-

Table of Contents

- Introduction

- Understanding the Role of Regulatory Authorities in Qatar

- Key Business Regulations in Qatar: A Comprehensive Overview

- Navigating Qatar’s Regulatory Landscape: A Guide for Businesses

- Qatar Government Agencies: An In-depth Analysis

- Compliance with Regulatory Authorities in Qatar: Best Practices for Businesses

- Regulatory Challenges and Opportunities for Businesses in Qatar

- The Impact of Regulatory Authorities on Foreign Investments in Qatar

- Ensuring Regulatory Compliance: Strategies for Businesses in Qatar

- Qatar’s Regulatory Reforms: Implications for Businesses

- Regulatory Authorities in Qatar: A Roadmap for Business Success

- Q&A

- Conclusion

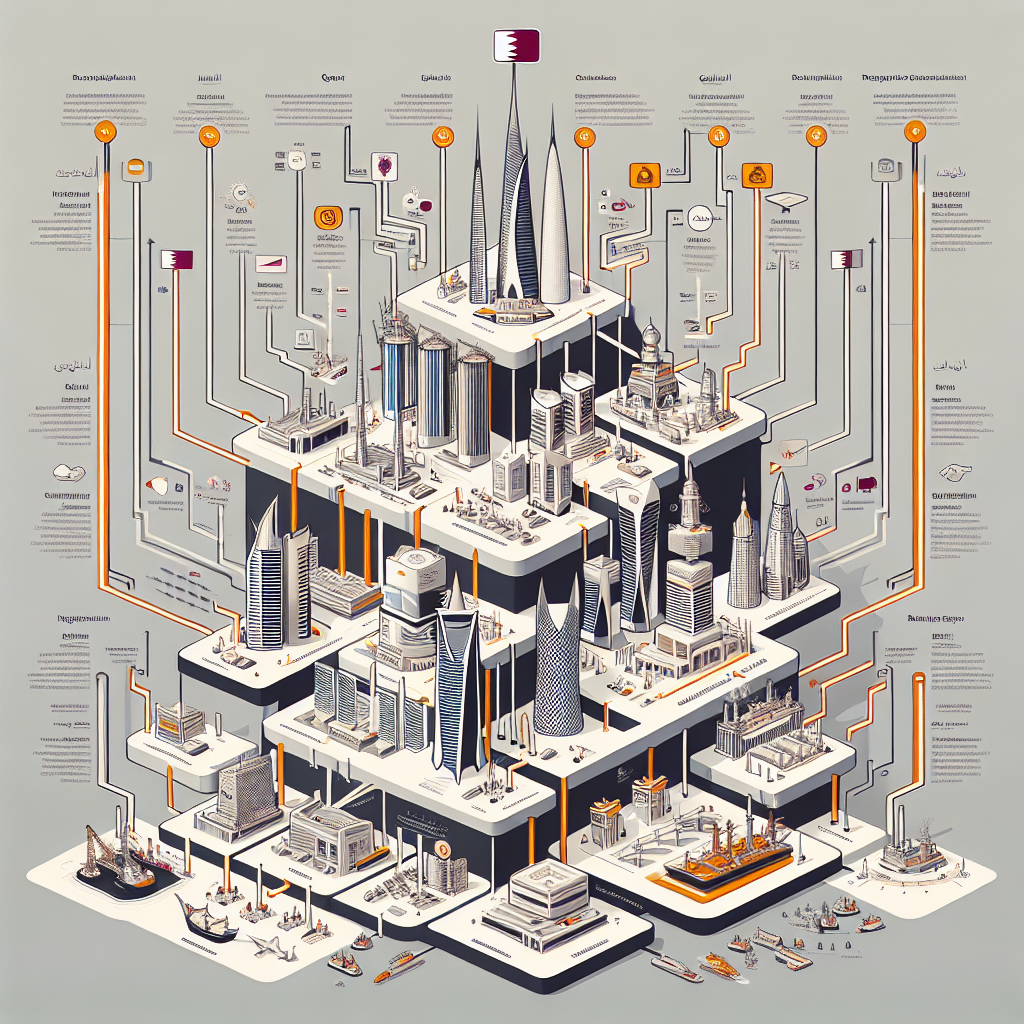

Navigating Qatar’s Regulatory Landscape: Unlocking Business Opportunities

Introduction

Deciphering Regulatory Authorities in Qatar: A Business Perspective

Understanding the regulatory landscape is crucial for businesses operating in any country. In Qatar, a rapidly growing economy in the Middle East, navigating the regulatory authorities is essential for success. This article aims to provide an introduction to deciphering the regulatory authorities in Qatar from a business perspective. By gaining insights into the key regulatory bodies and their roles, businesses can ensure compliance and make informed decisions to thrive in the Qatari market.

Understanding the Role of Regulatory Authorities in Qatar

Deciphering Regulatory Authorities in Qatar: A Business Perspective

Understanding the Role of Regulatory Authorities in Qatar

When it comes to doing business in Qatar, it is essential to have a clear understanding of the role of regulatory authorities. These entities play a crucial role in ensuring that businesses operate within the legal framework and adhere to the necessary regulations. In this article, we will delve into the various regulatory authorities in Qatar and their functions, providing a comprehensive overview for businesses looking to establish themselves in the country.

One of the primary regulatory authorities in Qatar is the Ministry of Commerce and Industry (MOCI). This authority is responsible for regulating and supervising commercial activities in the country. It oversees the registration and licensing of businesses, ensuring compliance with laws and regulations related to trade, investment, and consumer protection. The MOCI also plays a vital role in promoting fair competition and creating a favorable business environment for both local and foreign investors.

Another significant regulatory authority in Qatar is the Qatar Financial Centre Regulatory Authority (QFCRA). This authority is responsible for regulating and supervising financial services within the Qatar Financial Centre (QFC). The QFCRA ensures that financial institutions operating within the QFC comply with international standards and best practices. It also provides a robust regulatory framework that promotes transparency, stability, and investor confidence in the financial sector.

In addition to these authorities, there are several sector-specific regulatory bodies in Qatar. For example, the Qatar Central Bank (QCB) is responsible for regulating and supervising the banking sector. It ensures the stability and soundness of the banking system, sets monetary policy, and oversees the implementation of anti-money laundering and counter-terrorism financing measures.

The Qatar General Authority of Customs (QGAC) is another important regulatory body. It is responsible for regulating and supervising customs activities in the country. The QGAC ensures compliance with customs laws and regulations, facilitates trade, and collects customs duties and taxes. It plays a crucial role in promoting international trade and ensuring the smooth flow of goods in and out of Qatar.

Furthermore, the Qatar Financial Markets Authority (QFMA) is responsible for regulating and supervising the securities market in Qatar. It ensures the integrity and transparency of the market, protects investors’ interests, and promotes fair and efficient trading. The QFMA also oversees the licensing and supervision of financial services providers operating in the securities market.

It is worth noting that these regulatory authorities work in close collaboration with each other to ensure a coordinated and effective regulatory framework. They share information, coordinate inspections, and collaborate on policy development to create a business-friendly environment while safeguarding the interests of all stakeholders.

In conclusion, understanding the role of regulatory authorities in Qatar is crucial for businesses looking to operate in the country. The Ministry of Commerce and Industry, Qatar Financial Centre Regulatory Authority, Qatar Central Bank, Qatar General Authority of Customs, and Qatar Financial Markets Authority are some of the key regulatory bodies that businesses need to be aware of. These authorities play a vital role in ensuring compliance with laws and regulations, promoting fair competition, and creating a favorable business environment. By working in close collaboration, they contribute to the overall growth and development of Qatar’s economy.

Key Business Regulations in Qatar: A Comprehensive Overview

Deciphering Regulatory Authorities in Qatar: A Business Perspective

Key Business Regulations in Qatar: A Comprehensive Overview

When it comes to doing business in Qatar, understanding the regulatory landscape is crucial. Qatar has established a robust framework of laws and regulations to ensure a fair and transparent business environment. In this article, we will provide a comprehensive overview of the key regulatory authorities in Qatar and their roles in shaping the business landscape.

The Ministry of Commerce and Industry (MOCI) is the primary regulatory authority responsible for overseeing business activities in Qatar. It plays a vital role in promoting economic growth and regulating commercial activities. MOCI is responsible for issuing commercial licenses, regulating trade practices, and enforcing consumer protection laws. It also oversees the registration of companies and handles intellectual property rights.

Another important regulatory authority in Qatar is the Qatar Financial Centre (QFC). The QFC is an independent regulatory body that oversees the financial services sector in Qatar. It provides a business-friendly environment for companies operating in the financial services industry. The QFC regulates banking, insurance, asset management, and other financial activities. It also offers a legal and regulatory framework that is based on international best practices.

The Qatar Central Bank (QCB) is the regulatory authority responsible for overseeing the banking sector in Qatar. It ensures the stability and integrity of the financial system by regulating banks and other financial institutions. The QCB sets monetary policy, issues licenses to banks, and supervises their operations. It also plays a crucial role in maintaining the stability of the Qatari riyal and managing foreign exchange reserves.

In addition to these regulatory authorities, Qatar has established specialized bodies to regulate specific sectors. For example, the Qatar General Authority of Customs (QGAC) is responsible for regulating customs procedures and ensuring compliance with import and export regulations. It plays a crucial role in facilitating international trade and preventing illegal trade activities.

The Qatar Financial Markets Authority (QFMA) is another important regulatory body in Qatar. It regulates the securities market and ensures the protection of investors. The QFMA oversees the listing and trading of securities, enforces disclosure requirements, and monitors the conduct of market participants. It aims to create a fair and transparent capital market that attracts both domestic and international investors.

The Qatar Financial Information Unit (QFIU) is responsible for combating money laundering and terrorist financing. It collects, analyzes, and disseminates financial intelligence to relevant authorities. The QFIU plays a crucial role in ensuring the integrity of Qatar’s financial system and preventing illicit financial activities.

It is important for businesses operating in Qatar to comply with the regulations set by these regulatory authorities. Non-compliance can result in penalties, fines, or even the revocation of licenses. Therefore, businesses should familiarize themselves with the relevant laws and regulations and seek legal advice if needed.

In conclusion, understanding the regulatory authorities in Qatar is essential for businesses operating in the country. The Ministry of Commerce and Industry, Qatar Financial Centre, Qatar Central Bank, and other specialized bodies play crucial roles in shaping the business landscape. By complying with the regulations set by these authorities, businesses can ensure a smooth and successful operation in Qatar.

Navigating Qatar’s Regulatory Landscape: A Guide for Businesses

Deciphering Regulatory Authorities in Qatar: A Business Perspective

Navigating Qatar’s Regulatory Landscape: A Guide for Businesses

Qatar, a rapidly growing economy in the Middle East, offers numerous opportunities for businesses looking to expand their operations in the region. However, like any other country, Qatar has its own set of regulations and regulatory authorities that businesses must navigate to ensure compliance and success. In this article, we will explore the key regulatory authorities in Qatar and their roles from a business perspective.

One of the most important regulatory authorities in Qatar is the Ministry of Commerce and Industry (MOCI). The MOCI is responsible for regulating and promoting trade and commerce in the country. It plays a crucial role in issuing licenses and permits for businesses, ensuring fair competition, and protecting consumer rights. Any business looking to establish a presence in Qatar must register with the MOCI and obtain the necessary licenses and permits.

Another significant regulatory authority in Qatar is the Qatar Financial Centre (QFC). The QFC is an independent regulatory authority that oversees and regulates the financial services sector in Qatar. It provides a business-friendly environment for financial institutions and offers various incentives to attract foreign investment. Businesses operating in the financial services sector must obtain a license from the QFC to operate in Qatar.

The Qatar Central Bank (QCB) is the regulatory authority responsible for overseeing the banking and monetary system in Qatar. It ensures the stability and integrity of the financial system and promotes sound banking practices. Any business involved in banking or financial services must comply with the regulations set by the QCB to operate in Qatar.

The Qatar General Authority of Customs (QGAC) is responsible for regulating and facilitating international trade in Qatar. It ensures the smooth flow of goods in and out of the country and enforces customs regulations. Businesses involved in import and export activities must comply with the customs regulations set by the QGAC to avoid any delays or penalties.

The Qatar Financial Markets Authority (QFMA) is the regulatory authority responsible for overseeing the securities market in Qatar. It regulates and supervises the activities of listed companies, brokers, and other market participants. Any business looking to raise capital through the securities market or engage in securities trading must comply with the regulations set by the QFMA.

The Qatar Central Securities Depository (QCSD) is another important regulatory authority in Qatar. It provides a centralized platform for the safekeeping and settlement of securities. Any business involved in securities trading must register with the QCSD and comply with its regulations.

In addition to these regulatory authorities, businesses in Qatar must also comply with various sector-specific regulatory bodies. For example, businesses in the healthcare sector must comply with the regulations set by the Ministry of Public Health (MoPH), while businesses in the telecommunications sector must comply with the regulations set by the Communications Regulatory Authority (CRA).

In conclusion, navigating Qatar’s regulatory landscape is crucial for businesses looking to establish a presence in the country. Understanding the roles and responsibilities of the key regulatory authorities, such as the MOCI, QFC, QCB, QGAC, QFMA, and QCSD, is essential for ensuring compliance and success. Additionally, businesses must also be aware of sector-specific regulatory bodies that govern their respective industries. By staying informed and complying with the regulations, businesses can thrive in Qatar’s growing economy.

Qatar Government Agencies: An In-depth Analysis

Deciphering Regulatory Authorities in Qatar: A Business Perspective

Qatar, a rapidly growing economy in the Middle East, has become an attractive destination for businesses looking to expand their operations. However, navigating the regulatory landscape can be a daunting task for foreign companies. Understanding the various government agencies and their roles is crucial for success in the Qatari market.

The Ministry of Commerce and Industry (MOCI) is the primary regulatory authority in Qatar. It is responsible for overseeing all commercial activities and ensuring compliance with the country’s laws and regulations. The MOCI plays a vital role in issuing licenses and permits for businesses operating in Qatar. It also regulates trade and enforces consumer protection laws.

Another important regulatory authority is the Qatar Financial Centre (QFC). Established in 2005, the QFC is an independent regulatory body that oversees the financial services sector in Qatar. It provides a business-friendly environment for companies operating in the financial industry, offering tax incentives and a streamlined regulatory framework. The QFC also promotes Qatar as a regional hub for financial services.

The Qatar Central Bank (QCB) is the country’s central banking authority. It is responsible for maintaining monetary stability and regulating the banking sector. The QCB issues licenses to banks and other financial institutions, sets interest rates, and manages the country’s foreign exchange reserves. It plays a crucial role in ensuring the stability and integrity of Qatar’s financial system.

The Qatar General Authority of Customs (QGAC) is responsible for regulating and facilitating international trade. It ensures compliance with customs laws and regulations, collects customs duties, and enforces import and export controls. The QGAC plays a vital role in facilitating the smooth flow of goods in and out of Qatar, promoting trade and economic growth.

The Qatar Financial Markets Authority (QFMA) is the regulatory body for the securities market in Qatar. It oversees the Qatar Stock Exchange and ensures fair and transparent trading practices. The QFMA regulates listed companies, brokers, and other market participants to maintain market integrity and protect investors’ interests. It plays a crucial role in promoting a vibrant and well-regulated capital market in Qatar.

The Qatar Central Securities Depository (QCSD) is responsible for the safekeeping and settlement of securities in Qatar. It provides a centralized platform for the issuance, trading, and settlement of securities, ensuring efficient and secure transactions. The QCSD plays a vital role in promoting investor confidence and facilitating capital market activities.

In addition to these regulatory authorities, there are several other government agencies that businesses need to be aware of. These include the Ministry of Labor and Social Affairs, which regulates employment and labor relations, and the Ministry of Municipality and Environment, which oversees urban planning and environmental regulations. Understanding the roles and responsibilities of these agencies is essential for businesses to comply with the relevant laws and regulations.

In conclusion, navigating the regulatory landscape in Qatar is crucial for businesses looking to establish a presence in the country. Understanding the roles and responsibilities of the various government agencies is essential for compliance and success. From the Ministry of Commerce and Industry to the Qatar Financial Centre, each regulatory authority plays a vital role in ensuring a business-friendly environment and promoting economic growth. By familiarizing themselves with these agencies, businesses can navigate the regulatory landscape with confidence and thrive in the Qatari market.

Compliance with Regulatory Authorities in Qatar: Best Practices for Businesses

Deciphering Regulatory Authorities in Qatar: A Business Perspective

Compliance with Regulatory Authorities in Qatar: Best Practices for Businesses

When it comes to doing business in Qatar, understanding and complying with the regulatory authorities is crucial. Qatar has a well-established legal framework that governs various aspects of business operations, and failure to comply with these regulations can have serious consequences. In this article, we will explore the importance of compliance with regulatory authorities in Qatar and discuss some best practices for businesses.

One of the key regulatory authorities in Qatar is the Ministry of Commerce and Industry (MOCI). The MOCI is responsible for regulating and promoting trade and commerce in the country. It oversees various aspects of business operations, including licensing, commercial registration, and consumer protection. Businesses operating in Qatar must ensure that they have the necessary licenses and permits from the MOCI to operate legally.

Another important regulatory authority in Qatar is the Qatar Financial Centre (QFC). The QFC is an independent regulatory authority that oversees the financial services sector in Qatar. It provides a regulatory framework that is aligned with international standards and promotes transparency and stability in the financial sector. Businesses operating in the financial services sector must comply with the regulations set by the QFC to ensure the integrity of their operations.

In addition to these regulatory authorities, businesses in Qatar must also comply with various sector-specific regulatory bodies. For example, businesses in the healthcare sector must comply with the regulations set by the Ministry of Public Health (MoPH). The MoPH is responsible for regulating healthcare facilities, medical professionals, and pharmaceutical products in Qatar. Compliance with the regulations set by the MoPH is essential for businesses in the healthcare sector to ensure the safety and well-being of their patients.

Compliance with regulatory authorities in Qatar is not only a legal requirement but also a best practice for businesses. Non-compliance can result in fines, penalties, and even the suspension or revocation of licenses. It can also damage a business’s reputation and hinder its ability to operate effectively in the market. Therefore, businesses must prioritize compliance and establish robust systems and processes to ensure adherence to the regulations set by the regulatory authorities.

To achieve compliance, businesses should start by conducting a thorough assessment of the regulatory requirements applicable to their industry. This includes understanding the licensing and registration requirements, as well as any specific regulations that govern their operations. Businesses should also establish clear policies and procedures that outline the steps to be taken to ensure compliance. Regular training and awareness programs should be conducted to educate employees about the regulations and their responsibilities in maintaining compliance.

Maintaining open lines of communication with the regulatory authorities is also crucial for businesses in Qatar. This includes timely reporting of any changes or incidents that may impact compliance. Businesses should also actively engage with the regulatory authorities to seek guidance and clarification on any regulatory matters. This proactive approach can help businesses stay updated on any changes in regulations and ensure that they are always in compliance.

In conclusion, compliance with regulatory authorities in Qatar is essential for businesses to operate legally and effectively. Understanding the regulatory landscape and establishing robust compliance systems and processes are key to achieving compliance. By prioritizing compliance and maintaining open lines of communication with the regulatory authorities, businesses can navigate the regulatory environment in Qatar successfully and thrive in the market.

Regulatory Challenges and Opportunities for Businesses in Qatar

Deciphering Regulatory Authorities in Qatar: A Business Perspective

Regulatory Challenges and Opportunities for Businesses in Qatar

Doing business in Qatar can be a lucrative venture for many companies, but it also comes with its fair share of challenges. One of the most significant challenges that businesses face in Qatar is navigating the complex regulatory landscape. Understanding the various regulatory authorities and their roles is crucial for any company looking to establish a presence in the country.

The regulatory framework in Qatar is overseen by several key authorities, each with its own specific responsibilities. One of the most prominent regulatory bodies is the Qatar Financial Centre Regulatory Authority (QFCRA). The QFCRA is responsible for regulating and supervising financial services conducted within the Qatar Financial Centre (QFC). This includes overseeing banking, insurance, and investment activities, as well as ensuring compliance with international standards and best practices.

Another important regulatory authority in Qatar is the Qatar Central Bank (QCB). The QCB is the country’s central bank and is responsible for maintaining monetary stability and promoting financial stability. It regulates and supervises banks and other financial institutions operating in Qatar, ensuring that they adhere to prudential regulations and maintain the integrity of the financial system.

In addition to financial regulation, businesses in Qatar must also comply with various sector-specific regulations. For example, companies operating in the oil and gas industry must adhere to regulations set by the Ministry of Energy and Industry. These regulations cover a wide range of areas, including exploration and production, environmental protection, and health and safety.

The telecommunications sector in Qatar is regulated by the Communications Regulatory Authority (CRA). The CRA is responsible for ensuring fair competition and consumer protection in the telecommunications market. It sets and enforces regulations related to licensing, interconnection, and quality of service, among other things.

Navigating the regulatory landscape in Qatar can be a daunting task for businesses, especially those unfamiliar with the local laws and regulations. However, it is important to note that there are also opportunities for businesses within the regulatory framework. Qatar has made significant efforts to create a business-friendly environment, and regulatory authorities are often willing to work with companies to facilitate their operations.

One such opportunity is the Qatar Free Zones Authority (QFZA), which oversees the establishment and operation of free zones in the country. Free zones offer a range of incentives and benefits to businesses, including tax exemptions, simplified customs procedures, and access to world-class infrastructure. Companies operating in free zones are subject to a separate regulatory framework, which is designed to attract foreign investment and promote economic diversification.

Another opportunity for businesses in Qatar is the country’s commitment to sustainable development. Qatar has set ambitious goals to reduce its carbon footprint and promote renewable energy. The Qatar General Electricity and Water Corporation (KAHRAMAA) is responsible for regulating and overseeing the electricity and water sector in the country. It has implemented various initiatives to encourage the use of renewable energy and promote energy efficiency, creating opportunities for companies operating in the clean energy sector.

In conclusion, understanding the regulatory authorities in Qatar is essential for businesses looking to operate in the country. Navigating the complex regulatory landscape can be challenging, but it also presents opportunities for companies willing to comply with local laws and regulations. By working closely with regulatory authorities and taking advantage of the incentives and benefits offered, businesses can thrive in Qatar’s business-friendly environment.

The Impact of Regulatory Authorities on Foreign Investments in Qatar

Deciphering Regulatory Authorities in Qatar: A Business Perspective

The Impact of Regulatory Authorities on Foreign Investments in Qatar

When it comes to foreign investments, understanding the regulatory landscape of a country is crucial for businesses looking to expand their operations. In Qatar, regulatory authorities play a significant role in shaping the business environment and ensuring compliance with laws and regulations. This article aims to shed light on the impact of regulatory authorities on foreign investments in Qatar, providing businesses with valuable insights into the country’s regulatory framework.

One of the key regulatory authorities in Qatar is the Qatar Financial Centre Regulatory Authority (QFCRA). Established in 2005, the QFCRA is responsible for regulating and supervising financial services conducted within the Qatar Financial Centre (QFC). The QFCRA’s role is to ensure that businesses operating within the QFC adhere to international standards and best practices, promoting transparency and investor confidence.

Foreign investors looking to establish a presence in Qatar’s financial sector can benefit from the QFCRA’s regulatory framework. The QFCRA provides a streamlined process for obtaining licenses and permits, making it easier for businesses to navigate the regulatory landscape. Additionally, the QFCRA’s commitment to maintaining high regulatory standards attracts international financial institutions, creating a conducive environment for foreign investments.

Another important regulatory authority in Qatar is the Qatar Central Bank (QCB). As the country’s central bank, the QCB is responsible for maintaining monetary stability and regulating the banking sector. The QCB plays a crucial role in safeguarding the interests of both domestic and foreign investors by ensuring the stability of the financial system.

Foreign investors in Qatar’s banking sector must comply with the QCB’s regulations and guidelines. These regulations cover various aspects, including capital requirements, risk management, and anti-money laundering measures. By adhering to these regulations, foreign investors can contribute to the stability and integrity of Qatar’s banking sector, fostering trust and confidence among investors.

In addition to financial regulatory authorities, Qatar also has regulatory bodies overseeing other sectors. For instance, the Qatar General Authority of Customs (QGAC) is responsible for regulating and facilitating international trade. The QGAC ensures compliance with customs laws and regulations, streamlining import and export processes for businesses.

Foreign investors involved in international trade can benefit from the QGAC’s efficient customs procedures. By adhering to the QGAC’s regulations, businesses can avoid delays and complications in their import and export activities, enhancing their competitiveness in the global market.

Furthermore, the Qatar Financial Markets Authority (QFMA) regulates and supervises the country’s financial markets. The QFMA’s role is to protect investors, ensure fair and transparent trading practices, and promote market integrity. Foreign investors participating in Qatar’s financial markets can rely on the QFMA’s regulatory oversight to safeguard their interests and maintain a level playing field.

In conclusion, regulatory authorities in Qatar have a significant impact on foreign investments. Understanding the roles and responsibilities of these authorities is crucial for businesses looking to expand into Qatar. The QFCRA, QCB, QGAC, and QFMA play vital roles in shaping the business environment, ensuring compliance with regulations, and promoting investor confidence. By adhering to the regulations set forth by these authorities, foreign investors can navigate the regulatory landscape effectively and contribute to Qatar’s economic growth.

Ensuring Regulatory Compliance: Strategies for Businesses in Qatar

Deciphering Regulatory Authorities in Qatar: A Business Perspective

Ensuring Regulatory Compliance: Strategies for Businesses in Qatar

When it comes to doing business in Qatar, understanding and complying with the country’s regulatory framework is crucial. Qatar has a well-established system of regulatory authorities that oversee various sectors and industries, ensuring fair competition, consumer protection, and overall economic stability. In this article, we will explore the key regulatory authorities in Qatar and discuss strategies for businesses to ensure regulatory compliance.

One of the most prominent regulatory authorities in Qatar is the Ministry of Commerce and Industry (MOCI). The MOCI is responsible for regulating and promoting trade and commerce in the country. It sets the rules and regulations for business activities, issues licenses, and monitors compliance. Businesses operating in Qatar must register with the MOCI and obtain the necessary permits and licenses to operate legally.

Another important regulatory authority in Qatar is the Qatar Financial Centre Regulatory Authority (QFCRA). The QFCRA oversees the financial services sector, including banking, insurance, and investment activities. It ensures that financial institutions comply with international standards and best practices, promoting transparency and stability in the financial sector. Businesses operating in the financial services industry must obtain the necessary licenses and adhere to the regulations set by the QFCRA.

In addition to these regulatory authorities, there are sector-specific regulatory bodies in Qatar. For example, the Qatar General Authority of Customs (QGAC) regulates import and export activities, ensuring compliance with customs laws and regulations. The Qatar Central Bank (QCB) oversees the banking sector, ensuring the stability and integrity of the financial system. These sector-specific regulatory bodies play a crucial role in ensuring compliance within their respective industries.

For businesses operating in Qatar, ensuring regulatory compliance is not only a legal requirement but also a strategic imperative. Non-compliance can result in hefty fines, reputational damage, and even the suspension of business operations. Therefore, businesses must develop effective strategies to navigate the regulatory landscape in Qatar.

First and foremost, businesses should invest in understanding the regulatory requirements applicable to their industry. This involves conducting thorough research, seeking legal advice if necessary, and staying updated on any changes or updates to regulations. By having a clear understanding of the regulatory landscape, businesses can proactively ensure compliance and avoid any potential pitfalls.

Furthermore, businesses should establish robust internal compliance mechanisms. This includes implementing policies and procedures that align with the regulatory requirements, conducting regular audits to identify any compliance gaps, and providing training to employees to ensure they are aware of their responsibilities. By embedding a culture of compliance within the organization, businesses can minimize the risk of non-compliance and demonstrate their commitment to ethical business practices.

Collaboration with regulatory authorities is also crucial for businesses in Qatar. Building strong relationships with the relevant regulatory bodies can help businesses stay informed about any changes or updates to regulations, seek guidance when needed, and address any compliance issues proactively. Regular communication and engagement with regulatory authorities can foster a cooperative and transparent business environment.

In conclusion, regulatory compliance is a critical aspect of doing business in Qatar. Understanding the key regulatory authorities and their roles is essential for businesses to navigate the regulatory landscape effectively. By investing in understanding the regulatory requirements, establishing robust internal compliance mechanisms, and collaborating with regulatory authorities, businesses can ensure regulatory compliance and thrive in Qatar’s business environment.

Qatar’s Regulatory Reforms: Implications for Businesses

Deciphering Regulatory Authorities in Qatar: A Business Perspective

Qatar, a small but prosperous country in the Middle East, has been making significant strides in recent years to attract foreign investment and promote economic growth. As part of its efforts, the Qatari government has implemented a series of regulatory reforms aimed at creating a more business-friendly environment. These reforms have had far-reaching implications for both local and international businesses operating in Qatar.

One of the key aspects of Qatar’s regulatory reforms is the establishment of various regulatory authorities. These authorities play a crucial role in overseeing and enforcing regulations in different sectors of the economy. Understanding the functions and responsibilities of these regulatory bodies is essential for businesses looking to navigate the Qatari market successfully.

The Ministry of Commerce and Industry (MOCI) is one of the most important regulatory authorities in Qatar. It is responsible for regulating and promoting trade and commerce in the country. The MOCI plays a vital role in issuing licenses and permits for businesses, ensuring fair competition, and protecting consumer rights. Any business looking to operate in Qatar must register with the MOCI and comply with its regulations.

Another significant regulatory authority in Qatar is the Qatar Financial Centre (QFC). The QFC is an independent regulatory body that oversees the financial services sector in the country. It provides a platform for international businesses to establish a presence in Qatar and offers a range of incentives and benefits to attract foreign investment. The QFC has its own legal and regulatory framework, which is based on international best practices, making it an attractive option for businesses looking to operate in Qatar’s financial sector.

In addition to the MOCI and the QFC, there are several other regulatory authorities in Qatar that businesses need to be aware of. These include the Qatar Central Bank, the Qatar Financial Markets Authority, and the Qatar General Authority of Customs. Each of these authorities has its own specific mandate and responsibilities, which are essential for businesses to understand and comply with.

The regulatory reforms in Qatar have had significant implications for businesses operating in the country. On one hand, these reforms have made it easier for businesses to set up and operate in Qatar by streamlining processes and reducing bureaucratic hurdles. On the other hand, they have also increased the level of scrutiny and compliance requirements for businesses, particularly in sectors such as finance and trade.

For businesses looking to enter the Qatari market, it is crucial to have a thorough understanding of the regulatory landscape and the role of different regulatory authorities. This includes understanding the licensing and registration requirements, compliance obligations, and the potential consequences of non-compliance. Failure to comply with the regulations can result in fines, penalties, or even the revocation of licenses, which can have severe implications for businesses.

In conclusion, Qatar’s regulatory reforms have created a more business-friendly environment, attracting foreign investment and promoting economic growth. However, businesses need to navigate the regulatory landscape carefully and understand the role of different regulatory authorities. By doing so, businesses can ensure compliance, mitigate risks, and take advantage of the opportunities offered by Qatar’s growing economy.

Regulatory Authorities in Qatar: A Roadmap for Business Success

Deciphering Regulatory Authorities in Qatar: A Business Perspective

Qatar, a small but prosperous country in the Middle East, has been attracting businesses from around the world due to its strategic location, stable economy, and business-friendly environment. However, like any other country, Qatar has its own set of regulatory authorities that businesses need to navigate in order to ensure compliance and success. In this article, we will explore the various regulatory authorities in Qatar and provide a roadmap for businesses to thrive in this dynamic market.

One of the key regulatory authorities in Qatar is the Ministry of Commerce and Industry (MOCI). MOCI plays a crucial role in regulating and promoting trade and investment in the country. It is responsible for issuing commercial licenses, regulating commercial activities, and enforcing consumer protection laws. Any business looking to establish a presence in Qatar must obtain the necessary licenses and approvals from MOCI.

Another important regulatory authority in Qatar is the Qatar Financial Centre (QFC). The QFC is an independent regulatory authority that oversees the financial services sector in Qatar. It provides a business-friendly environment for financial institutions and offers a wide range of services, including licensing, regulation, and dispute resolution. Businesses operating in the financial services sector must comply with the regulations set forth by the QFC to ensure transparency and stability in the market.

In addition to MOCI and QFC, businesses in Qatar also need to be aware of the Qatar Central Bank (QCB). The QCB is the central bank of Qatar and is responsible for maintaining monetary stability and regulating the banking sector. It sets monetary policy, issues currency, and supervises banks and other financial institutions. Any business involved in banking or financial services must adhere to the regulations and guidelines set by the QCB to ensure the integrity of the financial system.

Furthermore, businesses operating in specific industries need to comply with sector-specific regulatory authorities. For example, the Supreme Committee for Delivery and Legacy (SC) is responsible for overseeing the preparations for the FIFA World Cup 2022 in Qatar. Any business involved in construction, hospitality, or event management related to the World Cup must comply with the regulations and guidelines set by the SC to ensure the successful delivery of the event.

Navigating the regulatory landscape in Qatar can be complex, especially for foreign businesses. However, with the right knowledge and guidance, businesses can thrive in this market. It is essential for businesses to engage with local legal and consulting firms that specialize in regulatory compliance to ensure they are aware of and adhere to all relevant regulations.

In conclusion, understanding and complying with the regulatory authorities in Qatar is crucial for businesses looking to establish a presence in this dynamic market. From the Ministry of Commerce and Industry to the Qatar Financial Centre and sector-specific regulatory authorities, businesses must navigate a complex landscape to ensure compliance and success. By engaging with local experts and staying up-to-date with the latest regulations, businesses can thrive in Qatar and take advantage of the numerous opportunities it offers.

Q&A

1. What is the role of regulatory authorities in Qatar?

Regulatory authorities in Qatar oversee and enforce laws and regulations to ensure compliance and fair business practices.

2. Which regulatory authorities are responsible for overseeing business activities in Qatar?

The main regulatory authorities in Qatar include the Ministry of Commerce and Industry, Qatar Financial Markets Authority, Qatar Central Bank, and Qatar Financial Centre Regulatory Authority.

3. What is the purpose of the Ministry of Commerce and Industry in Qatar?

The Ministry of Commerce and Industry is responsible for regulating and promoting trade, industry, and investment in Qatar.

4. What does the Qatar Financial Markets Authority do?

The Qatar Financial Markets Authority regulates and supervises the financial markets in Qatar, including stock exchanges and securities activities.

5. What is the role of the Qatar Central Bank?

The Qatar Central Bank is the country’s central monetary authority, responsible for maintaining financial stability, regulating banks, and managing the national currency.

6. What does the Qatar Financial Centre Regulatory Authority do?

The Qatar Financial Centre Regulatory Authority oversees and regulates the financial services sector within the Qatar Financial Centre, a business hub for international companies.

7. How do regulatory authorities in Qatar ensure compliance with laws and regulations?

Regulatory authorities in Qatar conduct inspections, audits, and investigations to ensure businesses comply with laws and regulations. They may also impose penalties for non-compliance.

8. What are the benefits of complying with regulatory authorities in Qatar?

Compliance with regulatory authorities in Qatar helps businesses maintain a good reputation, avoid legal issues, and build trust with customers and partners.

9. What are the potential consequences of non-compliance with regulatory authorities in Qatar?

Non-compliance with regulatory authorities in Qatar can result in fines, penalties, legal actions, reputational damage, and even business closure.

10. How can businesses stay updated with regulatory changes in Qatar?

Businesses can stay updated with regulatory changes in Qatar by regularly monitoring official announcements, engaging with industry associations, and seeking legal advice when necessary.

Conclusion

In conclusion, deciphering regulatory authorities in Qatar is crucial for businesses operating in the country. Understanding the roles and responsibilities of these authorities is essential for compliance and successful operations. The Qatar Financial Centre Regulatory Authority, Qatar Central Bank, and Ministry of Commerce and Industry are among the key regulatory bodies that businesses need to be familiar with. By navigating and adhering to the regulations set forth by these authorities, businesses can ensure legal and sustainable operations in Qatar’s business landscape.