-

Table of Contents

- Introduction

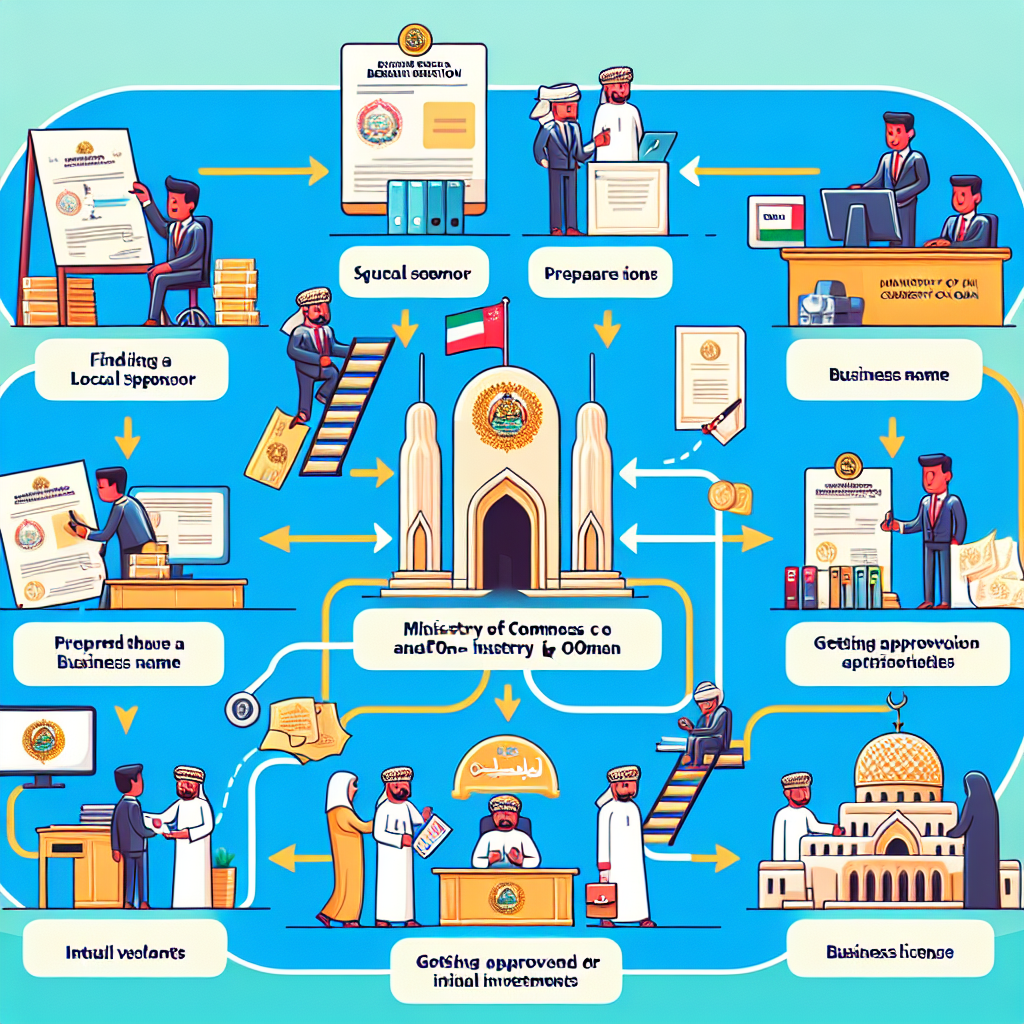

- Overview of the Business Registration Process in Oman

- Step-by-Step Guide to Registering a Business in Oman

- Types of Business Entities in Oman for Registration

- Legal Requirements for Business Registration in Oman

- Benefits and Incentives for Registering a Business in Oman

- Key Documents and Forms for Business Registration in Oman

- Understanding the Costs and Fees of Business Registration in Oman

- Common Challenges and Solutions in the Business Registration Process in Oman

- Important Considerations for Foreign Investors Registering a Business in Oman

- Expert Tips for a Smooth Business Registration Process in Oman

- Q&A

- Conclusion

Your one-stop resource for navigating the Business Registration Process in Oman.

Introduction

Introduction:

The Complete Guide to Business Registration Process in Oman provides a comprehensive overview of the steps and requirements involved in Registering a Business in Oman. This guide aims to assist entrepreneurs and investors in understanding the necessary procedures, legal frameworks, and documentation needed to establish a business entity in Oman. By following this guide, individuals can navigate through the registration process smoothly and ensure compliance with the country’s regulations.

Overview of the Business Registration Process in Oman

Oman, a country located in the Middle East, offers a favorable business environment for both local and foreign investors. If you are considering starting a business in Oman, it is essential to understand the business registration process. This article will provide you with a complete guide to the Business Registration Process in Oman.

The first step in Registering a Business in Oman is to choose a legal structure. There are several options available, including a sole proprietorship, partnership, limited liability company (LLC), and joint stock company. Each legal structure has its own requirements and benefits, so it is crucial to choose the one that best suits your business needs.

Once you have decided on the legal structure, the next step is to reserve a company name. The company name should be unique and not already registered by another business in Oman. You can check the availability of a company name through the Ministry of Commerce and Industry’s online portal. If the name is available, you can reserve it for a period of 90 days.

After reserving the company name, you need to prepare the necessary documents for the registration process. These documents include a copy of the company’s articles of association, a copy of the company’s memorandum of association, and a copy of the company’s commercial registration certificate. Additionally, you will need to provide copies of the shareholders’ passports and proof of their residency in Oman.

Once you have gathered all the required documents, you can submit them to the Ministry of Commerce and Industry. The ministry will review the documents and conduct a thorough examination of your application. This process may take several weeks, so it is important to be patient.

During the examination process, the ministry may request additional documents or information. It is crucial to promptly provide any requested documents to avoid delays in the registration process. Once the ministry approves your application, you will receive a commercial registration certificate.

After obtaining the commercial registration certificate, you need to register with the Oman Chamber of Commerce and Industry. This registration is mandatory for all businesses operating in Oman. The chamber will provide you with a membership certificate, which is required for various business activities, such as participating in tenders and applying for visas for your employees.

In addition to the above steps, you may also need to obtain additional licenses and permits depending on the nature of your business. For example, if you are starting a restaurant, you will need to obtain a food license from the Ministry of Health. It is important to research and understand the specific requirements for your industry to ensure compliance with all regulations.

In conclusion, starting a business in Oman requires a thorough understanding of the business registration process. From choosing a legal structure to obtaining the necessary licenses and permits, each step is crucial for a successful registration. By following this complete guide, you can navigate through the process smoothly and establish your business in Oman.

Step-by-Step Guide to Registering a Business in Oman

Starting a business in Oman can be an exciting and rewarding venture. However, before you can begin operations, it is essential to go through the business registration process. This process ensures that your business is legally recognized and compliant with the laws and regulations of the country. In this article, we will provide you with a step-by-step guide to Registering a Business in Oman.

The first step in the business registration process is to determine the legal structure of your business. Oman offers several options, including sole proprietorship, partnership, limited liability company (LLC), and joint stock company. Each structure has its own advantages and requirements, so it is crucial to choose the one that best suits your needs.

Once you have decided on the legal structure, the next step is to choose a business name. The name should be unique and not already registered by another company in Oman. You can check the availability of a name by conducting a search on the Ministry of Commerce and Industry’s website. If the name is available, you can proceed with the registration process.

After selecting a name, you need to prepare the necessary documents for registration. These documents typically include a copy of your passport, a copy of your visa, a copy of your residency card, and a copy of your lease agreement if you have a physical office space. Additionally, you will need to provide a letter from your sponsor or local partner, confirming their support for your business.

Once you have gathered all the required documents, you can submit them to the Ministry of Commerce and Industry. The ministry will review your application and may request additional information or documents if necessary. It is important to ensure that all the information provided is accurate and complete to avoid any delays in the registration process.

After the ministry approves your application, you will need to pay the registration fees. The fees vary depending on the legal structure of your business and the activities it will engage in. It is advisable to consult with a legal advisor or a business consultant to determine the exact amount you need to pay.

Once the fees are paid, you will receive a commercial registration certificate, which officially recognizes your business. This certificate includes important information such as your business name, legal structure, activities, and address. It is essential to keep this certificate safe, as you may need it for various purposes, such as opening a bank account or applying for licenses and permits.

In addition to the commercial registration certificate, you may also need to obtain other licenses and permits depending on the nature of your business. These may include a trade license, a municipality license, a health license, and a labor license. The requirements for these licenses vary, so it is crucial to research and comply with the specific regulations applicable to your industry.

In conclusion, Registering a Business in Oman involves several steps and requirements. It is essential to carefully consider the legal structure, choose a unique business name, gather the necessary documents, and pay the registration fees. By following this step-by-step guide, you can ensure a smooth and successful registration process for your business in Oman.

Types of Business Entities in Oman for Registration

Oman, a country located in the Middle East, offers a favorable environment for businesses to thrive. If you are considering starting a business in Oman, it is essential to understand the different types of business entities available for registration. This article will provide a complete guide to the Business Registration Process in Oman, focusing on the various types of business entities.

One of the most common types of business entities in Oman is the Limited Liability Company (LLC). An LLC is a separate legal entity that offers limited liability protection to its owners. This means that the owners’ personal assets are protected in case the business faces financial difficulties. To register an LLC in Oman, you need a minimum of two shareholders and a maximum of 40. Additionally, you must have a minimum share capital of OMR 20,000.

Another type of business entity in Oman is the Joint Stock Company (SAOG). A SAOG is a publicly traded company that can issue shares to the public. This type of entity is suitable for large-scale businesses that require substantial capital investment. To register a SAOG in Oman, you need a minimum of three shareholders, and there is no maximum limit. The minimum share capital requirement for a SAOG is OMR 150,000.

If you are looking for a more flexible business entity, you may consider registering a Simple Commandite Company (SCC). An SCC is a partnership where at least one partner has unlimited liability, while the liability of the other partners is limited to their capital contribution. This type of entity is commonly used for professional services firms. To register an SCC in Oman, you need a minimum of two partners, and there is no maximum limit. There is no minimum share capital requirement for an SCC.

For businesses in the oil and gas sector, the Petroleum Development Oman (PDO) offers a unique business entity called the Limited Liability Partnership (LLP). An LLP is a partnership where the liability of the partners is limited to their capital contribution. This type of entity is specifically designed for businesses involved in the exploration and production of oil and gas. To register an LLP in Oman, you need a minimum of two partners, and there is no maximum limit. The minimum share capital requirement for an LLP is OMR 150,000.

Lastly, if you are a foreign investor looking to establish a business in Oman, you may consider registering a Branch Office. A Branch Office is an extension of a foreign company and is not considered a separate legal entity. This type of entity is suitable for businesses that want to have a presence in Oman without going through the process of setting up a separate company. To register a Branch Office in Oman, you need to provide the necessary documents from the parent company, including a certificate of incorporation and a board resolution authorizing the establishment of the branch.

In conclusion, when starting a business in Oman, it is crucial to choose the right type of business entity for registration. The Limited Liability Company, Joint Stock Company, Simple Commandite Company, Limited Liability Partnership, and Branch Office are the main options available. Each type of entity has its own requirements and benefits, so it is essential to carefully consider your business needs before making a decision. By understanding the different types of business entities in Oman, you can navigate the registration process more effectively and set your business up for success.

Legal Requirements for Business Registration in Oman

The legal requirements for business registration in Oman are an essential aspect of starting a business in the country. Understanding these requirements is crucial to ensure a smooth and successful registration process. This article will provide a complete guide to the Business Registration Process in Oman, focusing specifically on the legal requirements that entrepreneurs need to fulfill.

First and foremost, it is important to note that the legal framework for business registration in Oman is governed by the Commercial Companies Law. This law outlines the various types of business entities that can be registered, including limited liability companies, joint stock companies, and partnerships. Entrepreneurs must carefully consider the type of entity that best suits their business needs before proceeding with the registration process.

One of the primary legal requirements for business registration in Oman is the submission of a memorandum of association. This document outlines the company’s name, objectives, capital, and the names and addresses of its shareholders. It must be notarized and submitted to the Ministry of Commerce and Industry along with other required documents.

In addition to the memorandum of association, entrepreneurs must also provide a copy of their passport, a bank reference letter, and a lease agreement for the company’s premises. These documents are necessary to verify the identity and financial standing of the shareholders and to establish the company’s physical presence in Oman.

Another crucial legal requirement for business registration in Oman is obtaining a commercial registration certificate. This certificate is issued by the Ministry of Commerce and Industry and serves as proof that the company is legally registered and authorized to conduct business activities in the country. It is essential for opening bank accounts, obtaining visas for employees, and entering into contracts with other businesses.

Furthermore, entrepreneurs must also obtain a tax card from the Tax Authority in Oman. This card is necessary for fulfilling tax obligations and ensuring compliance with the country’s tax laws. It is important to note that Oman has a relatively low tax rate, making it an attractive destination for businesses seeking to establish a presence in the Middle East.

Additionally, entrepreneurs must register their employees with the Public Authority for Social Insurance (PASI). This registration ensures that employees are covered by social insurance, including health insurance and retirement benefits. It is a legal requirement that must be fulfilled to protect the rights and well-being of employees.

Lastly, entrepreneurs must also comply with labor laws and regulations in Oman. These laws govern various aspects of employment, including working hours, wages, and employee rights. It is crucial for businesses to familiarize themselves with these laws to ensure compliance and avoid any legal issues in the future.

In conclusion, understanding the legal requirements for business registration in Oman is essential for entrepreneurs looking to establish a business in the country. From submitting a memorandum of association to obtaining a commercial registration certificate and complying with tax and labor laws, entrepreneurs must navigate through various legal processes to ensure a successful registration. By fulfilling these requirements, entrepreneurs can establish a strong legal foundation for their business and embark on a path to success in Oman’s thriving business landscape.

Benefits and Incentives for Registering a Business in Oman

Benefits and Incentives for Registering a Business in Oman

When considering starting a business in Oman, it is important to understand the benefits and incentives that come with registering your business in this Middle Eastern country. Oman offers a range of advantages to entrepreneurs and investors, making it an attractive destination for business ventures.

One of the key benefits of Registering a Business in Oman is the country’s strategic location. Situated at the crossroads of Asia, Africa, and Europe, Oman serves as a gateway to the Gulf Cooperation Council (GCC) countries. This advantageous location provides businesses with access to a large market of over 50 million consumers, offering significant opportunities for growth and expansion.

Furthermore, Oman has a stable and investor-friendly business environment. The government has implemented various measures to attract foreign investment and promote economic diversification. These measures include the establishment of free zones, which offer tax incentives, 100% foreign ownership, and simplified procedures for setting up businesses. Free zones such as the Sohar Port and Freezone, Salalah Free Zone, and Al Mazunah Free Zone have become popular choices for investors due to their attractive incentives and infrastructure.

In addition to the favorable business environment, Oman offers a range of incentives to registered businesses. One such incentive is the exemption from income tax for a certain period. New businesses can enjoy a tax holiday for up to five years, providing them with a significant advantage in terms of profitability and cash flow. This tax exemption allows businesses to reinvest their profits into expansion and development, fostering growth and sustainability.

Moreover, Oman provides various financial incentives to registered businesses. The government offers grants, loans, and subsidies to support the establishment and growth of businesses in key sectors such as manufacturing, tourism, and agriculture. These financial incentives aim to encourage investment in priority areas and stimulate economic development.

Another benefit of Registering a Business in Oman is access to a skilled and educated workforce. The country has made significant investments in education and training, resulting in a highly skilled labor force. Omanis are known for their strong work ethic, professionalism, and adaptability, making them valuable assets to businesses operating in the country. Additionally, the government has implemented policies to promote the employment of Omani nationals, providing businesses with incentives and support to hire and train local talent.

Furthermore, registered businesses in Oman can take advantage of the country’s modern infrastructure and logistics capabilities. Oman has invested heavily in developing its transportation networks, including ports, airports, and roadways. This infrastructure facilitates the movement of goods and services, enabling businesses to efficiently import and export their products. The country’s logistics capabilities, combined with its strategic location, make Oman an ideal hub for regional and international trade.

In conclusion, Registering a Business in Oman offers numerous benefits and incentives. The country’s strategic location, stable business environment, tax exemptions, financial incentives, skilled workforce, and modern infrastructure make it an attractive destination for entrepreneurs and investors. By taking advantage of these advantages, businesses can position themselves for success and growth in Oman’s thriving economy.

Key Documents and Forms for Business Registration in Oman

The process of Registering a Business in Oman can seem daunting, but with the right information and guidance, it can be a smooth and straightforward process. One of the key aspects of business registration in Oman is ensuring that you have all the necessary documents and forms in order. In this article, we will provide a complete guide to the key documents and forms required for business registration in Oman.

The first document that you will need is a copy of your passport. This is required for all shareholders and directors of the company. It is important to ensure that your passport is valid for at least six months from the date of application. Additionally, you will need to provide a copy of your residency card if you are a resident of Oman.

Next, you will need to provide a copy of your company’s memorandum and articles of association. These documents outline the purpose and structure of your company and are essential for the registration process. It is important to ensure that these documents are drafted in accordance with the requirements of the Omani Commercial Companies Law.

In addition to the memorandum and articles of association, you will also need to provide a copy of your company’s trade name reservation certificate. This certificate is obtained from the Ministry of Commerce and Industry and confirms that your chosen trade name is available and can be registered.

Another important document that you will need is a copy of your company’s lease agreement. This agreement should outline the terms and conditions of your company’s lease of office space or premises in Oman. It is important to note that the lease agreement must be registered with the Ministry of Housing and Urban Planning.

Furthermore, you will need to provide a copy of your company’s commercial registration certificate. This certificate is obtained from the Ministry of Commerce and Industry and confirms that your company is registered and authorized to conduct business in Oman. It is important to ensure that your company’s commercial registration certificate is valid and up to date.

Additionally, you will need to provide a copy of your company’s tax registration certificate. This certificate is obtained from the Tax Authority and confirms that your company is registered for tax purposes in Oman. It is important to ensure that your company’s tax registration certificate is valid and up to date.

Finally, you will need to complete and submit the necessary forms for business registration in Oman. These forms include the application form for commercial registration, the application form for tax registration, and the application form for a trade license. It is important to ensure that these forms are completed accurately and submitted along with all the required documents.

In conclusion, the key documents and forms required for business registration in Oman include a copy of your passport, the memorandum and articles of association, the trade name reservation certificate, the lease agreement, the commercial registration certificate, the tax registration certificate, and the necessary application forms. By ensuring that you have all these documents and forms in order, you can navigate the Business Registration Process in Oman with ease.

Understanding the Costs and Fees of Business Registration in Oman

The process of Registering a Business in Oman can be complex and time-consuming. It is important for entrepreneurs and investors to have a clear understanding of the costs and fees associated with business registration in the country. This article aims to provide a comprehensive guide to help individuals navigate through the various expenses involved in setting up a business in Oman.

One of the first costs to consider when Registering a Business in Oman is the initial capital requirement. The minimum capital requirement varies depending on the type of business entity being established. For example, a limited liability company (LLC) requires a minimum capital of OMR 150,000, while a joint stock company (SAOG) requires a minimum capital of OMR 2 million. It is important to note that these figures are subject to change and it is advisable to consult with a legal professional or business consultant for the most up-to-date information.

In addition to the initial capital requirement, there are various fees associated with the registration process. These fees include the cost of obtaining a commercial license, which is necessary for conducting business activities in Oman. The fee for a commercial license varies depending on the type of business and the activities it will engage in. It is important to carefully consider the nature of the business and its intended activities to determine the appropriate license and associated fees.

Another important cost to consider is the fee for registering the business with the Ministry of Commerce and Industry. This fee is typically based on the capital of the company and can range from OMR 100 to OMR 500. Additionally, there may be fees for obtaining other necessary permits and approvals, such as a trade name registration or a foreign investment license. These fees can vary depending on the specific requirements of the business and should be factored into the overall cost of registration.

It is also important to consider ongoing costs and fees associated with maintaining a registered business in Oman. These costs include annual renewal fees for the commercial license, which must be paid to the Ministry of Commerce and Industry. The amount of the renewal fee is typically based on the capital of the company and can range from OMR 100 to OMR 500. Additionally, there may be other fees for services such as auditing, accounting, and legal compliance, which are necessary for operating a business in Oman.

It is worth noting that there may be additional costs and fees associated with specific industries or activities. For example, businesses in certain sectors, such as banking or insurance, may be subject to additional regulatory requirements and fees. It is important to thoroughly research and understand the specific requirements and costs associated with the intended business activities to avoid any surprises or unexpected expenses.

In conclusion, understanding the costs and fees associated with business registration in Oman is crucial for entrepreneurs and investors. From the initial capital requirement to the fees for obtaining licenses and permits, there are various expenses to consider. Additionally, ongoing costs for maintaining a registered business should be factored into the overall budget. By carefully considering and planning for these costs, individuals can navigate the Business Registration Process in Oman more effectively and ensure a smooth start to their entrepreneurial journey.

Common Challenges and Solutions in the Business Registration Process in Oman

The Business Registration Process in Oman can be a complex and time-consuming endeavor. Entrepreneurs and business owners often face various challenges during this process. However, with the right knowledge and guidance, these challenges can be overcome. In this section, we will discuss some common challenges faced by individuals and businesses when Registering a Business in Oman, as well as potential solutions to these challenges.

One of the most significant challenges in the business registration process is understanding the legal requirements and procedures. Oman has specific laws and regulations that govern the establishment and operation of businesses. Navigating through these legal requirements can be overwhelming, especially for those unfamiliar with the local laws. To overcome this challenge, it is crucial to seek professional assistance from lawyers or business consultants who are well-versed in Omani business laws. These experts can guide entrepreneurs through the registration process, ensuring compliance with all legal requirements.

Another challenge faced by businesses during the registration process is the documentation and paperwork involved. The Omani government requires various documents to be submitted, such as proof of identity, proof of address, and financial statements. Gathering and organizing these documents can be time-consuming and tedious. To streamline this process, it is advisable to create a checklist of all required documents and ensure they are readily available. Additionally, utilizing technology and digital platforms can help in the efficient management and submission of documents.

Language barriers can also pose a challenge for individuals and businesses during the registration process. Arabic is the official language of Oman, and most official documents and forms are in Arabic. For non-Arabic speakers, understanding and completing these documents can be difficult. To overcome this challenge, it is recommended to hire a translator or interpreter who can assist in translating and understanding the necessary documents. This ensures accurate completion of forms and avoids any misunderstandings or errors.

Another common challenge faced by businesses is the lengthy processing time for registration. The registration process in Oman can take several weeks or even months, depending on the type of business and the completeness of the application. This delay can be frustrating for entrepreneurs who are eager to start their operations. To mitigate this challenge, it is essential to ensure that all required documents and information are provided accurately and promptly. Additionally, maintaining regular communication with the relevant authorities can help expedite the process.

Lastly, understanding the local market and industry-specific regulations can be a challenge for foreign businesses entering Oman. Each industry may have specific requirements and regulations that need to be adhered to. It is crucial to conduct thorough market research and seek advice from industry experts to understand these regulations and ensure compliance. Engaging with local business networks and associations can also provide valuable insights and guidance.

In conclusion, the Business Registration Process in Oman can present various challenges for entrepreneurs and business owners. However, with proper guidance and preparation, these challenges can be overcome. Seeking professional assistance, organizing required documents, addressing language barriers, managing processing time, and understanding industry-specific regulations are key solutions to navigate through the registration process smoothly. By being well-informed and proactive, individuals and businesses can successfully register their businesses in Oman and embark on their entrepreneurial journey.

Important Considerations for Foreign Investors Registering a Business in Oman

Important Considerations for Foreign Investors Registering a Business in Oman

When it comes to expanding your business internationally, Oman is an attractive destination for foreign investors. With its stable economy, strategic location, and business-friendly policies, Oman offers numerous opportunities for growth and success. However, before you can start operating in Oman, it is crucial to understand the business registration process and the important considerations that foreign investors need to keep in mind.

One of the first things to consider is the legal structure of your business. In Oman, foreign investors can choose between several legal forms, including limited liability companies (LLCs), joint stock companies, and branches of foreign companies. Each legal structure has its own advantages and requirements, so it is essential to carefully evaluate which option best suits your business goals and objectives.

Another important consideration is the minimum capital requirement. In Oman, the minimum capital requirement for LLCs is OMR 150,000 (approximately USD 390,000). However, this requirement may vary depending on the nature of your business and the industry you operate in. It is advisable to consult with a legal expert or a business consultant to determine the exact capital requirement for your specific business.

Foreign investors should also be aware of the local sponsorship requirement in Oman. According to Omani law, foreign investors must have a local sponsor who is an Omani national or a company wholly owned by Omani nationals. The local sponsor will hold a 51% ownership stake in the business, while the foreign investor can retain the remaining 49%. It is important to choose a reliable and trustworthy local sponsor who can provide the necessary support and guidance throughout the registration process and beyond.

Furthermore, foreign investors should familiarize themselves with the licensing and permit requirements in Oman. Depending on the nature of your business, you may need to obtain specific licenses and permits from various government authorities. These may include commercial registration, trade licenses, environmental permits, and approvals from relevant ministries or regulatory bodies. It is crucial to ensure that you comply with all the necessary requirements to avoid any legal issues or delays in the registration process.

Additionally, foreign investors should consider the taxation system in Oman. Oman has a favorable tax regime, with no personal income tax and a low corporate tax rate of 15%. However, it is important to understand the tax obligations and requirements for your business, including VAT registration and compliance with tax laws and regulations. Seeking advice from a tax consultant or an accounting firm can help you navigate the tax landscape and ensure compliance with all tax obligations.

Lastly, foreign investors should be aware of the cultural and business practices in Oman. Building strong relationships and understanding local customs and traditions can greatly contribute to the success of your business. It is advisable to engage with local business networks, attend industry events, and seek guidance from local professionals to establish a strong presence in the Omani market.

In conclusion, Registering a Business in Oman as a foreign investor requires careful consideration of various factors. Understanding the legal structure, minimum capital requirement, local sponsorship, licensing and permit requirements, taxation system, and cultural practices are all crucial for a smooth and successful registration process. By taking these important considerations into account and seeking professional advice when needed, foreign investors can navigate the Business Registration Process in Oman with confidence and set themselves up for long-term success in the country.

Expert Tips for a Smooth Business Registration Process in Oman

Starting a business in Oman can be an exciting and rewarding venture. However, navigating the business registration process can be complex and time-consuming. To help you through this process, we have compiled a complete guide with expert tips for a smooth Business Registration Process in Oman.

The first step in registering your business in Oman is to determine the legal structure of your company. There are several options available, including a sole proprietorship, partnership, limited liability company (LLC), or a joint stock company. Each structure has its own advantages and requirements, so it is important to carefully consider which one is best suited for your business.

Once you have determined the legal structure, the next step is to choose a business name. It is important to select a name that is unique and not already registered by another company in Oman. You can check the availability of a business name through the Ministry of Commerce and Industry’s online portal. It is also advisable to consult with a local lawyer or business consultant to ensure that your chosen name complies with local regulations.

After selecting a business name, you will need to prepare the necessary documents for registration. This includes a memorandum of association, articles of association, and a commercial registration application form. These documents outline the purpose, activities, and ownership structure of your company. It is important to ensure that these documents are accurately prepared and comply with local laws and regulations.

Once the documents are prepared, you will need to submit them to the Ministry of Commerce and Industry along with the required fees. The ministry will review your application and may request additional information or clarification. It is important to respond promptly to any requests to avoid delays in the registration process.

After the ministry approves your application, you will receive a commercial registration certificate. This certificate is proof that your business is legally registered in Oman. It is important to keep this certificate in a safe place, as you may be required to present it for various business transactions, such as opening a bank account or signing contracts.

In addition to the registration process, there are several other considerations to keep in mind when starting a business in Oman. One important aspect is obtaining the necessary licenses and permits. Depending on the nature of your business, you may need to obtain specific licenses from various government authorities. It is advisable to consult with a local lawyer or business consultant to ensure that you comply with all licensing requirements.

Another consideration is the hiring of employees. Oman has specific regulations regarding employment, including the requirement to hire a certain percentage of Omani nationals. It is important to familiarize yourself with these regulations and ensure that you comply with them when hiring employees for your business.

Finally, it is important to have a good understanding of the tax obligations for your business in Oman. The tax system in Oman is relatively straightforward, with a corporate income tax rate of 15%. However, there may be additional taxes or duties depending on the nature of your business. It is advisable to consult with a local accountant or tax advisor to ensure that you comply with all tax obligations.

In conclusion, starting a business in Oman can be a rewarding endeavor. By following the steps outlined in this guide and seeking expert advice when needed, you can navigate the business registration process smoothly and ensure that your business is legally compliant. With careful planning and preparation, you can set your business up for success in Oman.

Q&A

1. What is the first step in the Business Registration Process in Oman?

The first step is to reserve a unique business name with the Ministry of Commerce and Industry.

2. What are the types of business entities that can be registered in Oman?

Businesses can be registered as sole proprietorships, partnerships, limited liability companies, or joint stock companies.

3. What documents are required for business registration in Oman?

The required documents include a completed application form, copies of the owner’s identification documents, a lease agreement for the business premises, and a bank reference letter.

4. Is it necessary to have a local sponsor or partner to register a business in Oman?

Yes, foreign investors are required to have a local sponsor or partner who holds at least 30% ownership in the business.

5. What is the minimum capital requirement for business registration in Oman?

The minimum capital requirement varies depending on the type of business entity. For example, a limited liability company requires a minimum capital of OMR 20,000.

6. How long does the business registration process take in Oman?

The registration process typically takes around 2-3 weeks, but it can vary depending on the complexity of the business and the completeness of the required documents.

7. Are there any specific industry regulations or licenses required for certain businesses in Oman?

Yes, certain industries such as healthcare, education, and finance have specific regulations and licensing requirements that need to be fulfilled.

8. Can foreign investors own 100% of a business in Oman?

Foreign investors can own 100% of a business in certain free zones or if the business falls under specific sectors identified by the government.

9. Are there any tax incentives or benefits for businesses in Oman?

Yes, Oman offers various tax incentives and benefits to attract foreign investment, such as exemptions from income tax for a certain period or reduced tax rates in certain sectors.

10. What is the role of the Public Authority for Small and Medium Enterprises Development (Riyada) in the business registration process?

Riyada provides support and guidance to small and medium-sized enterprises (SMEs) throughout the business registration process, including assistance with licensing and permits.

Conclusion

In conclusion, the Complete Guide to Business Registration Process in Oman provides a comprehensive overview of the steps and requirements involved in registering a business in the country. It covers important aspects such as choosing a business structure, obtaining necessary licenses and permits, registering with relevant authorities, and fulfilling legal obligations. By following this guide, individuals and entrepreneurs can navigate the Business Registration Process in Oman efficiently and effectively.