Tag: Legal Entities and Business Structures in Bahrain

Legal Entities and Business Structures in Bahrain

Introduction to Bahrain’s Business Landscape

Understanding the various legal entities and business structures in Bahrain is essential for establishing a successful enterprise. Bahrain offers a conducive environment for businesses with its blend of modern regulations and favorable economic policies.

Types of Business Structures in Bahrain

Bahrain provides a range of business structures to cater to different business needs. These include:

Sole Proprietorship

A sole proprietorship is the simplest form of business. It is owned and operated by one individual who is personally liable for all business debts and obligations. This structure is easy to establish and offers complete control to the owner.

Partnerships

Partnerships involve two or more individuals sharing ownership of a business. There are two main types:

- General Partnership: All partners share equal responsibility and liability for the business.

- Limited Partnership: This includes both general and limited partners, with limited partners having restricted liability and minimal management roles.

Limited Liability Company (LLC)

An LLC is a popular choice for many businesses in Bahrain. It offers limited liability protection to its shareholders, meaning their personal assets are not at risk. An LLC can have between 2 to 50 shareholders, making it suitable for small and medium-sized enterprises.

Joint Stock Company (JSC)

A JSC is ideal for larger businesses. It allows for raising capital through public or private offerings. There are two types of JSCs:

- Public Joint Stock Company: Shares are offered to the public and listed on the stock exchange.

- Closed Joint Stock Company: Shares are not offered to the public and are limited to a specific group of investors.

Branch Office

Foreign companies can establish a branch office in Bahrain to conduct business without forming a separate legal entity. The parent company is fully liable for the branch’s activities. This structure is beneficial for companies looking to expand their operations into Bahrain.

Representative Office

A representative office can conduct marketing and promotional activities but cannot engage in direct business transactions. This structure is ideal for foreign companies wanting to establish a presence in Bahrain without full-scale operations.

Free Zone Entities

Bahrain offers several free zones that provide tax incentives and other benefits. Businesses operating in these zones enjoy advantages such as 100% foreign ownership, tax exemptions, and simplified regulatory procedures. Free zones are designed to attract foreign investment and promote trade.

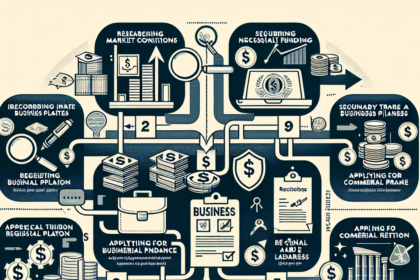

Steps to Establish a Business in Bahrain

- Choose the Business Structure: Select the appropriate legal structure based on the business’s needs.

- Reserve a Business Name: Ensure the name complies with Bahraini regulations and is available for use.

- Obtain Necessary Licenses: Acquire the required licenses from relevant authorities, depending on the business activity.

- Register the Business: Complete the registration process with the Ministry of Industry, Commerce, and Tourism.

- Open a Bank Account: Set up a corporate bank account for financial transactions.

- Hire Employees: Ensure compliance with Bahraini labor laws when hiring staff.

Compliance and Legal Considerations

Businesses must comply with local laws and regulations to operate legally in Bahrain. This includes adhering to tax obligations, labor laws, and corporate governance standards. Ensuring compliance helps maintain a good standing with regulatory authorities and avoids legal issues.

Conclusion

Choosing the right legal entity and business structure is crucial for success in Bahrain. By understanding the available options and following the necessary steps, businesses can establish a strong presence and thrive in the Bahraini market. Whether opting for a sole proprietorship, partnership, LLC, JSC, branch office, or free zone entity, each structure offers unique benefits and challenges tailored to different business needs.