-

Table of Contents

- Introduction

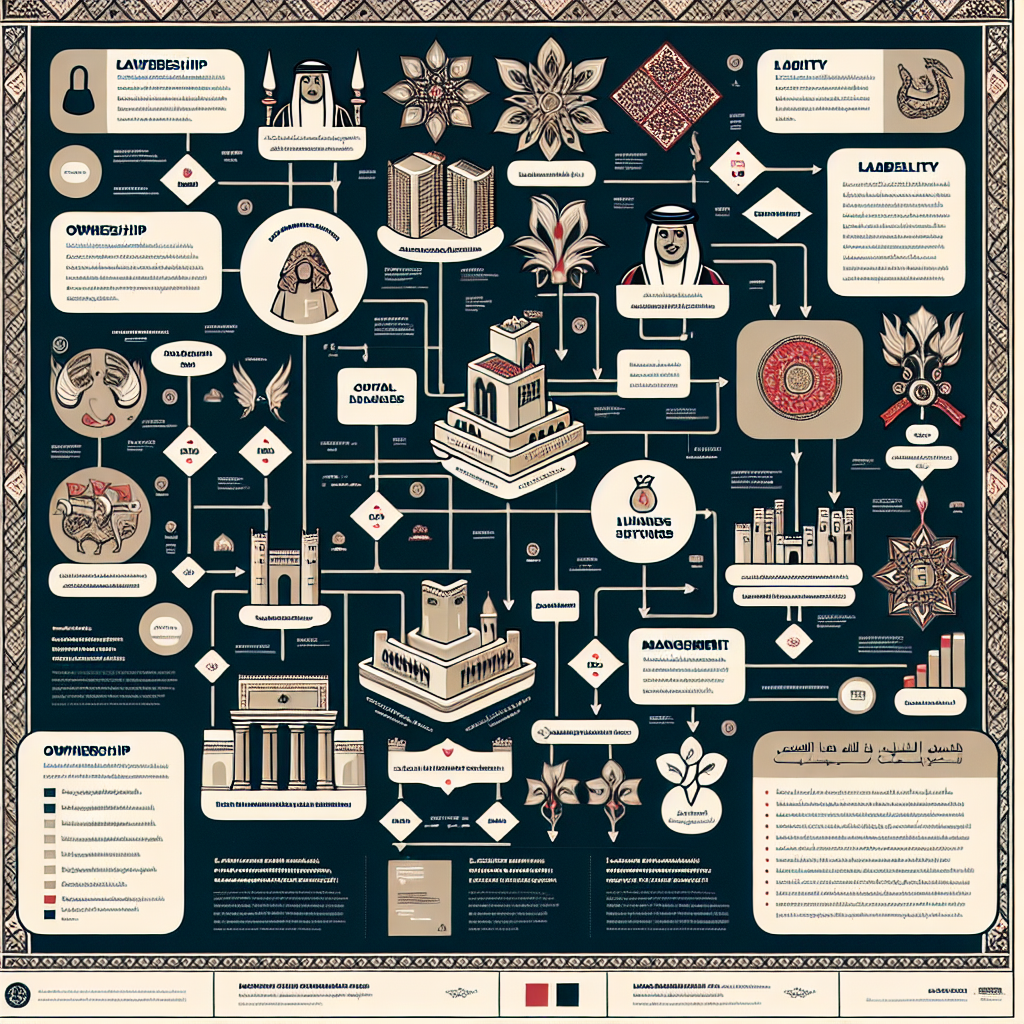

- Understanding the Different Legal Entities in Bahrain

- Exploring Business Structures for Company Setup in Bahrain

- Key Considerations for Choosing the Right Legal Entity in Bahrain

- A Comprehensive Guide to Business Structures in Bahrain

- Demystifying Company Types and Legal Entities in Bahrain

- Legal Framework for Business Setup in Bahrain: Explained

- Pros and Cons of Different Business Structures in Bahrain

- Navigating Business Law in Bahrain: Legal Entities and Structures

- Step-by-Step Process for Setting up a Business in Bahrain

- Choosing the Ideal Business Structure for Your Venture in Bahrain

- Q&A

- Conclusion

Unraveling Bahrain‘s legal entities and business structures

Introduction

Introduction:

Demystifying legal entities and business structures in Bahrain

Understanding the legal entities and business structures in Bahrain is crucial for individuals and organizations looking to establish or expand their business ventures in the country. Bahrain offers a favorable business environment with various options for structuring businesses, each with its own advantages and considerations. This article aims to provide a comprehensive overview of the different legal entities and business structures available in Bahrain, shedding light on their key features, requirements, and implications. By demystifying these concepts, readers will gain a better understanding of the options available to them and be better equipped to make informed decisions when it comes to establishing or structuring their businesses in Bahrain.

Understanding the Different Legal Entities in Bahrain

Demystifying legal entities and business structures in Bahrain

Understanding the Different legal entities in Bahrain

When starting a business in Bahrain, it is crucial to understand the different legal entities and business structures available. Choosing the right legal entity is essential as it determines the liability of the owners, tax obligations, and the overall governance of the business. In this article, we will explore the various legal entities in Bahrain and their characteristics.

The most common legal entity in Bahrain is the Limited Liability Company (LLC). An LLC is a separate legal entity from its owners, providing limited liability protection to its shareholders. This means that the owners’ personal assets are protected in case of any business liabilities. An LLC can be owned by individuals or corporate entities, and the minimum capital requirement is BD 20,000. LLCs are governed by the Bahrain Commercial Companies Law and must have a minimum of two shareholders and a maximum of 50.

Another legal entity option in Bahrain is the Single Person Company (SPC). As the name suggests, an SPC is a company owned by a single individual. It offers limited liability protection to the owner, similar to an LLC. The minimum capital requirement for an SPC is BD 50,000, and it is governed by the same regulations as an LLC.

For businesses looking to raise capital from the public, a Public Shareholding Company (B.S.C) is a suitable option. A B.S.C is a company whose shares are publicly traded on the Bahrain Bourse. It must have a minimum capital of BD 1 million and at least seven shareholders. The governance and reporting requirements for a B.S.C are more stringent compared to an LLC or an SPC.

In addition to these entities, Bahrain also offers the option of establishing a Branch Office. A Branch Office is an extension of a foreign company and does not have a separate legal identity. It operates under the name and legal status of the parent company. The parent company is fully liable for the activities and obligations of the branch office. To establish a branch office in Bahrain, the parent company must have a proven track record and obtain the necessary approvals from the Ministry of Industry, Commerce, and Tourism.

Lastly, there is the option of setting up a Representative Office. A Representative Office is a non-trading entity that serves as a liaison between the parent company and its clients in Bahrain. It is not allowed to engage in any commercial activities and is subject to strict regulations. Representative Offices are typically established for market research, promotion, and customer support purposes.

In conclusion, understanding the different legal entities and business structures in Bahrain is crucial when starting a business. The choice of legal entity determines the liability of the owners, tax obligations, and the overall governance of the business. The most common legal entity options in Bahrain are the Limited Liability Company, Single Person Company, Public Shareholding Company, Branch Office, and Representative Office. Each entity has its own characteristics and requirements, and it is important to carefully consider the specific needs and goals of the business before making a decision. Seeking professional advice from legal and financial experts is highly recommended to ensure compliance with the laws and regulations of Bahrain.

Exploring Business Structures for Company Setup in Bahrain

Demystifying legal entities and business structures in Bahrain

When it comes to setting up a business in Bahrain, understanding the different legal entities and business structures is crucial. Choosing the right structure for your company can have a significant impact on its success and growth potential. In this article, we will explore the various business structures available in Bahrain and shed light on their advantages and disadvantages.

One of the most common business structures in Bahrain is the sole proprietorship. This structure is suitable for small businesses and individuals who want to have complete control over their operations. As a sole proprietor, you are personally liable for all debts and obligations of the business. While this structure offers simplicity and flexibility, it also carries a higher level of risk.

Another popular option is the partnership structure. In a partnership, two or more individuals come together to share the profits and losses of a business. There are two types of partnerships in Bahrain: general partnerships and limited partnerships. In a general partnership, all partners have unlimited liability, meaning they are personally responsible for the debts and obligations of the business. On the other hand, in a limited partnership, there are both general partners and limited partners. General partners have unlimited liability, while limited partners have limited liability, meaning their liability is limited to the amount they have invested in the business.

For those looking for more protection and separation between personal and business assets, a limited liability company (LLC) may be the ideal choice. An LLC is a separate legal entity that provides limited liability protection to its owners, known as members. This means that the members’ personal assets are generally protected from the company’s debts and obligations. An LLC also offers flexibility in terms of management and taxation, making it a popular choice for many businesses in Bahrain.

If you have ambitions of taking your business public or attracting outside investors, a public joint-stock company (PJSC) may be the right structure for you. A PJSC is a company whose shares are publicly traded on the stock exchange. This structure allows for greater access to capital and provides a platform for growth and expansion. However, setting up and maintaining a PJSC can be complex and costly, as it requires compliance with strict regulations and reporting requirements.

Lastly, we have the branch office structure, which is suitable for foreign companies looking to establish a presence in Bahrain. A branch office is an extension of the parent company and operates under its name. While this structure allows for easy entry into the Bahraini market, it also means that the parent company is fully liable for the branch’s debts and obligations.

In conclusion, choosing the right legal entity and business structure is a critical decision when setting up a company in Bahrain. Each structure has its own advantages and disadvantages, and it is essential to consider factors such as liability, taxation, and growth potential. Whether you opt for a sole proprietorship, partnership, LLC, PJSC, or branch office, seeking professional advice and guidance is highly recommended to ensure compliance with local laws and regulations. With the right structure in place, you can lay a solid foundation for your business and pave the way for success in Bahrain‘s thriving economy.

Key Considerations for Choosing the Right Legal Entity in Bahrain

Demystifying legal entities and business structures in Bahrain

When starting a business in Bahrain, one of the key considerations is choosing the right legal entity. The legal entity you choose will have a significant impact on various aspects of your business, including liability, taxation, and governance. Therefore, it is crucial to understand the different options available and their implications before making a decision.

One of the most common legal entities in Bahrain is the sole proprietorship. This is a simple and straightforward structure where an individual owns and operates the business. While it offers complete control and flexibility, the downside is that the owner is personally liable for all debts and obligations of the business. This means that if the business fails, the owner’s personal assets may be at risk.

Another option is a partnership, which involves two or more individuals coming together to run a business. There are two types of partnerships in Bahrain: general partnerships and limited partnerships. In a general partnership, all partners have unlimited liability for the business’s debts and obligations. On the other hand, in a limited partnership, there are both general partners, who have unlimited liability, and limited partners, whose liability is limited to their investment in the business.

For those looking for more protection against personal liability, a limited liability company (LLC) may be the right choice. An LLC is a separate legal entity from its owners, known as members. This means that the members’ personal assets are generally protected from the company’s debts and obligations. Additionally, an LLC offers flexibility in terms of management and taxation, making it an attractive option for many businesses.

If you have ambitions of taking your business public or raising capital from investors, a public joint-stock company (PJSC) may be the way to go. A PJSC is a company whose shares are publicly traded on the stock exchange. This structure allows for greater access to capital and liquidity, but it also comes with more stringent regulatory requirements and reporting obligations.

For businesses that operate in highly regulated industries, such as banking or insurance, a closed joint-stock company (CJSC) may be the most suitable legal entity. A CJSC is similar to a PJSC, but its shares are not publicly traded. This structure provides more control and privacy, but it also limits the ability to raise capital from the public.

Lastly, there is the option of establishing a branch or representative office in Bahrain. This is a common choice for foreign companies looking to establish a presence in the country without going through the process of setting up a separate legal entity. However, it is important to note that a branch or representative office does not have a separate legal identity from its parent company, which means that the parent company is fully liable for the branch’s activities.

In conclusion, choosing the right legal entity is a critical decision when starting a business in Bahrain. Each option has its own advantages and disadvantages, and it is important to carefully consider your business’s needs and goals before making a choice. Whether you opt for a sole proprietorship, partnership, LLC, PJSC, CJSC, or a branch/representative office, understanding the implications of each structure will help you make an informed decision and set your business up for success.

A Comprehensive Guide to Business Structures in Bahrain

Demystifying legal entities and business structures in Bahrain

Bahrain, a small island nation in the Arabian Gulf, has emerged as a thriving business hub in recent years. With its strategic location, favorable business environment, and supportive government policies, many entrepreneurs and investors are flocking to Bahrain to establish their businesses. However, before diving into the world of business in Bahrain, it is crucial to understand the various legal entities and business structures available in the country.

One of the most common legal entities in Bahrain is the sole proprietorship. This structure is suitable for small businesses and individuals who want to operate their businesses alone. In a sole proprietorship, the owner has complete control over the business and is personally liable for all its debts and obligations. While this structure offers simplicity and flexibility, it also exposes the owner to unlimited liability, which means that their personal assets can be used to settle business debts.

For those looking for a more formal business structure, a partnership might be the right choice. In a partnership, two or more individuals come together to share the profits and losses of a business. There are two types of partnerships in Bahrain: general partnerships and limited partnerships. In a general partnership, all partners have equal rights and responsibilities, and they are jointly and severally liable for the partnership’s debts. On the other hand, in a limited partnership, there are two types of partners: general partners and limited partners. General partners have unlimited liability, while limited partners have limited liability, meaning their liability is limited to the amount they have invested in the partnership.

Another popular business structure in Bahrain is the limited liability company (LLC). An LLC is a separate legal entity from its owners, known as members. This means that the members’ personal assets are protected from the company’s debts and liabilities. An LLC can have one or more members, and its management can be carried out by the members themselves or by appointed managers. This structure offers a great deal of flexibility and is suitable for both small and large businesses.

For those looking to establish a larger business or attract foreign investors, a public joint-stock company (PJSC) might be the way to go. A PJSC is a company whose shares are publicly traded on the stock exchange. This structure allows for the mobilization of large amounts of capital and offers shareholders limited liability. However, establishing a PJSC requires compliance with strict regulatory requirements and is subject to more extensive reporting and disclosure obligations.

Lastly, for businesses engaged in professional services, such as law firms, accounting firms, or engineering consultancies, a professional partnership might be the most appropriate structure. A professional partnership is similar to a general partnership, but it is specifically designed for professionals who provide services in their respective fields. This structure allows professionals to pool their resources and expertise while maintaining individual liability for their own actions.

In conclusion, understanding the various legal entities and business structures available in Bahrain is essential for anyone looking to establish a business in the country. From sole proprietorships to public joint-stock companies, each structure has its own advantages and disadvantages. It is crucial to carefully consider the nature of the business, the level of liability protection desired, and the long-term goals before deciding on the most suitable structure. Seeking professional advice from legal and financial experts is highly recommended to ensure compliance with local laws and regulations. With the right structure in place, entrepreneurs and investors can navigate the Bahraini business landscape with confidence and set themselves up for success.

Demystifying Company Types and Legal Entities in Bahrain

Demystifying legal entities and business structures in Bahrain

When starting a business in Bahrain, one of the first decisions you need to make is choosing the right legal entity and business structure. This choice will have significant implications for your business’s operations, liability, and taxation. Understanding the different options available and their characteristics is crucial to making an informed decision.

The most common legal entities in Bahrain are sole proprietorships, partnerships, limited liability companies (LLCs), and joint stock companies (JSCs). Each has its own advantages and disadvantages, so let’s take a closer look at each one.

A sole proprietorship is the simplest and most common form of business structure. It is owned and operated by a single individual who assumes all the risks and liabilities. While it offers complete control and flexibility, the owner is personally liable for all debts and obligations of the business. This means that personal assets can be at risk in the event of a lawsuit or bankruptcy.

Partnerships, on the other hand, involve two or more individuals who share the profits, losses, and liabilities of the business. There are two types of partnerships in Bahrain: general partnerships and limited partnerships. In a general partnership, all partners have equal rights and responsibilities, while in a limited partnership, there are general partners who manage the business and limited partners who contribute capital but have limited liability.

Limited liability companies (LLCs) are a popular choice for small and medium-sized businesses. They offer limited liability protection to their owners, meaning that personal assets are generally not at risk. LLCs also provide flexibility in terms of management and taxation. They can be managed by the owners themselves or by appointed managers, and they have the option to be taxed as a partnership or a corporation.

Joint stock companies (JSCs) are more suitable for larger businesses that plan to raise capital through public offerings. They are owned by shareholders who hold shares of stock in the company. JSCs have a separate legal identity from their shareholders, which means that the shareholders’ personal assets are protected. They are also subject to more stringent regulations and reporting requirements.

When choosing a legal entity, it is important to consider factors such as liability, taxation, management structure, and capital requirements. It is also advisable to seek legal and professional advice to ensure compliance with local laws and regulations.

In addition to legal entities, businesses in Bahrain can also choose from various business structures, such as branches, representative offices, and free zone companies. Branches are extensions of foreign companies and are subject to the same legal entity as their parent company. Representative offices, on the other hand, are limited to non-commercial activities and cannot engage in profit-generating activities.

Free zone companies are a popular choice for businesses looking to benefit from tax incentives and simplified regulations. They are located in designated free zones and are subject to specific rules and regulations. Free zone companies can be owned entirely by foreign investors and enjoy 100% repatriation of profits.

In conclusion, choosing the right legal entity and business structure is a crucial step when starting a business in Bahrain. It determines the level of liability, taxation, and operational flexibility. Understanding the different options available and seeking professional advice will help you make an informed decision that aligns with your business goals and objectives.

Legal Framework for Business Setup in Bahrain: Explained

Demystifying legal entities and business structures in Bahrain

Bahrain, a small island nation in the Arabian Gulf, has emerged as a thriving business hub in recent years. Its strategic location, stable political environment, and investor-friendly policies have attracted numerous entrepreneurs and multinational corporations to set up their businesses in the country. However, before diving into the world of business in Bahrain, it is crucial to understand the legal framework and the various business structures available.

Bahrain offers a range of legal entities for business setup, each with its own advantages and requirements. The most common types of legal entities in Bahrain are sole proprietorships, partnerships, limited liability companies (LLCs), and joint stock companies (JSCs).

Sole proprietorships are the simplest form of business structure, where an individual operates a business in their own name. This type of entity is suitable for small-scale businesses and freelancers. However, it is important to note that the owner is personally liable for all debts and obligations of the business.

Partnerships, on the other hand, involve two or more individuals who come together to carry out a business venture. There are two types of partnerships in Bahrain: general partnerships and limited partnerships. In a general partnership, all partners have unlimited liability for the debts and obligations of the business. In a limited partnership, there are both general partners, who have unlimited liability, and limited partners, whose liability is limited to their investment in the business.

Limited liability companies (LLCs) are the most popular choice for foreign investors in Bahrain. An LLC is a separate legal entity from its owners, providing limited liability protection to its shareholders. This means that the shareholders’ personal assets are not at risk in case of business debts or legal issues. Additionally, an LLC can have a minimum of one shareholder and a maximum of 50 shareholders.

Joint stock companies (JSCs) are another option for business setup in Bahrain. JSCs are suitable for large-scale businesses and are often listed on the Bahrain Bourse. They can have an unlimited number of shareholders and are governed by a board of directors. Shareholders in a JSC have limited liability, similar to an LLC.

When setting up a business in Bahrain, it is important to consider the legal requirements and procedures involved. The first step is to register the business with the Ministry of Industry, Commerce, and Tourism. This involves submitting the necessary documents, such as the company’s memorandum and articles of association, along with the required fees.

In addition to the legal entities, Bahrain also offers various business structures, such as free zones and offshore companies. Free zones are designated areas where businesses can enjoy tax benefits, customs exemptions, and simplified regulations. These zones are particularly attractive for companies engaged in international trade and logistics.

Offshore companies, on the other hand, are entities that are incorporated in Bahrain but conduct business outside the country. These companies benefit from Bahrain‘s favorable tax regime and confidentiality provisions. Offshore companies are commonly used for asset protection, estate planning, and international investment purposes.

In conclusion, Bahrain provides a favorable legal framework for business setup, with a range of legal entities and business structures to choose from. Whether you are a small-scale entrepreneur or a multinational corporation, Bahrain offers the right platform to establish and grow your business. However, it is essential to understand the legal requirements and procedures involved in order to ensure a smooth and successful setup. With the right knowledge and guidance, Bahrain can be the ideal destination for your business ventures in the Arabian Gulf.

Pros and Cons of Different Business Structures in Bahrain

When starting a business in Bahrain, one of the most important decisions you will have to make is choosing the right legal entity and business structure. This decision will have long-term implications for your business, so it is crucial to understand the pros and cons of each option before making a choice.

One of the most common business structures in Bahrain is the sole proprietorship. This is the simplest and easiest way to start a business, as it requires minimal paperwork and allows for complete control over the business. However, one of the main drawbacks of a sole proprietorship is that the owner is personally liable for all debts and obligations of the business. This means that if the business fails or faces legal issues, the owner’s personal assets may be at risk.

Another popular option is the partnership. In a partnership, two or more individuals come together to start and run a business. This structure allows for shared responsibilities and resources, which can be beneficial for certain types of businesses. However, partnerships also come with their own set of challenges. One of the main disadvantages is that each partner is personally liable for the actions and debts of the business, including those incurred by other partners. This means that if one partner makes a mistake or faces legal issues, all partners may be held responsible.

For those looking for more protection and separation between personal and business assets, a limited liability company (LLC) may be the best choice. An LLC is a separate legal entity that provides limited liability protection to its owners, known as members. This means that the personal assets of the members are generally protected from the debts and obligations of the business. Additionally, an LLC offers flexibility in terms of management and taxation, making it an attractive option for many entrepreneurs. However, setting up an LLC requires more paperwork and can be more expensive compared to other business structures.

If you are planning to start a larger business or attract outside investors, a public or private joint stock company may be the way to go. A joint stock company is a separate legal entity with its own shareholders and a board of directors. This structure allows for the sale of shares to raise capital and provides limited liability protection to its shareholders. However, setting up and maintaining a joint stock company can be complex and requires compliance with various regulations and reporting requirements.

Lastly, for those looking to establish a non-profit organization, a foundation may be the appropriate choice. A foundation is a legal entity that is established for charitable, educational, or other non-profit purposes. It is governed by a board of trustees and does not have shareholders. Foundations enjoy tax benefits and can attract donations from individuals and corporations. However, establishing and operating a foundation requires compliance with specific regulations and reporting requirements.

In conclusion, choosing the right legal entity and business structure is a critical decision when starting a business in Bahrain. Each option has its own pros and cons, and it is important to carefully consider your specific needs and goals before making a choice. Consulting with a legal professional or business advisor can help you navigate the complexities of the different structures and ensure that you make an informed decision that sets your business up for success.

Navigating Business Law in Bahrain: Legal Entities and Structures

Demystifying legal entities and business structures in Bahrain

Navigating the complex world of business law can be a daunting task, especially when it comes to understanding the different legal entities and business structures in Bahrain. In this article, we will demystify these concepts and provide you with a clear understanding of how they work.

Firstly, let’s start with legal entities. A legal entity is an organization that has legal rights and obligations, separate from its owners or members. In Bahrain, there are several types of legal entities that businesses can choose from, depending on their specific needs and goals.

One of the most common legal entities in Bahrain is the sole proprietorship. This is a business structure where an individual owns and operates the business on their own. It is the simplest form of business structure and is often chosen by small businesses or individuals who want to have full control over their operations.

Another popular legal entity in Bahrain is the partnership. A partnership is formed when two or more individuals come together to carry out a business venture. In a partnership, the partners share the profits, losses, and liabilities of the business. This type of legal entity is often chosen by professionals, such as lawyers or accountants, who want to pool their resources and expertise.

For businesses that want to have a separate legal identity from their owners, a company is the preferred legal entity. In Bahrain, there are two types of companies: the limited liability company (LLC) and the joint stock company (JSC). An LLC is a company where the liability of the shareholders is limited to their investment in the company. On the other hand, a JSC is a company where the shareholders’ liability is limited to the value of their shares.

Now that we have covered legal entities, let’s move on to business structures. A business structure refers to how a business is organized and managed. In Bahrain, businesses can choose from several business structures, depending on their size, nature, and objectives.

The most common business structure in Bahrain is the private company. A private company is a business that is owned and managed by a small group of individuals. It is often chosen by small to medium-sized enterprises (SMEs) that want to maintain control over their operations and decision-making processes.

For businesses that want to raise capital from the public, a public company is the ideal business structure. A public company is a business that offers its shares to the public through an initial public offering (IPO). This business structure is often chosen by large corporations that need substantial capital for expansion or investment.

Lastly, we have the branch office business structure. A branch office is an extension of a foreign company in Bahrain. It allows the foreign company to establish a presence in Bahrain without having to incorporate a separate legal entity. This business structure is often chosen by multinational corporations that want to expand their operations into Bahrain.

In conclusion, understanding the different legal entities and business structures in Bahrain is crucial for anyone looking to start or expand their business in the country. By choosing the right legal entity and business structure, businesses can ensure compliance with the law, protect their assets, and achieve their goals. Whether it’s a sole proprietorship, partnership, company, or branch office, each legal entity and business structure has its own advantages and considerations. Therefore, it is essential to seek professional advice and guidance to make informed decisions that will set your business up for success in Bahrain.

Step-by-Step Process for Setting up a Business in Bahrain

Setting up a business in Bahrain can be an exciting and rewarding endeavor. However, before diving into the process, it is important to understand the different legal entities and business structures available in the country. This article aims to demystify these concepts and provide a step-by-step guide to setting up a business in Bahrain.

The first step in setting up a business in Bahrain is to determine the legal entity that best suits your needs. There are several options available, including sole proprietorship, partnership, limited liability company (LLC), and joint stock company (JSC). Each legal entity has its own advantages and disadvantages, so it is crucial to carefully consider your business goals and requirements.

A sole proprietorship is the simplest and most common form of business structure. It is owned and operated by a single individual who assumes all liabilities and responsibilities. This structure is ideal for small businesses with low-risk operations. However, it offers no protection for personal assets and may limit the ability to raise capital.

Partnerships, on the other hand, involve two or more individuals who share the profits and losses of the business. There are two types of partnerships in Bahrain: general partnerships and limited partnerships. General partnerships offer equal liability for all partners, while limited partnerships provide limited liability for some partners. Partnerships are suitable for businesses that require multiple owners and shared decision-making.

For businesses seeking limited liability protection, an LLC is a popular choice. An LLC is a separate legal entity that shields the owners’ personal assets from business liabilities. It offers flexibility in terms of management and taxation, making it an attractive option for many entrepreneurs. However, setting up an LLC requires more paperwork and formalities compared to sole proprietorships and partnerships.

For larger businesses with significant capital requirements, a JSC may be the most suitable option. A JSC is a publicly traded company that can issue shares to raise funds. It is governed by a board of directors and offers limited liability to its shareholders. Establishing a JSC involves more complex procedures and compliance requirements, including the need for a minimum share capital.

Once you have determined the legal entity for your business, the next step is to register it with the relevant authorities in Bahrain. This process involves obtaining the necessary licenses and permits, as well as registering the business name and obtaining a commercial registration certificate. It is advisable to seek legal advice or engage the services of a professional firm to ensure compliance with all legal requirements.

Additionally, it is important to consider the tax implications of your chosen business structure. Bahrain has a favorable tax regime, with no corporate or personal income tax. However, certain industries may be subject to specific taxes or fees. It is crucial to understand the tax obligations associated with your business and ensure compliance with all tax laws and regulations.

In conclusion, setting up a business in Bahrain requires careful consideration of the legal entities and business structures available. By understanding the advantages and disadvantages of each option, entrepreneurs can make informed decisions that align with their business goals. Additionally, seeking professional advice and ensuring compliance with all legal and tax requirements will contribute to a smooth and successful business setup process.

Choosing the Ideal Business Structure for Your Venture in Bahrain

Choosing the Ideal Business Structure for Your Venture in Bahrain

When starting a business in Bahrain, one of the most important decisions you will have to make is choosing the ideal business structure. The business structure you choose will have significant implications for your venture, including legal and financial considerations. In this article, we will demystify legal entities and business structures in Bahrain, helping you make an informed decision for your business.

Bahrain offers several business structures for entrepreneurs to choose from, each with its own advantages and disadvantages. The most common business structures in Bahrain include sole proprietorship, partnership, limited liability company (LLC), and joint stock company (JSC). Understanding the characteristics of each structure is crucial in determining which one is best suited for your business.

Sole proprietorship is the simplest and most common form of business structure. It is suitable for small businesses and individuals who want to have complete control over their business. As a sole proprietor, you are personally liable for all debts and obligations of the business. While this structure offers simplicity and flexibility, it may not be ideal if you are seeking to raise capital or limit personal liability.

Partnerships are another option for entrepreneurs in Bahrain. There are two types of partnerships: general partnerships and limited partnerships. In a general partnership, all partners share equal responsibility and liability for the business. In a limited partnership, there are general partners who have unlimited liability and limited partners who have limited liability. Partnerships can be a good choice if you want to share the responsibilities and risks of the business with others.

Limited liability companies (LLCs) are a popular choice for entrepreneurs in Bahrain. An LLC combines the benefits of a partnership and a corporation. It offers limited liability protection to its owners, known as members, while allowing flexibility in management and taxation. LLCs are suitable for small to medium-sized businesses and provide a favorable environment for foreign investors.

For larger businesses, a joint stock company (JSC) may be the preferred business structure. A JSC is a publicly traded company that can issue shares to raise capital. It is governed by a board of directors and offers limited liability to its shareholders. This structure is more complex and requires compliance with additional regulations, making it more suitable for established businesses with significant capital requirements.

When choosing the ideal business structure for your venture in Bahrain, it is important to consider factors such as liability, taxation, management, and capital requirements. You should also consult with legal and financial professionals to ensure compliance with local laws and regulations.

In conclusion, choosing the ideal business structure for your venture in Bahrain is a crucial decision that will impact the success and growth of your business. Understanding the characteristics and implications of different business structures is essential in making an informed choice. Whether you opt for a sole proprietorship, partnership, LLC, or JSC, it is important to consider your specific needs and consult with professionals to ensure compliance and maximize the potential of your business.

Q&A

1. What is a legal entity?

A legal entity is an organization or entity that has legal rights and responsibilities, separate from its owners or members.

2. What are the common types of legal entities in Bahrain?

Common types of legal entities in Bahrain include sole proprietorships, partnerships, limited liability companies (LLCs), and public and private joint stock companies.

3. What is a sole proprietorship?

A sole proprietorship is a business owned and operated by a single individual, who is personally liable for all debts and obligations of the business.

4. What is a partnership?

A partnership is a business structure where two or more individuals or entities share ownership and responsibility for the business.

5. What is a limited liability company (LLC)?

An LLC is a legal entity that provides limited liability protection to its owners, known as members. It combines elements of both partnerships and corporations.

6. What is a public joint stock company?

A public joint stock company is a legal entity that offers shares to the public and is listed on a stock exchange.

7. What is a private joint stock company?

A private joint stock company is a legal entity that offers shares to a limited number of shareholders, usually not exceeding 50.

8. What are the advantages of forming a legal entity in Bahrain?

Advantages of forming a legal entity in Bahrain include limited liability protection, separate legal existence, access to funding, and potential tax benefits.

9. What are the steps to form a legal entity in Bahrain?

The steps to form a legal entity in Bahrain typically involve choosing a business name, drafting and notarizing the company’s articles of association, obtaining necessary licenses and permits, and registering with relevant authorities.

10. Are there any specific regulations or requirements for foreign investors in Bahrain?

Yes, foreign investors in Bahrain are subject to specific regulations and requirements, including obtaining necessary approvals from the Bahrain Economic Development Board and complying with foreign ownership restrictions in certain sectors.

Conclusion

In conclusion, understanding legal entities and business structures in Bahrain is crucial for individuals and organizations looking to establish or operate a business in the country. By demystifying these concepts, potential entrepreneurs can make informed decisions about the most suitable structure for their business, taking into account factors such as liability, taxation, and governance. It is important to consult with legal professionals and relevant authorities to ensure compliance with Bahraini laws and regulations when establishing a business entity.