-

Table of Contents

- Introduction

- Understanding the Legal Structures of Business Entities in Egypt

- A Comprehensive Overview of Business Types in Egypt

- Choosing the Right Business Entity in Egypt: Key Considerations

- Step-by-Step Guide to Registering a Business Entity in Egypt

- Exploring the Tax Implications of Different Business Entities in Egypt

- Navigating the Legal Requirements for Foreign-Owned Business Entities in Egypt

- Comparing the Advantages and Disadvantages of Different Business Entities in Egypt

- Essential Tips for Managing and Operating Business Entities in Egypt

- Resolving Common Legal Challenges Faced by Business Entities in Egypt

- Future Trends and Opportunities for Business Entities in Egypt

- Q&A

- Conclusion

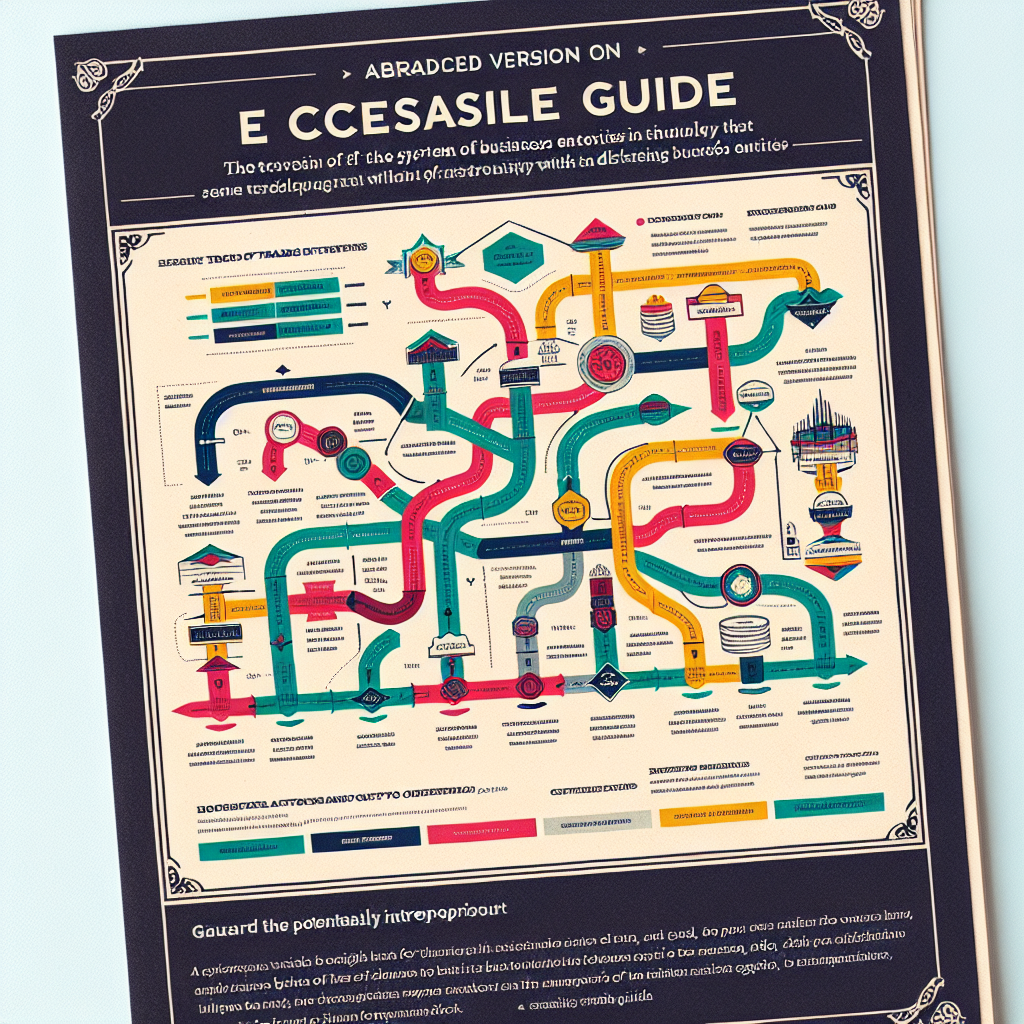

Navigating Business Entities in Egypt: A Practical guide – Your Roadmap to Success in the Egyptian Business Landscape.

Introduction

Navigating Business Entities in Egypt: A Practical guide is a comprehensive resource that provides essential information and guidance for individuals and organizations looking to establish and operate business entities in Egypt. This guide aims to assist readers in understanding the various types of business entities available in Egypt, the legal requirements and procedures involved in their establishment, as well as the rights and obligations associated with each entity type. By offering practical insights and expert advice, this guide equips readers with the necessary knowledge to make informed decisions and successfully navigate the complexities of the Egyptian business landscape.

Understanding the Legal Structures of Business Entities in Egypt

Navigating Business Entities in Egypt: A Practical guide

Understanding the legal structures of Business Entities in Egypt

When starting a business in Egypt, it is crucial to understand the different legal structures available for business entities. Choosing the right structure is essential as it determines the legal and financial responsibilities of the business owners. In this article, we will explore the various business entity options in Egypt and provide a practical guide to help entrepreneurs make informed decisions.

The most common types of business entities in Egypt are sole proprietorships, partnerships, limited liability companies (LLCs), and joint stock companies. Each structure has its own advantages and disadvantages, and it is important to consider factors such as liability, taxation, and management control before making a decision.

Sole proprietorships are the simplest form of business entity in Egypt. In this structure, the business is owned and operated by a single individual. While this type of entity offers complete control and flexibility to the owner, it also exposes them to unlimited personal liability. This means that the owner’s personal assets can be used to satisfy business debts or legal obligations.

Partnerships, on the other hand, involve two or more individuals who agree to share the profits and losses of a business. There are two main types of partnerships in Egypt: general partnerships and limited partnerships. In a general partnership, all partners have unlimited liability for the business’s debts and obligations. In a limited partnership, there are both general partners, who have unlimited liability, and limited partners, whose liability is limited to their investment in the business.

Limited liability companies (LLCs) are a popular choice for entrepreneurs in Egypt. This structure combines the benefits of a partnership and a corporation. LLCs offer limited liability to their owners, meaning that their personal assets are protected from business debts. Additionally, LLCs provide flexibility in terms of management and taxation. They can be managed by the owners themselves or by appointed managers, and they have the option to be taxed as a partnership or a corporation.

Joint stock companies are another common business entity in Egypt. These companies are owned by shareholders who hold shares of stock in the company. Joint stock companies have a separate legal personality from their shareholders, which means that the shareholders’ personal assets are protected. However, they are subject to more stringent regulations and reporting requirements compared to other business entities.

When choosing a business entity in Egypt, it is important to consider the specific needs and goals of the business. Factors such as liability, taxation, management control, and reporting requirements should all be taken into account. Consulting with a legal professional or business advisor can help entrepreneurs make informed decisions and navigate the complexities of Egyptian business law.

In conclusion, understanding the legal structures of business entities in Egypt is crucial for entrepreneurs looking to start a business in the country. Sole proprietorships, partnerships, limited liability companies, and joint stock companies are the main options available. Each structure has its own advantages and disadvantages, and it is important to carefully consider the specific needs of the business before making a decision. Seeking professional advice can help entrepreneurs make informed choices and ensure compliance with Egyptian business laws and regulations.

A Comprehensive Overview of Business Types in Egypt

Egypt is a country with a rich history and a vibrant business landscape. For those looking to start a business in Egypt, it is important to understand the different types of business entities available and the legal requirements associated with each. This article aims to provide a comprehensive overview of the various business types in Egypt, helping entrepreneurs navigate the complexities of the Egyptian business environment.

One of the most common business entities in Egypt is the sole proprietorship. This type of business is owned and operated by a single individual, who is personally liable for all debts and obligations of the business. Sole proprietorships are relatively easy to set up and require minimal paperwork. However, they offer little protection to the owner’s personal assets and may not be suitable for businesses with high liability risks.

Another popular business entity in Egypt is the partnership. Partnerships can be either general partnerships or limited partnerships. In a general partnership, all partners share equal responsibility for the business’s debts and obligations. This type of partnership is relatively easy to establish and offers flexibility in terms of management and decision-making. However, partners are personally liable for the partnership’s debts, which can be a significant risk.

Limited partnerships, on the other hand, consist of general partners who have unlimited liability and limited partners who have limited liability. Limited partners are not involved in the day-to-day management of the business and are only liable for the amount they have invested in the partnership. Limited partnerships offer a balance between liability protection and flexibility, making them an attractive option for many entrepreneurs.

For those looking for more liability protection, a limited liability company (LLC) may be the best choice. LLCs are separate legal entities that provide limited liability to their owners, known as members. Members are not personally liable for the company’s debts and obligations, and their personal assets are protected. LLCs are relatively easy to set up and offer flexibility in terms of management and taxation. However, they require more paperwork and formalities compared to sole proprietorships and partnerships.

For larger businesses, a joint stock company (JSC) may be the most suitable option. JSCs are owned by shareholders and are managed by a board of directors. Shareholders’ liability is limited to the amount they have invested in the company. JSCs are subject to more regulations and formalities compared to other business entities, but they offer advantages such as the ability to raise capital through the sale of shares and the ability to transfer ownership easily.

Lastly, there is the option of establishing a branch or representative office of a foreign company in Egypt. This allows foreign companies to conduct business in Egypt without setting up a separate legal entity. Branches and representative offices are subject to certain restrictions and regulations, but they offer the advantage of leveraging the parent company’s brand and resources.

In conclusion, starting a business in Egypt requires careful consideration of the different types of business entities available. Each entity has its own advantages and disadvantages, and entrepreneurs should choose the one that best suits their needs and goals. Whether it is a sole proprietorship, partnership, LLC, JSC, or a branch/representative office, understanding the legal requirements and implications of each entity is crucial for success in the Egyptian business landscape.

Choosing the Right Business Entity in Egypt: Key Considerations

Choosing the right business entity is a crucial decision for any entrepreneur looking to establish a presence in Egypt. The country offers a variety of options, each with its own advantages and disadvantages. Understanding the key considerations when selecting a business entity is essential to ensure compliance with local regulations and to maximize the potential for success.

One of the first factors to consider is the level of liability protection desired. In Egypt, entrepreneurs can choose between several types of business entities, including sole proprietorships, partnerships, limited liability companies (LLCs), and joint stock companies. Each entity type offers a different level of liability protection for its owners.

Sole proprietorships are the simplest and most common form of business entity in Egypt. They are easy to set up and require minimal paperwork. However, sole proprietors are personally liable for all business debts and obligations. This means that if the business fails, the owner’s personal assets may be at risk.

Partnerships, on the other hand, allow two or more individuals to share the profits and losses of a business. There are two main types of partnerships in Egypt: general partnerships and limited partnerships. In a general partnership, all partners have unlimited liability for the partnership’s debts. In a limited partnership, there are both general partners, who have unlimited liability, and limited partners, whose liability is limited to their investment in the partnership.

Limited liability companies (LLCs) are a popular choice for entrepreneurs in Egypt. They offer a higher level of liability protection than sole proprietorships and partnerships. In an LLC, the owners’ personal assets are generally protected from business debts and obligations. Additionally, LLCs have a flexible management structure and are subject to fewer regulatory requirements than joint stock companies.

Joint stock companies are another option for entrepreneurs in Egypt. They are typically used for larger businesses and require a minimum capital investment. Joint stock companies offer limited liability for their shareholders and can be publicly traded on the stock exchange. However, they are subject to more stringent regulatory requirements and are more complex to set up and manage.

Another important consideration when choosing a business entity in Egypt is the tax implications. Different entity types are subject to different tax rates and regulations. For example, sole proprietors and partnerships are generally subject to personal income tax, while LLCs and joint stock companies are subject to corporate income tax. It is important to consult with a tax advisor to understand the tax implications of each entity type and choose the one that best aligns with the business’s financial goals.

Additionally, entrepreneurs should consider the ease of doing business and the level of bureaucracy associated with each entity type. Some business entities require more paperwork and administrative tasks than others. For example, joint stock companies are subject to more regulatory requirements and must comply with corporate governance rules. On the other hand, sole proprietorships and partnerships have fewer administrative burdens but offer less liability protection.

In conclusion, choosing the right business entity in Egypt is a critical decision that requires careful consideration of several key factors. Entrepreneurs must weigh the level of liability protection, tax implications, ease of doing business, and administrative requirements associated with each entity type. By understanding these considerations and seeking professional advice, entrepreneurs can navigate the complexities of business entities in Egypt and set themselves up for success.

Step-by-Step Guide to Registering a Business Entity in Egypt

Navigating Business Entities in Egypt: A Practical guide

Starting a business in Egypt can be an exciting and rewarding venture. However, before you can begin operations, it is crucial to understand the process of registering a business entity in the country. This step-by-step guide will walk you through the necessary procedures and requirements, ensuring a smooth and successful registration process.

The first step in registering a business entity in Egypt is to determine the type of entity that best suits your needs. The most common types of business entities in Egypt are sole proprietorships, partnerships, limited liability companies (LLCs), and joint stock companies. Each type has its own advantages and disadvantages, so it is essential to carefully consider your business goals and objectives before making a decision.

Once you have determined the type of entity, the next step is to choose a name for your business. The name should be unique and not infringe on any existing trademarks or copyrights. It is advisable to conduct a thorough search to ensure that your chosen name is available and not already registered by another entity.

After selecting a name, you will need to prepare the necessary documents for registration. These documents typically include a memorandum of association, articles of association, and a commercial register application form. The memorandum of association outlines the company’s objectives, while the articles of association detail the internal regulations and governance structure.

Once the documents are prepared, they must be notarized by a public notary. This step is crucial as it ensures the authenticity and legality of the documents. It is important to note that all documents must be in Arabic, so if you are not fluent in the language, it is advisable to seek the assistance of a professional translator.

After notarization, the next step is to submit the documents to the relevant government authorities. In Egypt, the General Authority for Investment and Free Zones (GAFI) is responsible for registering business entities. The application must be accompanied by the necessary fees, which vary depending on the type of entity and the capital invested.

Once the application is submitted, it will undergo a thorough review by GAFI. This review process typically takes several weeks, during which the authorities will verify the accuracy and completeness of the submitted documents. If any discrepancies or issues are identified, you may be required to provide additional information or make amendments to the documents.

Once the application is approved, you will receive a commercial register certificate, which officially registers your business entity. This certificate serves as proof of your business’s legal existence and allows you to commence operations. It is important to note that you may also be required to obtain additional licenses or permits depending on the nature of your business activities.

In conclusion, registering a business entity in Egypt requires careful planning and adherence to the necessary procedures and requirements. By following this step-by-step guide, you can navigate the registration process smoothly and ensure compliance with the country’s laws and regulations. Remember to seek professional advice and assistance when needed to ensure a successful and legally compliant business registration in Egypt.

Exploring the Tax Implications of Different Business Entities in Egypt

Egypt is a country with a rich history and a vibrant business environment. As a result, many entrepreneurs and investors are drawn to the opportunities that Egypt has to offer. However, before diving into the world of business in Egypt, it is important to understand the different types of business entities and their tax implications.

One of the most common business entities in Egypt is the sole proprietorship. This is a simple and straightforward structure where an individual owns and operates the business. From a tax perspective, the income generated by the business is considered personal income and is subject to personal income tax rates. This can be advantageous for small businesses as the tax rates for individuals are generally lower than those for corporations.

Another popular business entity in Egypt is the partnership. A partnership is formed when two or more individuals come together to carry out a business venture. In terms of taxation, partnerships are treated similarly to sole proprietorships. The income generated by the partnership is considered personal income and is subject to personal income tax rates. However, it is important to note that each partner is individually responsible for their share of the tax liability.

For those looking for a more formal business structure, a limited liability company (LLC) may be the way to go. An LLC is a separate legal entity from its owners, providing limited liability protection. From a tax perspective, an LLC is considered a separate taxpayer and is subject to corporate income tax rates. This can be advantageous for businesses with higher levels of income as corporate tax rates are generally lower than personal income tax rates. Additionally, an LLC allows for more flexibility in terms of ownership and management structure.

If you are considering a larger business venture in Egypt, a joint stock company (JSC) may be the most suitable option. A JSC is a publicly traded company that can have an unlimited number of shareholders. From a tax perspective, a JSC is also considered a separate taxpayer and is subject to corporate income tax rates. However, it is important to note that JSCs are subject to additional regulations and reporting requirements compared to other business entities.

When choosing a business entity in Egypt, it is important to consider not only the tax implications but also other factors such as liability protection, ease of formation, and management structure. It is advisable to consult with a legal and tax professional to determine the most suitable business entity for your specific needs and goals.

In conclusion, navigating the different business entities in Egypt can be a complex task. Understanding the tax implications of each entity is crucial in making an informed decision. Whether you choose a sole proprietorship, partnership, LLC, or JSC, it is important to consider the advantages and disadvantages of each structure. By doing so, you can ensure that your business is set up for success in Egypt‘s dynamic business environment.

Navigating the Legal Requirements for Foreign-Owned Business Entities in Egypt

Navigating the Legal Requirements for Foreign-Owned Business Entities in Egypt

When it comes to establishing a foreign-owned business entity in Egypt, understanding the legal requirements is crucial. Egypt has specific regulations and procedures that must be followed to ensure compliance and a smooth business operation. In this practical guide, we will explore the key legal requirements for foreign-owned business entities in Egypt.

First and foremost, it is important to note that foreign investors are allowed to establish different types of business entities in Egypt. The most common forms include limited liability companies (LLCs), joint stock companies, and branch offices. Each type has its own set of legal requirements and considerations.

For foreign investors looking to establish an LLC, the process begins with obtaining an investment license from the General Authority for Investment and Free Zones (GAFI). This license is required for all foreign investments in Egypt and serves as a guarantee of legal protection and incentives. The application for an investment license must include detailed information about the proposed business activities, capital investment, and ownership structure.

Once the investment license is obtained, the next step is to register the LLC with the Companies Registry Office. This involves submitting the necessary documents, such as the articles of association, memorandum of association, and proof of capital deposit. It is important to note that the minimum capital requirement for an LLC in Egypt is EGP 50,000.

For foreign investors considering a joint stock company, the process is slightly different. In addition to obtaining an investment license from GAFI, the company must also obtain approval from the Egyptian Financial Regulatory Authority (EFRA). This approval is necessary for companies planning to issue shares to the public. The process of obtaining EFRA approval involves submitting a detailed prospectus and financial statements.

Branch offices, on the other hand, do not require an investment license. However, they must still be registered with the Companies Registry Office. The registration process for branch offices involves submitting documents such as the parent company’s articles of association, a power of attorney appointing a local representative, and proof of capital deposit.

Regardless of the type of business entity, foreign investors must also comply with certain tax obligations in Egypt. This includes registering for tax purposes with the Egyptian Tax Authority and obtaining a tax identification number. Additionally, businesses are required to keep accurate financial records and submit regular tax returns.

It is worth noting that Egypt has made significant efforts to improve its business environment and attract foreign investment. In recent years, the government has implemented various reforms to streamline procedures and reduce bureaucracy. These reforms have included the establishment of a one-stop shop for business registration and the introduction of online services.

In conclusion, navigating the legal requirements for foreign-owned business entities in Egypt is essential for a successful venture. Understanding the specific regulations and procedures for establishing different types of business entities is crucial. By obtaining the necessary investment licenses, registering with the Companies Registry Office, and complying with tax obligations, foreign investors can ensure a smooth and compliant operation in Egypt.

Comparing the Advantages and Disadvantages of Different Business Entities in Egypt

Comparing the Advantages and Disadvantages of Different Business Entities in Egypt

When starting a business in Egypt, one of the most important decisions to make is choosing the right business entity. The type of entity you choose will have significant implications for your business’s legal structure, taxation, liability, and overall operations. In this article, we will compare the advantages and disadvantages of different business entities in Egypt to help you make an informed decision.

One of the most common business entities in Egypt is the sole proprietorship. This is a simple and cost-effective option for small businesses. As a sole proprietor, you have complete control over your business and all its profits. However, one major disadvantage is that you are personally liable for all debts and obligations of the business. This means that your personal assets are at risk if the business fails or faces legal issues.

Another popular option is the partnership. In a partnership, two or more individuals share the profits, losses, and liabilities of the business. One advantage of a partnership is that it allows for shared decision-making and resources. Additionally, partnerships are relatively easy to set up and dissolve. However, like sole proprietorships, partners are personally liable for the debts and obligations of the business. This can be a significant disadvantage, as it puts personal assets at risk.

For those looking for more limited liability, a limited liability company (LLC) may be a suitable choice. An LLC combines the advantages of a partnership and a corporation. It provides limited liability protection to its owners, known as members, while allowing for flexible management and taxation options. Additionally, an LLC can have an unlimited number of members, making it an attractive option for businesses with multiple owners. However, forming an LLC can be more complex and costly compared to sole proprietorships or partnerships.

If you are planning to raise capital from investors or take your business public, a joint stock company (JSC) may be the right choice. A JSC is a legal entity with share capital divided into shares. It allows for the transfer of shares and the issuance of securities, making it easier to attract investors. Additionally, a JSC provides limited liability protection to its shareholders. However, forming and operating a JSC requires compliance with strict regulations and reporting requirements, which can be time-consuming and costly.

Lastly, for those looking for the highest level of limited liability protection, a corporation may be the best option. A corporation is a separate legal entity from its owners, known as shareholders. This means that shareholders are not personally liable for the debts and obligations of the corporation. Additionally, corporations have perpetual existence, meaning they can continue to operate even if ownership changes. However, forming and operating a corporation can be complex and expensive, requiring compliance with various legal and regulatory requirements.

In conclusion, choosing the right business entity in Egypt is a crucial decision that will impact your business’s legal structure, taxation, liability, and overall operations. Each type of entity has its own advantages and disadvantages. Sole proprietorships and partnerships offer simplicity but come with personal liability risks. LLCs provide limited liability protection and flexibility but can be more complex to set up. JSCs are suitable for raising capital but require compliance with strict regulations. Corporations offer the highest level of limited liability protection but can be complex and expensive to form and operate. It is essential to carefully consider your business’s needs and consult with legal and financial professionals before making a decision.

Essential Tips for Managing and Operating Business Entities in Egypt

Navigating Business Entities in Egypt: A Practical guide

Egypt is a country with a rich history and a vibrant business landscape. For those looking to establish or expand their business in Egypt, it is essential to understand the various business entities available and the regulations that govern them. This article aims to provide essential tips for managing and operating business entities in Egypt.

One of the first decisions to make when establishing a business in Egypt is choosing the right business entity. The most common types of business entities in Egypt are sole proprietorships, partnerships, limited liability companies (LLCs), and joint stock companies. Each type has its own advantages and disadvantages, so it is crucial to carefully consider the specific needs and goals of your business.

Sole proprietorships are the simplest form of business entity in Egypt. They are owned and operated by a single individual, who is personally liable for all debts and obligations of the business. While sole proprietorships offer complete control and flexibility, they also carry a higher level of risk.

Partnerships, on the other hand, involve two or more individuals who share the profits and losses of the business. There are two main types of partnerships in Egypt: general partnerships and limited partnerships. In a general partnership, all partners have unlimited liability, while in a limited partnership, there are both general partners with unlimited liability and limited partners with limited liability.

Limited liability companies (LLCs) are a popular choice for many businesses in Egypt. They offer limited liability protection to their owners, meaning that their personal assets are not at risk in case of business debts or obligations. LLCs also provide flexibility in terms of management and taxation, making them an attractive option for both small and large businesses.

For those looking to raise capital through public offerings, joint stock companies are the way to go. Joint stock companies issue shares to the public and are subject to more stringent regulations and reporting requirements. They offer limited liability to their shareholders and allow for the transferability of shares, making it easier to attract investors.

Once you have chosen the right business entity, it is crucial to comply with the legal and regulatory requirements in Egypt. This includes obtaining the necessary licenses and permits, registering with the relevant authorities, and complying with tax obligations. It is advisable to seek professional advice from local lawyers or consultants who are familiar with the Egyptian business environment to ensure compliance with all legal requirements.

Another important aspect of managing and operating a business entity in Egypt is understanding the labor laws and regulations. Egypt has specific laws governing employment contracts, working hours, wages, and benefits. It is essential to familiarize yourself with these laws to avoid any legal issues or disputes with your employees.

In addition to legal and regulatory compliance, building strong relationships with local partners and stakeholders is crucial for success in Egypt. Networking and establishing trust are key elements of doing business in the country. It is advisable to invest time and effort in building relationships with local suppliers, customers, and government officials to navigate the business landscape effectively.

In conclusion, navigating business entities in Egypt requires careful consideration of the available options and compliance with legal and regulatory requirements. Choosing the right business entity, understanding labor laws, and building strong relationships are essential for managing and operating a successful business in Egypt. By following these essential tips, you can navigate the Egyptian business landscape with confidence and achieve your business goals.

Resolving Common Legal Challenges Faced by Business Entities in Egypt

Navigating Business Entities in Egypt: A Practical guide

Resolving Common Legal Challenges Faced by Business Entities in Egypt

When it comes to doing business in Egypt, understanding the legal landscape is crucial. Egypt has a complex legal system that can present challenges for both local and foreign business entities. In this section, we will explore some of the common legal challenges faced by business entities in Egypt and provide practical guidance on how to navigate them.

One of the first challenges that business entities often encounter in Egypt is the process of company registration. Establishing a legal entity in Egypt requires compliance with various laws and regulations. It is essential to engage the services of a local lawyer or legal advisor who can guide you through the registration process and ensure that all necessary documents are prepared and submitted correctly.

Once your business entity is registered, you may face challenges related to taxation. Egypt has a complex tax system, and understanding your tax obligations is crucial to avoid any legal issues. It is advisable to consult with a tax expert who can help you navigate the tax laws and ensure compliance. Additionally, keeping accurate financial records and maintaining transparency in your financial transactions will help you avoid any potential tax disputes.

Another common legal challenge faced by business entities in Egypt is labor law compliance. Egypt has strict labor laws that govern various aspects of employment, including working hours, wages, and employee benefits. It is essential to familiarize yourself with these laws and ensure that your business entity complies with them. This includes providing proper contracts to employees, adhering to minimum wage requirements, and providing a safe working environment. Failure to comply with labor laws can result in legal disputes and penalties.

Intellectual property protection is another area where business entities in Egypt often face challenges. Protecting your intellectual property rights is crucial to safeguard your business interests. Registering trademarks, patents, and copyrights with the relevant authorities is essential to establish legal protection. It is advisable to work with a local intellectual property lawyer who can guide you through the registration process and help you enforce your rights if necessary.

In addition to these challenges, business entities in Egypt may also face issues related to contract enforcement and dispute resolution. It is essential to have well-drafted contracts that clearly outline the rights and obligations of all parties involved. In the event of a dispute, engaging in alternative dispute resolution methods, such as mediation or arbitration, can help resolve issues more efficiently and cost-effectively than going to court.

Navigating the legal challenges faced by business entities in Egypt requires a comprehensive understanding of the country’s legal system and regulations. Engaging the services of local legal experts who specialize in Egyptian law is crucial to ensure compliance and mitigate any potential risks. By staying informed, seeking professional advice, and maintaining transparency in your business operations, you can navigate the legal landscape in Egypt successfully.

In conclusion, doing business in Egypt comes with its fair share of legal challenges. From company registration to tax compliance, labor laws, intellectual property protection, and contract enforcement, business entities must navigate a complex legal landscape. By seeking professional guidance, staying informed, and maintaining compliance with the relevant laws and regulations, businesses can overcome these challenges and thrive in Egypt‘s dynamic business environment.

Future Trends and Opportunities for Business Entities in Egypt

Future Trends and Opportunities for Business Entities in Egypt

As Egypt continues to experience economic growth and political stability, the country presents numerous opportunities for businesses looking to expand or establish a presence in the region. In this section, we will explore some of the future trends and opportunities for business entities in Egypt.

One of the key trends in Egypt‘s business landscape is the increasing focus on entrepreneurship and innovation. The government has implemented various initiatives to support startups and small businesses, including the establishment of innovation hubs and the introduction of tax incentives. This has created a favorable environment for entrepreneurs and has attracted foreign investment in sectors such as technology, renewable energy, and e-commerce.

Another promising opportunity for business entities in Egypt is the country’s strategic location and its role as a gateway to Africa and the Middle East. With its well-developed infrastructure and transportation networks, Egypt offers easy access to regional markets. This has led to the establishment of numerous logistics and distribution centers, making it an attractive destination for companies looking to expand their operations in the region.

Furthermore, Egypt‘s large and growing consumer market presents significant opportunities for businesses. With a population of over 100 million people, there is a strong demand for various goods and services, including consumer electronics, healthcare products, and fast-moving consumer goods. Companies that can tap into this market and offer innovative and affordable products are likely to thrive in Egypt.

In addition to these trends, there are also opportunities arising from the government’s focus on economic diversification. Egypt has traditionally relied heavily on sectors such as tourism and agriculture, but there is a growing emphasis on developing other industries, such as manufacturing, information technology, and renewable energy. This presents opportunities for businesses that can contribute to these sectors and help drive economic growth.

Moreover, Egypt‘s commitment to sustainable development and green initiatives opens up opportunities for businesses in the renewable energy sector. The government has set ambitious targets for renewable energy production, and there are incentives in place to attract investment in this sector. Companies that specialize in solar and wind energy, for example, can take advantage of these opportunities and contribute to Egypt‘s transition to a more sustainable and environmentally friendly economy.

Lastly, the ongoing digital transformation in Egypt presents opportunities for businesses in the technology sector. With a young and tech-savvy population, there is a growing demand for digital services and solutions. E-commerce, fintech, and software development are some of the areas that are experiencing rapid growth. Companies that can offer innovative digital solutions and adapt to the changing needs of consumers are well-positioned to succeed in Egypt‘s evolving business landscape.

In conclusion, Egypt offers a range of future trends and opportunities for business entities. From the focus on entrepreneurship and innovation to the country’s strategic location and large consumer market, there are numerous avenues for businesses to explore. Additionally, the government’s commitment to economic diversification, sustainable development, and digital transformation further enhances the potential for growth and success. By understanding and navigating these trends, businesses can position themselves to thrive in Egypt‘s evolving business environment.

Q&A

1. What is the purpose of the guide on navigating business entities in Egypt?

The purpose of the guide is to provide practical information and guidance on establishing and operating business entities in Egypt.

2. Who is the target audience for this guide?

The guide is aimed at individuals and companies interested in doing business in Egypt, including entrepreneurs, investors, and foreign entities.

3. What types of business entities are covered in the guide?

The guide covers various types of business entities in Egypt, including sole proprietorships, partnerships, limited liability companies, joint stock companies, and branches of foreign companies.

4. Does the guide provide information on the legal requirements for establishing a business entity in Egypt?

Yes, the guide provides detailed information on the legal requirements, procedures, and documentation needed to establish different types of business entities in Egypt.

5. Are there any specific regulations or restrictions for foreign entities establishing a business in Egypt?

Yes, the guide outlines the specific regulations and restrictions that foreign entities need to be aware of when establishing a business in Egypt, including foreign ownership limitations and sector-specific regulations.

6. Does the guide cover taxation and financial considerations for business entities in Egypt?

Yes, the guide provides information on the taxation system in Egypt, including corporate tax rates, VAT, and other relevant financial considerations for business entities.

7. Are there any specific labor laws or regulations discussed in the guide?

Yes, the guide covers labor laws and regulations in Egypt, including employment contracts, working hours, minimum wage, and other relevant labor considerations for business entities.

8. Does the guide provide information on intellectual property rights in Egypt?

Yes, the guide includes information on intellectual property rights protection in Egypt, including trademarks, copyrights, patents, and enforcement mechanisms.

9. Are there any specific considerations for business entities operating in free zones or special economic zones in Egypt?

Yes, the guide provides information on the benefits, regulations, and procedures for establishing and operating in free zones or special economic zones in Egypt.

10. Where can one access the guide on navigating business entities in Egypt?

The guide can be accessed through various sources, such as government websites, legal and business consulting firms, or relevant industry associations.

Conclusion

In conclusion, navigating business entities in Egypt can be a complex process, but with the right knowledge and guidance, it can be a practical endeavor. Understanding the various types of business entities available, such as partnerships, limited liability companies, and joint stock companies, is crucial for making informed decisions. Additionally, being aware of the legal and regulatory requirements, tax obligations, and licensing procedures is essential for establishing and operating a successful business in Egypt. Seeking professional advice and assistance can greatly facilitate the process and ensure compliance with local laws and regulations. Overall, with careful planning and adherence to the necessary procedures, navigating business entities in Egypt can be a practical and rewarding experience.