting with an attorney or business advisor can help ensure that you have all the necessary documents in place.

In conclusion, forming a business entity requires careful preparation and filing of essential documents. By following this document checklist, you can navigate the registration process smoothly and ensure that your business is legally recognized and protected. Remember to research the specific requirements for your business entity and consult with professionals if needed. With the right documents in place, you can start your business journey with confidence.

Legal Compliance Made Easy: Document Checklist for Business Entity Registration

Starting a business can be an exciting and rewarding endeavor. However, it also comes with a lot of paperwork and legal requirements. To ensure that you are in compliance with the law and have all the necessary documentation, it is important to have a document checklist for forming business entities. This article will provide you with a comprehensive list of essential paperwork that you need to have in order to register your business.

The first document on the checklist is the Articles of Incorporation or Articles of Organization. This document is required for forming a corporation or a limited liability company (LLC). It includes important information such as the name of the business, the purpose of the business, the registered agent, and the number of shares or members. It is important to carefully fill out this document and file it with the appropriate state agency.

Next on the checklist is the Operating Agreement. This document is specifically for LLCs and outlines the rights and responsibilities of the members, as well as the management structure of the company. While an Operating Agreement is not required in all states, it is highly recommended to have one in place to avoid any potential disputes or misunderstandings in the future.

Another important document to include on your checklist is the Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This number is used to identify your business for tax purposes and is necessary if you plan to hire employees or open a business bank account. Applying for an EIN is a relatively simple process and can be done online through the IRS website.

In addition to the EIN, you will also need to obtain any necessary state and local business licenses and permits. These requirements vary depending on the type of business and the location, so it is important to research and comply with the specific regulations in your area. Failure to obtain the necessary licenses and permits can result in fines or even the closure of your business.

Insurance is another important aspect of legal compliance for business entities. Depending on the nature of your business, you may need to have general liability insurance, professional liability insurance, or workers’ compensation insurance. It is important to consult with an insurance professional to determine the appropriate coverage for your business.

Lastly, it is important to keep accurate and up-to-date records of your business transactions. This includes financial records such as income statements, balance sheets, and cash flow statements. It also includes any contracts, agreements, or leases that your business enters into. Keeping organized records not only helps you stay in compliance with the law, but it also provides valuable information for making informed business decisions.

In conclusion, starting a business requires careful attention to legal compliance and documentation. By having a document checklist for forming business entities, you can ensure that you have all the necessary paperwork in order to register your business and operate legally. From the Articles of Incorporation to insurance policies and financial records, each document plays a crucial role in the success and longevity of your business. By staying organized and proactive in your legal compliance efforts, you can focus on growing your business and achieving your entrepreneurial goals.

The Importance of a Document Checklist in Forming Business Entities

When it comes to forming business entities, there are numerous legal and administrative tasks that need to be completed. From filing the necessary paperwork to obtaining the required licenses and permits, the process can be overwhelming. That’s why having a document checklist is essential. A document checklist serves as a guide, ensuring that all the necessary paperwork is completed and submitted correctly.

One of the main reasons why a document checklist is important is that it helps to ensure compliance with legal requirements. When forming a business entity, there are specific documents that need to be filed with the appropriate government agencies. These documents include articles of incorporation, operating agreements, and bylaws, among others. Failing to submit these documents can result in legal consequences and delays in the formation process. By having a document checklist, business owners can ensure that all the necessary paperwork is completed and submitted on time.

Another reason why a document checklist is important is that it helps to keep track of the progress of the formation process. Forming a business entity involves multiple steps, and it can be easy to overlook certain tasks. With a document checklist, business owners can easily see what tasks have been completed and what still needs to be done. This helps to ensure that nothing falls through the cracks and that the formation process proceeds smoothly.

Additionally, a document checklist can help to streamline the formation process. By having all the necessary paperwork organized and readily available, business owners can save time and effort. They won’t have to waste time searching for documents or figuring out what needs to be done next. Instead, they can simply refer to the document checklist and follow the steps outlined. This can help to expedite the formation process and get the business up and running sooner.

Furthermore, a document checklist can serve as a reference tool for future needs. Once the business entity is formed, there are ongoing legal and administrative tasks that need to be completed. These tasks may include filing annual reports, renewing licenses and permits, and maintaining corporate records. By having a document checklist, business owners can easily refer to it whenever these tasks need to be completed. This helps to ensure that nothing is overlooked and that the business remains in compliance with legal requirements.

In conclusion, a document checklist is an essential tool when forming business entities. It helps to ensure compliance with legal requirements, keeps track of the progress of the formation process, streamlines the process, and serves as a reference tool for future needs. By having a document checklist, business owners can navigate the complex process of forming a business entity with ease and confidence. So, before embarking on the formation process, be sure to create a comprehensive document checklist to guide you every step of the way.

Mastering the Paperwork: Document Checklist for Smooth Business Entity Formation

Starting a business can be an exciting and rewarding endeavor. However, before you can officially launch your business, there are several important documents that you need to gather and complete. These documents are essential for forming business entities and ensuring a smooth and successful start to your entrepreneurial journey.

One of the first documents you will need is the Articles of Incorporation or Articles of Organization, depending on the type of business entity you are forming. This document is filed with the state and establishes the legal existence of your business. It typically includes information such as the name and address of your business, the purpose of your business, and the names and addresses of the initial directors or members.

In addition to the Articles of Incorporation or Articles of Organization, you will also need to draft and adopt bylaws or an operating agreement. These documents outline the internal rules and regulations of your business and provide guidance on how your business will be managed. Bylaws are typically used for corporations, while operating agreements are used for limited liability companies (LLCs). These documents address important matters such as the roles and responsibilities of directors or members, voting procedures, and the distribution of profits and losses.

Another crucial document is the Employer Identification Number (EIN) application. This application is filed with the Internal Revenue Service (IRS) and is necessary for tax purposes. The EIN is essentially a social security number for your business and is used to identify your business for tax reporting and employment purposes. It is important to obtain an EIN as it is required for opening a business bank account, hiring employees, and filing tax returns.

In addition to these foundational documents, you may also need to obtain any necessary licenses and permits for your specific industry or location. These licenses and permits vary depending on the nature of your business and can include things like a business license, professional license, or health and safety permits. It is important to research and understand the specific requirements for your industry and location to ensure compliance and avoid any legal issues down the line.

Furthermore, if you plan on hiring employees, you will need to complete various employment-related documents. This includes obtaining a completed Form I-9, which verifies the identity and employment eligibility of your employees, as well as having them complete a W-4 form for tax withholding purposes. Additionally, you may need to provide your employees with an employee handbook or employment agreement that outlines the terms and conditions of their employment.

Lastly, it is important to keep accurate and organized records of all your business documents. This includes maintaining copies of your Articles of Incorporation or Articles of Organization, bylaws or operating agreement, EIN application, licenses and permits, and employment-related documents. These records are not only important for legal and compliance purposes but also for future reference and potential audits.

In conclusion, forming a business entity requires gathering and completing several essential documents. These documents include the Articles of Incorporation or Articles of Organization, bylaws or operating agreement, EIN application, licenses and permits, and employment-related documents. By ensuring that you have all the necessary paperwork in order, you can set a solid foundation for your business and navigate the complexities of starting a new venture with confidence.

Q&A

1. What is a document checklist for forming business entities?

A document checklist is a list of essential paperwork required for the formation of business entities.

2. Why is a document checklist important?

A document checklist ensures that all necessary paperwork is completed and submitted correctly, reducing the risk of legal issues or delays in the formation process.

3. What are some common documents included in a document checklist?

Common documents may include articles of incorporation, operating agreements, bylaws, tax identification numbers, and business licenses.

4. Are there any specific documents required for specific types of business entities?

Yes, specific documents may be required depending on the type of business entity being formed. For example, a limited liability company (LLC) may require an operating agreement, while a corporation may require articles of incorporation.

5. Can a document checklist vary by jurisdiction?

Yes, document requirements can vary by jurisdiction, so it is important to consult the specific regulations and requirements of the jurisdiction where the business entity is being formed.

6. How can a document checklist help with organization?

A document checklist helps keep track of all necessary paperwork, ensuring that nothing is missed or overlooked during the formation process.

7. Can a document checklist be used for ongoing compliance?

Yes, a document checklist can also be used for ongoing compliance, helping businesses stay organized and ensure they meet all necessary legal and regulatory requirements.

8. Are there any consequences for not having the required documents?

Not having the required documents can result in legal and regulatory issues, such as fines, penalties, or even the dissolution of the business entity.

9. Can a document checklist be customized?

Yes, a document checklist can be customized to fit the specific needs and requirements of the business entity being formed.

10. Where can one find a document checklist for forming business entities?

Document checklists can be found online, through legal resources, or by consulting with professionals such as attorneys or business formation services.

Conclusion

In conclusion, a document checklist is crucial for forming business entities as it ensures that all essential paperwork is completed and submitted accurately. This checklist helps business owners and entrepreneurs stay organized and compliant with legal requirements, facilitating a smooth and efficient formation process. By following a comprehensive document checklist, individuals can establish their business entities with confidence and minimize the risk of potential legal issues in the future.