-

Table of Contents

- Introduction

- Understanding the Importance of Complete Documentation for Business Entity Registration in KSA

- A Step-by-Step Guide to Gathering the Required Business Registration Documents in KSA

- Exploring the Legal Paperwork Involved in Business Entity Registration in KSA

- Key Company Registration Forms You Need to Know for Establishing a Business in KSA

- Common Challenges and Solutions in Completing Business Registration Documents in KSA

- Tips for Streamlining the Process of Business Entity Registration in KSA

- Ensuring Compliance: Legal Requirements for Business Registration in KSA

- The Role of Business Registration Documents in Protecting Your Intellectual Property in KSA

- Understanding the Different Types of Business Entities and Their Registration Documentation in KSA

- Frequently Asked Questions about Business Entity Registration Documents in KSA

- Q&A

- Conclusion

Your one-stop resource for hassle-free business entity registration in KSA.

Introduction

Introduction:

Registering a business entity in the Kingdom of Saudi Arabia (KSA) requires a thorough understanding of the documentation process. This complete documentation guide aims to provide a comprehensive overview of the necessary paperwork and requirements for business entity registration in KSA. Whether you are planning to establish a sole proprietorship, partnership, limited liability company (LLC), or any other type of business entity, this guide will help you navigate through the documentation process efficiently and ensure compliance with the regulations set by the Saudi Arabian authorities.

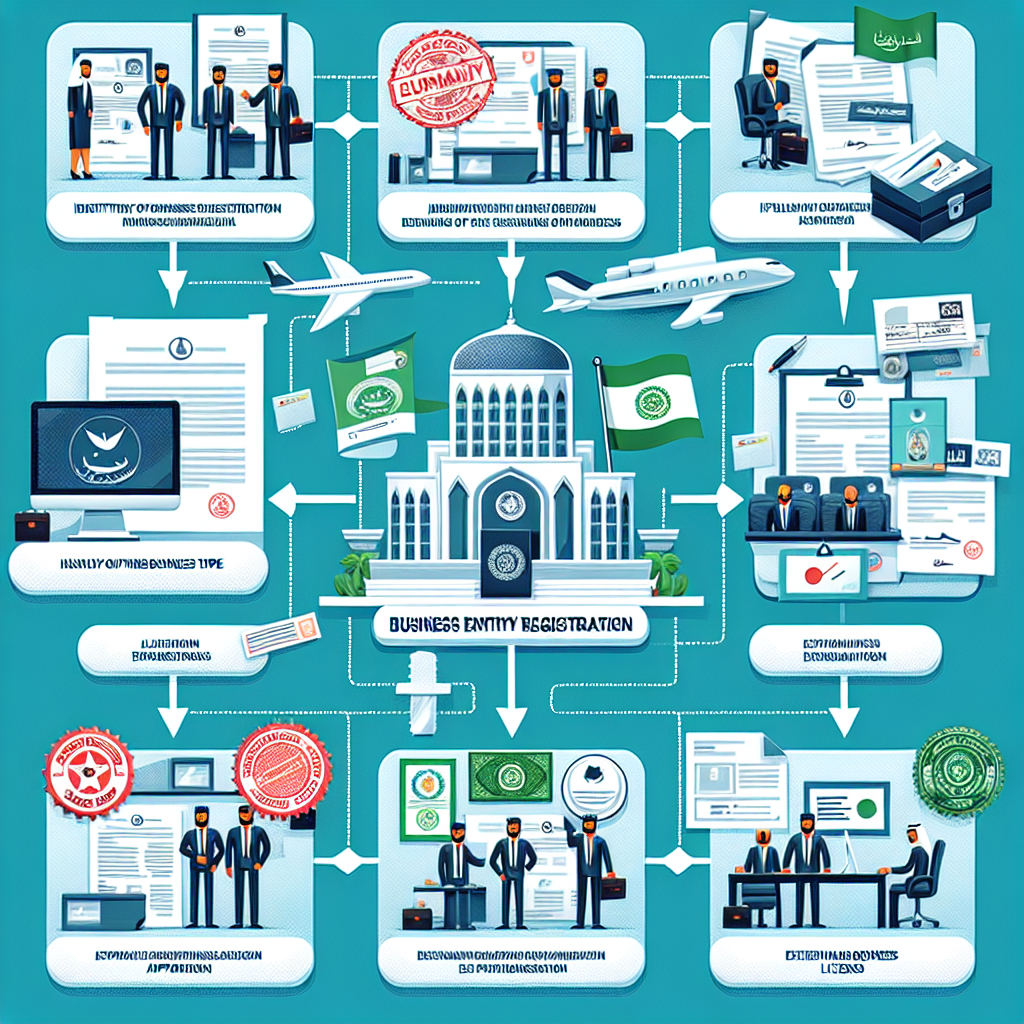

Understanding the Importance of Complete Documentation for Business Entity Registration in KSA

Understanding the Importance of Complete Documentation for Business Entity Registration in KSA

When it comes to starting a business in the Kingdom of Saudi Arabia (KSA), one of the most crucial steps is the registration of your business entity. This process requires careful attention to detail and the submission of complete documentation. In this article, we will explore the importance of complete documentation for business entity registration in KSA and provide a comprehensive guide to help you navigate this process smoothly.

First and foremost, it is essential to understand why complete documentation is vital for business entity registration in KSA. The government of KSA has implemented strict regulations and procedures to ensure transparency and accountability in the business sector. By requiring complete documentation, the government aims to verify the legitimacy of businesses and protect the interests of all stakeholders involved.

One of the primary reasons for submitting complete documentation is to establish the legal identity of your business entity. This includes providing proof of ownership, such as a copy of the commercial registration certificate or the memorandum of association. These documents serve as evidence that your business is registered and authorized to operate in KSA.

Additionally, complete documentation is necessary to comply with tax regulations in KSA. When registering your business entity, you will be required to provide financial statements, tax identification numbers, and other relevant financial documents. These documents enable the government to assess your business’s tax liability accurately and ensure that you are fulfilling your obligations as a taxpayer.

Furthermore, complete documentation is crucial for obtaining necessary permits and licenses for your business operations. Depending on the nature of your business, you may need specific permits or licenses from various government agencies. These agencies will require you to submit relevant documentation to verify your eligibility for obtaining these permits. Without complete documentation, your business may face delays or even rejection in obtaining the necessary permits, hindering your ability to operate legally.

Moreover, complete documentation plays a vital role in establishing credibility and trust with potential partners, investors, and customers. When conducting business in KSA, it is essential to build a reputation for reliability and professionalism. By providing complete and accurate documentation, you demonstrate your commitment to transparency and adherence to legal requirements. This, in turn, enhances your business’s credibility and increases the likelihood of attracting valuable partnerships, investments, and customers.

Now that we understand the importance of complete documentation for business entity registration in KSA, let’s delve into the specific documents required for this process. The exact documentation may vary depending on the type of business entity you are registering, but some common documents include:

1. Commercial registration certificate or memorandum of association

2. Articles of association

3. Proof of ownership or lease agreement for the business premises

4. Financial statements and tax identification numbers

5. Valid identification documents of the business owner(s) and authorized representatives

6. Permits and licenses specific to your business activities

It is crucial to ensure that all documents are complete, accurate, and up-to-date before submitting them for registration. Any discrepancies or missing information may result in delays or rejection of your application.

In conclusion, complete documentation is of utmost importance for business entity registration in KSA. It establishes the legal identity of your business, ensures compliance with tax regulations, facilitates obtaining necessary permits and licenses, and enhances credibility with stakeholders. By understanding the significance of complete documentation and following the guidelines provided, you can navigate the registration process smoothly and set your business up for success in the Kingdom of Saudi Arabia.

A Step-by-Step Guide to Gathering the Required Business Registration Documents in KSA

Starting a business in Saudi Arabia requires proper registration with the relevant authorities. This process involves gathering and submitting various documents to ensure compliance with the country’s regulations. In this article, we will provide a step-by-step guide to help you navigate through the documentation requirements for business entity registration in KSA.

The first step in the registration process is to obtain a commercial registration certificate from the Ministry of Commerce and Investment (MOCI). To do this, you will need to submit an application form along with the necessary supporting documents. These documents include a copy of your national ID or passport, a copy of your residency permit (if applicable), and a copy of your lease agreement or proof of ownership for the business premises.

Next, you will need to register your business with the General Authority for Zakat and Tax (GAZT). This step is crucial for tax purposes and requires the submission of additional documents. These include a copy of your commercial registration certificate, a copy of your national ID or passport, and a completed tax registration form. It is important to note that failure to register with GAZT may result in penalties and legal consequences.

In addition to the MOCI and GAZT registrations, certain business activities may require additional permits or licenses from specialized authorities. For example, if you plan to operate a restaurant, you will need to obtain a food service permit from the Saudi Food and Drug Authority (SFDA). Similarly, if your business involves importing or exporting goods, you will need to register with the Saudi Customs Authority.

To register with the SFDA, you will need to provide a copy of your commercial registration certificate, a copy of your national ID or passport, and a completed application form. The SFDA may also require additional documents such as a health certificate for food-related businesses.

For customs registration, you will need to submit a copy of your commercial registration certificate, a copy of your national ID or passport, and a completed customs registration form. You may also be required to provide additional documents depending on the nature of your business.

Once you have gathered all the necessary documents, it is important to ensure that they are properly translated into Arabic. All documents submitted for business registration in KSA must be in Arabic or accompanied by an official Arabic translation. This requirement helps facilitate the review process and ensures that the authorities can understand the content of the documents.

Finally, it is advisable to consult with a legal or business advisor to ensure that you have met all the necessary requirements and have the correct documentation. They can guide you through the process and help you avoid any potential pitfalls or delays.

In conclusion, starting a business in Saudi Arabia requires careful attention to the documentation requirements. By following this step-by-step guide and gathering the necessary documents, you can ensure a smooth and successful registration process. Remember to consult with experts to ensure compliance with all regulations and to avoid any unnecessary complications.

Exploring the Legal Paperwork Involved in Business Entity Registration in KSA

Starting a business in Saudi Arabia requires going through a series of legal procedures and paperwork. Understanding the documentation process is crucial to ensure a smooth and successful business entity registration in the Kingdom. In this article, we will explore the various legal paperwork involved in business entity registration in KSA.

The first step in the documentation process is obtaining a commercial registration certificate. This certificate is issued by the Ministry of Commerce and Investment (MCI) and serves as proof that your business is legally registered in Saudi Arabia. To obtain this certificate, you need to submit an application form along with the required documents, such as a copy of your national ID or passport, a copy of your lease agreement, and a copy of your company’s Articles of Association.

Next, you will need to obtain a tax identification number (TIN) from the General Authority of Zakat and Tax (GAZT). The TIN is essential for tax purposes and is required for all businesses operating in Saudi Arabia. To obtain a TIN, you will need to submit an application form along with supporting documents, such as a copy of your commercial registration certificate, a copy of your lease agreement, and a copy of your company’s Articles of Association.

In addition to the commercial registration certificate and TIN, you will also need to obtain a foreign investment license if you are a foreign investor. This license is issued by the Saudi Arabian General Investment Authority (SAGIA) and is required for foreign investors looking to establish a business in Saudi Arabia. To obtain this license, you will need to submit an application form along with supporting documents, such as a copy of your commercial registration certificate, a copy of your lease agreement, and a copy of your company’s Articles of Association.

Once you have obtained the necessary licenses and certificates, you will need to open a bank account for your business. This is a crucial step as it allows you to conduct financial transactions and manage your business’s finances. To open a bank account, you will need to provide the bank with the necessary documents, such as your commercial registration certificate, TIN, and a copy of your lease agreement.

Additionally, you may also need to obtain specific permits and licenses depending on the nature of your business. For example, if you are operating a restaurant, you will need to obtain a food service permit from the Ministry of Municipal and Rural Affairs. If you are operating a construction company, you will need to obtain a construction permit from the Ministry of Municipal and Rural Affairs. It is essential to research and understand the specific permits and licenses required for your business to ensure compliance with Saudi Arabian regulations.

In conclusion, starting a business in Saudi Arabia involves a series of legal procedures and paperwork. Obtaining a commercial registration certificate, tax identification number, foreign investment license (if applicable), and opening a bank account are essential steps in the business entity registration process. Additionally, understanding and obtaining any specific permits and licenses required for your business is crucial. By following the complete documentation guide for business entity registration in KSA, you can navigate the legal paperwork smoothly and establish a successful business in the Kingdom.

Key Company Registration Forms You Need to Know for Establishing a Business in KSA

Starting a business in Saudi Arabia requires a thorough understanding of the registration process and the necessary documentation. This article aims to provide a complete guide to business entity registration in KSA, focusing on the key Company Registration Forms that entrepreneurs need to know.

The first and most important form is the Memorandum of Association (MOA). This document outlines the company’s name, objectives, capital, and shareholders’ details. It is a legal requirement and must be notarized by a notary public. The MOA serves as the foundation of the company and defines its structure and purpose.

Another crucial form is the Articles of Association (AOA). This document complements the MOA by providing more detailed information about the company’s internal regulations, such as the roles and responsibilities of directors, shareholders’ rights, and procedures for decision-making. Like the MOA, the AOA must also be notarized.

To register a business in KSA, entrepreneurs must also submit a Commercial Registration (CR) form. This form provides information about the company’s activities, location, and ownership. It is essential for obtaining a commercial license and allows the company to engage in commercial activities within the country.

In addition to these forms, entrepreneurs must also complete a form for the General Authority for Zakat and Tax (GAZT). This form is necessary for tax registration and compliance with Saudi Arabia’s tax laws. It requires information about the company’s financial activities, including income, expenses, and assets.

To ensure compliance with labor laws, businesses in KSA must also submit a form for the General Organization for Social Insurance (GOSI). This form provides details about the company’s employees, including their salaries, benefits, and insurance coverage. It is crucial for protecting the rights of employees and ensuring their social security.

Furthermore, entrepreneurs must complete a form for the Saudi Arabian Monetary Authority (SAMA) to open a bank account for their business. This form requires information about the company’s financial activities, such as its sources of income and expected transactions. It is necessary for conducting financial transactions and managing the company’s finances.

Lastly, entrepreneurs must submit a form for the Ministry of Labor and Social Development (MLSD) to obtain a work permit for non-Saudi employees. This form requires information about the employee’s qualifications, job description, and salary. It is essential for ensuring that non-Saudi employees have the necessary legal authorization to work in the country.

In conclusion, starting a business in Saudi Arabia requires entrepreneurs to complete several key Company Registration Forms. These forms include the Memorandum of Association, Articles of Association, Commercial Registration, General Authority for Zakat and Tax form, General Organization for Social Insurance form, Saudi Arabian Monetary Authority form, and Ministry of Labor and Social Development form. Each form serves a specific purpose and is necessary for complying with legal requirements and establishing a business in KSA. Entrepreneurs should ensure that they have a thorough understanding of these forms and seek professional assistance if needed to navigate the registration process smoothly.

Common Challenges and Solutions in Completing Business Registration Documents in KSA

Starting a business in Saudi Arabia can be a complex process, especially when it comes to completing the necessary registration documents. Business entity registration in KSA requires careful attention to detail and adherence to specific guidelines set by the government. In this article, we will discuss some common challenges faced by entrepreneurs during the registration process and provide solutions to overcome them.

One of the most common challenges faced by business owners is understanding the specific requirements for each type of business entity. In KSA, there are several types of business entities, including sole proprietorships, partnerships, limited liability companies, and joint stock companies. Each entity has its own set of registration requirements, such as minimum capital requirements, licensing fees, and documentation.

To overcome this challenge, it is crucial for entrepreneurs to thoroughly research and understand the specific requirements for their chosen business entity. This can be done by consulting with legal professionals or utilizing online resources provided by government agencies. By having a clear understanding of the requirements, entrepreneurs can ensure that they gather all the necessary documents and information before starting the registration process.

Another challenge faced by business owners is the language barrier. The registration documents in KSA are typically in Arabic, which can be a significant obstacle for non-Arabic speakers. Translating the documents accurately and ensuring that all the information is correctly represented can be a daunting task.

To address this challenge, entrepreneurs can seek the assistance of professional translators who are fluent in both Arabic and their native language. It is essential to ensure that the translation is accurate and reflects the intended meaning of the original document. Additionally, it is advisable to have the translated documents reviewed by a legal professional to ensure compliance with local laws and regulations.

Completing the required documentation accurately and efficiently is another challenge faced by business owners. The registration process in KSA involves submitting various documents, such as a memorandum of association, articles of association, and a commercial registration certificate. Each document must be completed correctly and in accordance with the guidelines provided by the government.

To overcome this challenge, entrepreneurs can seek the assistance of experienced professionals who specialize in business registration services. These professionals have in-depth knowledge of the registration process and can guide entrepreneurs through each step, ensuring that all the necessary documents are completed accurately and efficiently.

Furthermore, utilizing technology can streamline the documentation process. Online platforms and software can help entrepreneurs organize and manage their registration documents, ensuring that all the required information is included and easily accessible. These tools can also provide templates and guidelines to ensure that the documents are completed correctly.

In conclusion, completing Business Registration Documents in KSA can be a challenging task. However, by understanding the specific requirements for each type of business entity, seeking professional assistance, and utilizing technology, entrepreneurs can overcome these challenges and successfully register their businesses. It is crucial to approach the registration process with careful attention to detail and ensure compliance with local laws and regulations. By doing so, entrepreneurs can lay a solid foundation for their businesses and embark on a successful entrepreneurial journey in Saudi Arabia.

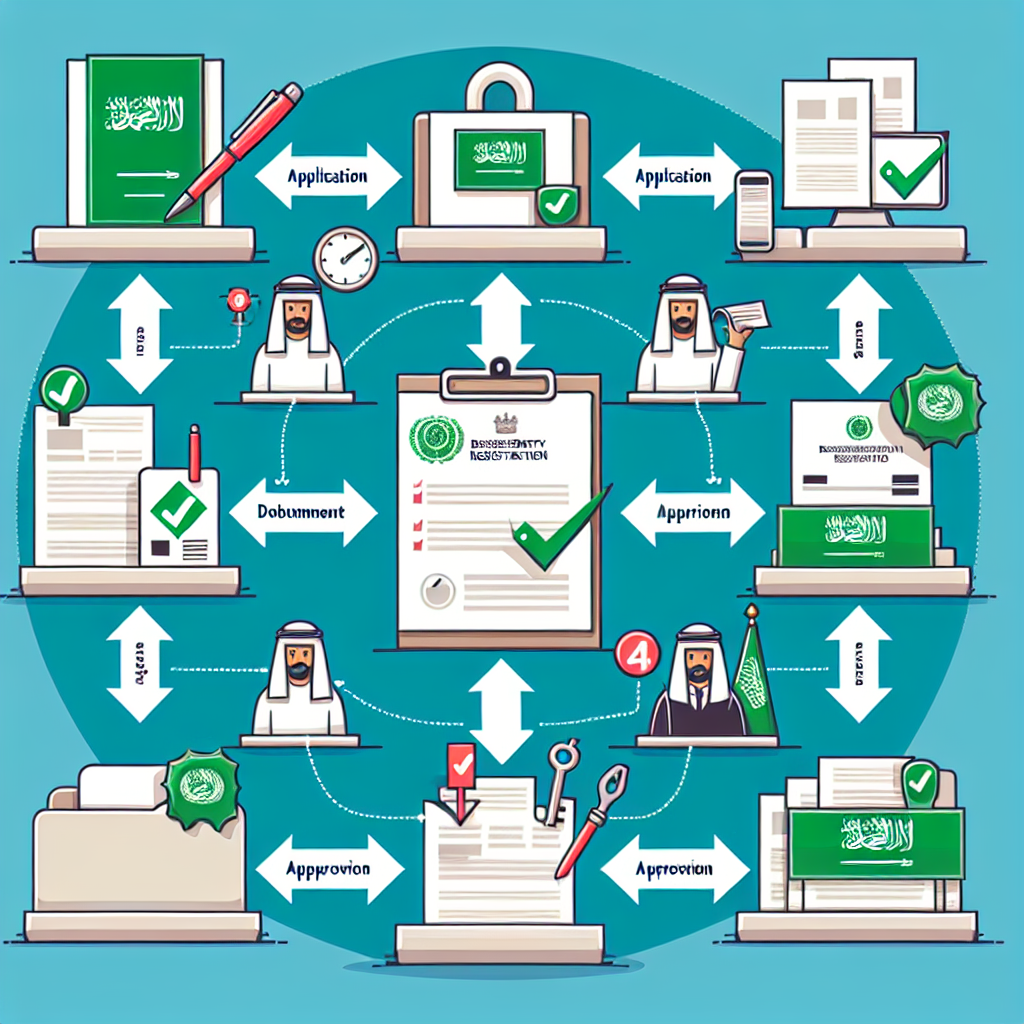

Tips for Streamlining the Process of Business Entity Registration in KSA

Starting a business in Saudi Arabia can be a complex process, especially when it comes to registering your business entity. However, with the right knowledge and guidance, you can streamline the process and ensure that you have all the necessary documentation in place. In this article, we will provide you with a complete documentation guide for business entity registration in KSA, along with some tips to help you navigate the process smoothly.

The first step in registering your business entity in KSA is to determine the type of entity you want to establish. The most common types of entities in Saudi Arabia are limited liability companies (LLCs) and joint stock companies (JSCs). Each type has its own set of requirements and documentation, so it is important to understand the differences before proceeding.

Once you have determined the type of entity, you will need to gather the necessary documentation. This includes a copy of your passport, a copy of your national ID card, and a copy of your residency permit if you are a foreign national. You will also need to provide proof of your address, such as a utility bill or rental agreement.

In addition to personal documentation, you will also need to provide documentation related to your business. This includes a copy of your business plan, financial statements, and any licenses or permits that may be required for your specific industry. It is important to ensure that all documentation is complete and accurate, as any discrepancies could delay the registration process.

Once you have gathered all the necessary documentation, you will need to submit it to the Ministry of Commerce and Investment (MOCI) for review. The MOCI will review your application and documentation to ensure that everything is in order. If there are any issues or missing documents, they will notify you and provide you with an opportunity to rectify the situation.

After the MOCI has reviewed your documentation and approved your application, you will need to pay the necessary fees. The fees vary depending on the type of entity and the size of your business. It is important to budget for these fees and ensure that you have the necessary funds available.

Once you have paid the fees, you will receive your business registration certificate. This certificate is proof that your business entity is registered and legally recognized in Saudi Arabia. It is important to keep this certificate in a safe place, as you may need to present it for various purposes, such as opening a bank account or entering into contracts.

In conclusion, registering a business entity in Saudi Arabia requires careful planning and attention to detail. By following the steps outlined in this article and ensuring that you have all the necessary documentation in place, you can streamline the process and avoid any unnecessary delays. Remember to consult with a legal professional or business consultant to ensure that you are meeting all the requirements and regulations specific to your industry. With the right guidance and preparation, you can successfully register your business entity in KSA and embark on your entrepreneurial journey.

Ensuring Compliance: Legal Requirements for Business Registration in KSA

Starting a business in Saudi Arabia requires careful planning and adherence to legal requirements. The Kingdom of Saudi Arabia (KSA) has specific regulations in place to ensure that businesses operate within the framework of the law. This article serves as a complete documentation guide for business entity registration in KSA, focusing on the legal requirements that must be met to ensure compliance.

One of the first steps in the business registration process is determining the appropriate legal structure for your business. KSA offers several options, including sole proprietorship, partnership, limited liability company (LLC), joint stock company, and branch of a foreign company. Each structure has its own set of requirements and implications, so it is crucial to choose the one that best suits your business goals and objectives.

Once you have decided on the legal structure, the next step is to prepare the necessary documentation. The first document you will need is a Memorandum of Association (MOA) or Articles of Association (AOA), depending on the type of business entity. This document outlines the company’s objectives, activities, capital, and ownership structure. It must be notarized and signed by all shareholders or partners.

In addition to the MOA or AOA, you will need to prepare a Commercial Registration (CR) certificate. This certificate serves as proof that your business is registered with the Ministry of Commerce and Investment (MOCI). It includes information such as the company name, address, activities, and ownership details. The CR certificate is essential for conducting business activities in KSA and must be renewed annually.

Another important document is the License from the relevant authorities. Depending on the nature of your business, you may need to obtain specific licenses or permits from regulatory bodies such as the Saudi Food and Drug Authority (SFDA), Saudi Arabian Monetary Authority (SAMA), or the General Authority for Zakat and Tax (GAZT). These licenses ensure that your business complies with industry-specific regulations and standards.

To complete the registration process, you will also need to provide identification documents for all shareholders or partners, such as passports or national ID cards. Additionally, you may be required to submit a bank reference letter, audited financial statements, and a lease agreement or proof of ownership for your business premises.

It is important to note that all documents must be in Arabic or translated into Arabic by a certified translator. The translated documents must be notarized by a Saudi Arabian notary public. This requirement ensures that all parties involved can understand and verify the contents of the documents.

Once you have gathered all the necessary documents, you can submit your application for business registration to the MOCI. The application process typically involves filling out the required forms, paying the registration fees, and providing the supporting documents. The MOCI will review your application and, if everything is in order, issue the necessary licenses and certificates.

In conclusion, starting a business in KSA requires compliance with specific legal requirements. This article has provided a complete documentation guide for business entity registration in KSA, highlighting the importance of choosing the right legal structure and preparing the necessary documents. By following these guidelines and ensuring compliance with the regulations, you can establish a legally sound business in Saudi Arabia.

The Role of Business Registration Documents in Protecting Your Intellectual Property in KSA

The Role of Business Registration Documents in Protecting Your Intellectual Property in KSA

When starting a business in Saudi Arabia, it is crucial to understand the importance of protecting your intellectual property. Intellectual property refers to creations of the mind, such as inventions, literary and artistic works, designs, and symbols. These intangible assets are valuable and can give your business a competitive edge. To safeguard your intellectual property rights, it is essential to have the necessary Business Registration Documents in place.

One of the primary documents required for business entity registration in Saudi Arabia is the Commercial Registration (CR). The CR is issued by the Ministry of Commerce and Investment (MOCI) and serves as proof that your business is legally registered and recognized by the government. This document contains vital information about your business, including its name, address, activities, and ownership structure.

The CR plays a crucial role in protecting your intellectual property rights. It establishes your business as a legal entity and provides you with exclusive rights to use your business name and logo. By registering your business, you prevent others from using similar names or logos that could confuse customers and dilute your brand identity. This protection is particularly important in a competitive market where brand recognition is key to success.

In addition to the CR, another essential document for protecting your intellectual property is the Trademark Registration Certificate. A trademark is a distinctive sign that identifies your products or services and sets them apart from those of your competitors. Registering your trademark with the Saudi Arabian Intellectual Property Authority (SAIP) provides you with exclusive rights to use and protect your brand.

The Trademark Registration Certificate serves as evidence of your ownership and can be used to take legal action against anyone who infringes on your trademark rights. It allows you to prevent others from using similar marks that could create confusion among consumers or damage your brand reputation. By registering your trademark, you establish a strong foundation for your business and ensure that your intellectual property is adequately protected.

Another important document related to intellectual property protection is the Patent Registration Certificate. A patent is a legal right granted to inventors for their inventions, providing them with exclusive rights to use and commercialize their creations. Registering your patent with the Saudi Patent Office ensures that your invention is protected from unauthorized use or reproduction.

The Patent Registration Certificate serves as proof of your ownership and can be used to enforce your rights in case of infringement. It allows you to take legal action against anyone who uses your patented invention without permission, ensuring that you can reap the benefits of your innovation. By registering your patent, you not only protect your intellectual property but also encourage innovation and economic growth in Saudi Arabia.

In conclusion, Business Registration Documents play a vital role in protecting your intellectual property in Saudi Arabia. The Commercial Registration establishes your business as a legal entity and provides exclusive rights to use your business name and logo. The Trademark Registration Certificate protects your brand identity and prevents others from using similar marks. The Patent Registration Certificate safeguards your inventions and grants you exclusive rights to use and commercialize them. By having these documents in place, you can ensure that your intellectual property is adequately protected, giving your business a competitive advantage in the Saudi Arabian market.

Understanding the Different Types of Business Entities and Their Registration Documentation in KSA

Starting a business in Saudi Arabia requires proper registration with the relevant authorities. Understanding the different types of business entities and their registration documentation is crucial for entrepreneurs looking to establish their presence in the Kingdom. This article serves as a complete documentation guide for business entity registration in KSA.

There are several types of business entities that individuals can choose from when registering their business in Saudi Arabia. The most common types include sole proprietorships, partnerships, limited liability companies (LLCs), and joint stock companies. Each type has its own set of requirements and documentation needed for registration.

For sole proprietorships, the registration process is relatively straightforward. The documentation required includes a completed application form, a copy of the owner’s national ID, and a copy of the owner’s commercial registration certificate if applicable. Additionally, a copy of the owner’s lease agreement or proof of ownership of the business premises may be required.

Partnerships, on the other hand, require additional documentation. In addition to the application form and national IDs of all partners, a partnership agreement must be drafted and notarized. This agreement should outline the rights and responsibilities of each partner, as well as the profit-sharing arrangement. It is important to note that partnerships in Saudi Arabia are limited to a maximum of 50 partners.

For those considering forming an LLC, the registration process is more complex. Along with the application form and national IDs of all shareholders, a memorandum of association must be prepared. This document outlines the company’s objectives, capital, and management structure. Additionally, the articles of association, which detail the internal regulations of the company, must be drafted and notarized. Other required documents include a lease agreement or proof of ownership of the company’s premises, as well as a bank certificate confirming the deposit of the minimum required capital.

Joint stock companies, which are typically larger entities, have their own set of registration requirements. In addition to the application form and national IDs of all shareholders, a prospectus must be prepared and approved by the Capital Market Authority (CMA). This document provides detailed information about the company’s activities, financials, and management. Furthermore, the articles of association and memorandum of association must be drafted and notarized. Similar to LLCs, a lease agreement or proof of ownership of the company’s premises, as well as a bank certificate confirming the deposit of the minimum required capital, are also required.

It is important to note that all business entities in Saudi Arabia must also obtain a commercial registration certificate from the Ministry of Commerce and Investment. This certificate serves as proof of the business’s legal existence and is required for various activities such as opening bank accounts, signing contracts, and obtaining visas for employees.

In conclusion, understanding the different types of business entities and their registration documentation is essential for entrepreneurs looking to establish their presence in Saudi Arabia. Whether it is a sole proprietorship, partnership, LLC, or joint stock company, each entity has its own specific requirements. By following the proper registration process and submitting the necessary documentation, entrepreneurs can ensure a smooth and successful establishment of their business in the Kingdom.

Frequently Asked Questions about Business Entity Registration Documents in KSA

Frequently Asked Questions about Business Entity Registration Documents in KSA

Starting a business in Saudi Arabia requires careful planning and adherence to the country’s regulations. One crucial aspect of setting up a business is the registration process, which involves submitting various documents to the relevant authorities. In this article, we will address some frequently asked questions about business entity registration documents in KSA.

Q: What are the basic documents required for business entity registration in KSA?

A: The specific documents needed may vary depending on the type of business entity you wish to establish. However, some common documents include a copy of the company’s articles of association, a copy of the commercial registration certificate, a copy of the owner’s national ID or passport, and a copy of the lease agreement for the business premises.

Q: Are there any additional documents required for foreign investors?

A: Yes, foreign investors are required to provide additional documents, such as a copy of the investor’s passport, a copy of the investor’s residency permit, and a letter of authorization if the investor is appointing a representative to handle the registration process on their behalf.

Q: Do I need to have my documents translated into Arabic?

A: Yes, all documents submitted for business entity registration in KSA must be translated into Arabic by a certified translator. This requirement ensures that the authorities can understand and verify the information provided.

Q: How should I authenticate my documents?

A: All documents must be notarized by a notary public in your home country and then legalized by the Saudi Arabian embassy or consulate. This process ensures the authenticity of the documents and their acceptance by the Saudi authorities.

Q: Can I submit electronic copies of the documents?

A: No, the Saudi authorities require original hard copies of all documents. Electronic copies or scanned versions are not accepted. It is advisable to keep multiple copies of all documents for your records.

Q: How long does it take to complete the registration process?

A: The registration process can take several weeks or even months, depending on the complexity of your business and the efficiency of the authorities. It is essential to start the process well in advance to avoid any delays in launching your business.

Q: Are there any specific requirements for certain types of businesses?

A: Yes, certain types of businesses may have additional requirements. For example, if you are establishing a healthcare facility, you may need to provide additional documents such as a health license and a certificate of conformity. It is crucial to research and understand the specific requirements for your industry before starting the registration process.

Q: Can I hire a professional service to handle the registration process for me?

A: Yes, many companies offer professional services to assist with the business entity registration process in KSA. These services can help ensure that all documents are prepared correctly, translated, and authenticated, saving you time and effort.

In conclusion, the business entity registration process in KSA requires the submission of various documents, including articles of association, commercial registration certificates, and identification documents. Foreign investors may have additional requirements, and all documents must be translated into Arabic and authenticated. It is crucial to start the process well in advance and consider hiring professional services to navigate the complexities of the registration process.

Q&A

1. What is the purpose of a complete documentation guide for business entity registration in KSA?

The purpose is to provide a comprehensive guide that outlines the required documents and procedures for registering a business entity in Saudi Arabia.

2. What are the key documents needed for business entity registration in KSA?

Key documents typically include a completed application form, proof of identity for the business owner(s), proof of address, a copy of the company’s articles of association, and a bank reference letter.

3. Are there any specific requirements for foreign businesses registering in KSA?

Yes, foreign businesses may need to provide additional documents such as a copy of their commercial registration certificate from their home country, a letter of authorization, and a copy of their memorandum of association.

4. Is it necessary to have a local sponsor or partner for business entity registration in KSA?

In some cases, yes. Depending on the type of business and its activities, a local sponsor or partner may be required. This requirement varies based on the business sector and legal structure.

5. What is the process for obtaining a commercial registration certificate in KSA?

The process typically involves submitting the required documents to the Ministry of Commerce and Investment, paying the necessary fees, and undergoing a review and approval process.

6. Are there any specific tax-related documents required for business entity registration in KSA?

Yes, businesses may need to provide tax-related documents such as a tax identification number (if applicable) and proof of tax compliance.

7. How long does the business entity registration process usually take in KSA?

The registration process can vary in duration, but it typically takes several weeks to complete. The timeline may be influenced by factors such as the complexity of the business structure and the efficiency of the registration authorities.

8. Are there any post-registration requirements for business entities in KSA?

Yes, after registration, businesses may need to obtain additional licenses or permits depending on their activities and industry. Compliance with ongoing reporting and tax obligations is also required.

9. What are the consequences of non-compliance with the registration requirements in KSA?

Non-compliance can result in penalties, fines, or even legal action. It is important to adhere to all registration requirements to ensure legal compliance and avoid any negative consequences.

10. Where can I find more detailed information about the complete documentation guide for business entity registration in KSA?

You can refer to the official website of the Ministry of Commerce and Investment in Saudi Arabia or consult with a legal professional or business consultant familiar with the registration process.

Conclusion

In conclusion, a complete documentation guide for business entity registration in KSA includes various important documents such as a valid passport copy, a copy of the national ID for Saudi nationals, a copy of the residency permit for non-Saudi nationals, a copy of the commercial registration certificate, a copy of the lease agreement or proof of ownership for the business premises, a copy of the company’s articles of association, a copy of the company’s memorandum of association, a copy of the company’s financial statements, a copy of the company’s bank statement, and any other relevant licenses or permits required for the specific type of business. It is crucial to ensure that all the necessary documents are prepared and submitted accurately to successfully register a business entity in KSA.