Tag: Business Registration Process in Oman

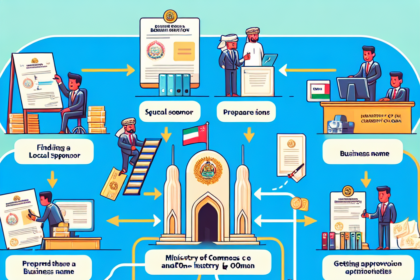

Step-by-Step Guide to the Business Registration Process in Oman

Introduction to Business Registration in Oman

Oman’s growing economy presents numerous opportunities for entrepreneurs and investors. Understanding the business registration process is essential for setting up a successful venture in this dynamic market. This guide outlines the steps involved in registering a business in Oman.

Choosing the Right Business Structure

Selecting the appropriate business structure is the first crucial step. Oman offers several types of business entities, including:

1. Limited Liability Company (LLC)

An LLC is a popular choice for small and medium-sized enterprises. It requires a minimum of two shareholders and offers limited liability protection.

2. Joint Stock Company (JSC)

A JSC is suitable for larger businesses. It can be either public, with shares traded on the stock exchange, or closed, with shares held by a few investors.

3. Branch Office

Foreign companies can establish a branch office to conduct business in Oman without creating a separate legal entity. The parent company retains full liability.

4. Representative Office

A representative office is limited to marketing and promotion activities and cannot engage in direct commercial transactions.

5. Free Zone Entity

Free zones offer benefits such as 100% foreign ownership, tax exemptions, and simplified regulatory procedures. These zones are ideal for businesses focused on trade, logistics, and manufacturing.

Steps to Register a Business in Oman

-

Reserve a Business Name

The first step is to choose a unique business name and reserve it with the Ministry of Commerce and Industry (MOCI). The name must comply with Omani regulations and should not infringe on existing trademarks.

-

Submit Initial Application

Submit the initial application form along with the required documents to the MOCI. The documents typically include:

- Copies of shareholders’ passports

- Proposed business activities

- Articles of Association (for LLCs and JSCs)

-

Obtain Approvals

Certain business activities may require additional approvals from relevant ministries or authorities. Ensure that you obtain all necessary permits and clearances before proceeding.

-

Draft Legal Documents

Prepare the legal documents, including the Memorandum of Association (MOA) and Articles of Association. These documents outline the company’s structure, objectives, and governance.

-

Open a Bank Account

Open a corporate bank account in Oman and deposit the required share capital. The bank will provide a certificate confirming the deposit, which is necessary for the registration process.

-

Register with the MOCI

Submit the final application, along with the bank certificate and legal documents, to the MOCI. Pay the applicable registration and licensing fees. Once approved, the MOCI will issue the commercial registration certificate.

-

Obtain Municipality License

Apply for a municipality license from the local municipality where the business will operate. This license is required for all businesses in Oman.

-

Register with the Tax Authority

Register the business with the Oman Tax Authority for Value Added Tax (VAT) and other applicable taxes. Ensure compliance with Omani tax regulations by filing regular returns.

-

Register for Social Insurance

If you plan to hire employees, register with the Public Authority for Social Insurance (PASI). This ensures compliance with social security and employee benefits regulations.

Compliance and Regulatory Requirements

Businesses in Oman must adhere to local laws and regulations. Key compliance areas include:

-

Commercial Licensing

Ensure your business holds a valid trade license and renew it annually.

-

Employment Laws

Comply with Omani labor laws, including employment contracts, working hours, and employee benefits.

-

Tax Regulations

File regular tax returns and pay applicable taxes to the Oman Tax Authority.

-

Environmental Regulations

If your business activities impact the environment, ensure compliance with environmental regulations and obtain necessary permits.

Conclusion

Understanding the business registration process in Oman is essential for establishing a successful venture. By following the outlined steps and ensuring compliance with local regulations, entrepreneurs can navigate the registration process smoothly and set the foundation for business success in Oman. Whether you choose an LLC, JSC, branch office, or free zone entity, Oman offers a supportive environment for business growth and development.