Business Law in the UAE

Understanding Business Law in the UAE

Introduction to Business Law in the UAE

Navigating the business law landscape in the United Arab Emirates (UAE) is crucial for entrepreneurs and investors. The UAE offers a robust legal framework that supports business growth while ensuring compliance and protection for all parties involved.

Legal Structures for Businesses in the UAE

Choosing the right legal structure is vital for the success of your business in the UAE. The most common types include:

1. Limited Liability Company (LLC)

An LLC is a popular choice among foreign investors. It requires a minimum of two and a maximum of fifty shareholders. The liability of shareholders is limited to their shares in the company. LLCs allow for significant local market penetration and operational flexibility.

2. Free Zone Company

Free zones offer numerous benefits such as 100% foreign ownership, tax exemptions, and simplified import/export procedures. Businesses in free zones can operate with minimal restrictions but are generally restricted from trading directly in the UAE market. This structure is ideal for companies involved in international trade, services, and manufacturing.

3. Branch Office

A branch office allows foreign companies to conduct business in the UAE without establishing a separate legal entity. The parent company is fully liable for the branch’s activities. This structure is suitable for companies looking to expand their operations into the UAE while maintaining control over their international business model.

4. Representative Office

A representative office can engage in marketing and promotional activities but cannot conduct commercial transactions. This setup is ideal for businesses aiming to establish a presence in the UAE to explore market opportunities and build client relationships.

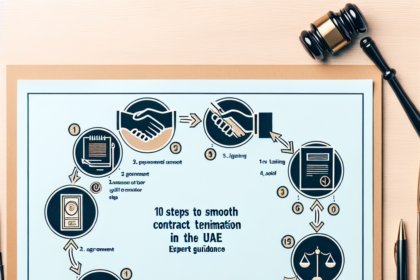

Business Registration Process

Registering a business in the UAE involves several key steps:

- Choose a Business Structure: Select the legal structure that best suits your business needs.

- Reserve a Trade Name: Ensure the trade name complies with UAE regulations and is available.

- Obtain Initial Approvals: Secure initial approvals from relevant authorities for your business activities.

- Draft Legal Documents: Prepare necessary documents, including the Memorandum of Association (MOA) and Articles of Association.

- Submit Applications: Submit the completed applications and required documents to the Department of Economic Development (DED) or the respective free zone authority.

- Pay Fees: Pay the necessary registration and licensing fees.

- Obtain Licenses: Receive your trade license and other required permits to start operations.

- Open Bank Accounts: Set up corporate bank accounts for business transactions.

- Register for VAT: Register for Value Added Tax (VAT) with the Federal Tax Authority (FTA) if applicable.

Compliance and Regulatory Requirements

Compliance with local laws and regulations is essential for operating smoothly in the UAE. Key compliance areas include:

- Commercial Licensing: Ensure your business holds a valid trade license and renew it annually.

- Employment Laws: Adhere to UAE labor laws, including employment contracts, working hours, and employee benefits.

- Tax Regulations: Register for VAT and file tax returns as required by the Federal Tax Authority.

- Economic Substance Regulations (ESR): Meet ESR requirements if your business activities fall under the scope of these regulations.

Contract Law and Dispute Resolution

Contracts are the foundation of business transactions. In the UAE, contracts must be legally binding and enforceable. Key considerations include:

- Governing Law: Contracts should specify the governing law, which can be UAE law or another jurisdiction, depending on the agreement between the parties.

- Dispute Resolution: The UAE offers various dispute resolution mechanisms, including litigation, arbitration, and mediation. The Dubai International Arbitration Centre (DIAC) is a popular choice for resolving commercial disputes efficiently and fairly.

Intellectual Property Protection

Protecting intellectual property (IP) is crucial for businesses in the UAE. The country has comprehensive IP laws to safeguard trademarks, patents, and copyrights.

- Trademark Registration: Register trademarks with the Ministry of Economy to secure legal protection. Trademarks are protected for ten years and can be renewed indefinitely.

- Patent Protection: The UAE grants patents for new inventions that involve an inventive step and are industrially applicable. Patents are valid for twenty years from the filing date.

- Copyright Laws: The UAE’s copyright laws protect literary, artistic, and scientific works, providing creators with exclusive rights to their creations.

Conclusion

Understanding business law in the UAE is essential for successful operations. By choosing the right legal structure, complying with regulations, and protecting intellectual property, businesses can thrive in the UAE’s dynamic market. Entrepreneurs and investors should stay informed and seek professional legal advice to navigate the complexities of the UAE legal landscape effectively.