-

Table of Contents

- Introduction

- Understanding the Basics of Business Incorporation in Canada

- Step-by-Step Guide to Registering a Business in Canada

- Choosing the Right Business Structure for Incorporation in Canada

- Essential Documents and Information Required for Business Incorporation in Canada

- Navigating the Legal Requirements for Incorporating a Business in Canada

- Tax Considerations for Incorporating a Business in Canada

- Hiring Professionals to Assist with the Business Incorporation Process in Canada

- Common Mistakes to Avoid When Incorporating a Business in Canada

- Benefits and Advantages of Incorporating a Business in Canada

- Post-Incorporation Obligations and Responsibilities for Canadian Businesses

- Q&A

- Conclusion

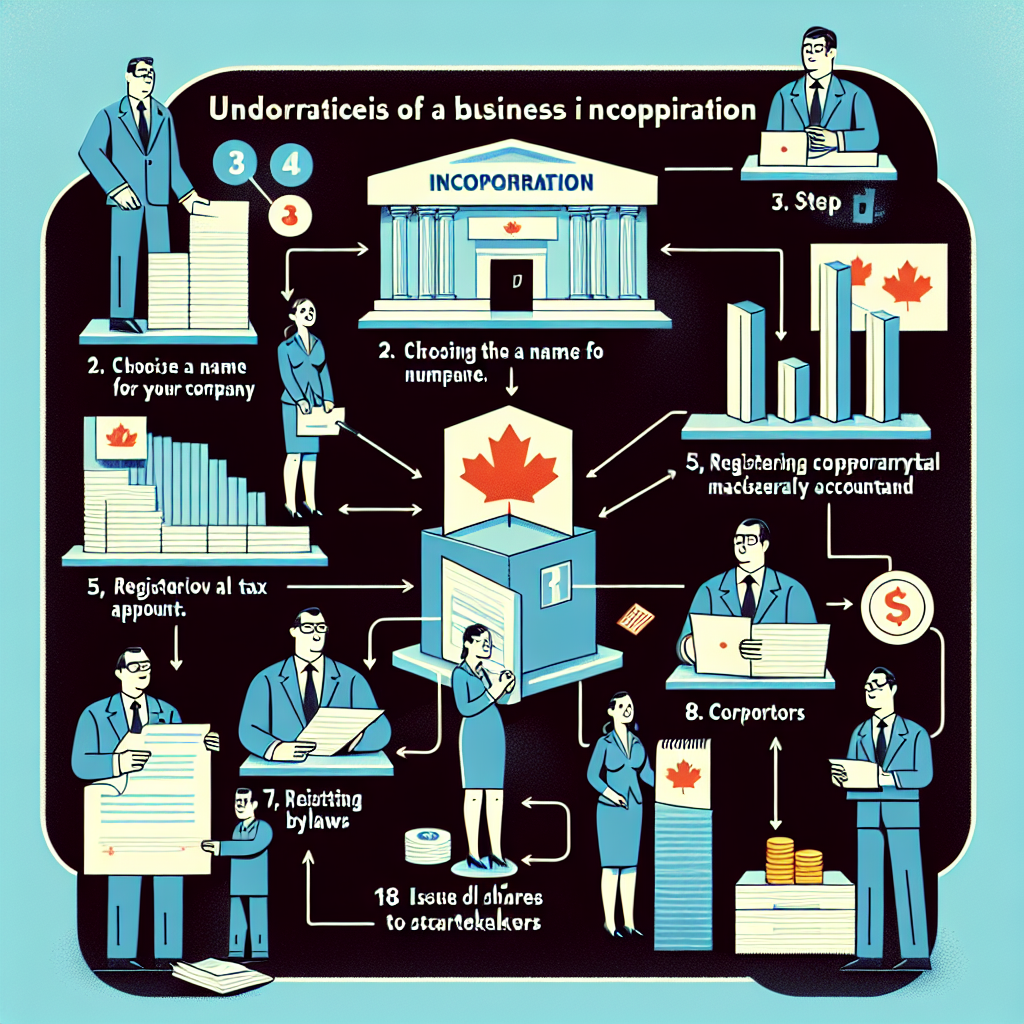

“8 Steps to Incorporate a Business in Canada: Your Ultimate Guide to Success”

Introduction

Introduction:

Incorporating a business in Canada is a crucial step for entrepreneurs looking to establish a legal entity that offers various benefits and protections. However, the process can be complex and overwhelming without proper guidance. This comprehensive guide aims to provide a clear understanding of the eight essential steps involved in incorporating a business in Canada. By following these steps, entrepreneurs can navigate the incorporation process smoothly and ensure compliance with all legal requirements.

Understanding the Basics of Business Incorporation in Canada

Starting a business can be an exciting and rewarding venture. However, before you can begin operating, it is important to understand the basics of business incorporation in Canada. Incorporating your business provides numerous benefits, such as limited liability protection and potential tax advantages. In this comprehensive guide, we will walk you through the eight steps to incorporate a business in Canada.

The first step in the process is to choose a business name. It is crucial to select a name that is unique and not already in use by another company. You can conduct a name search through the Canadian government’s online database to ensure that your chosen name is available. Once you have confirmed its availability, you can reserve the name for a small fee.

After selecting a name, the next step is to determine the type of business structure you want to establish. In Canada, the most common types of business structures are sole proprietorships, partnerships, and corporations. Each structure has its own advantages and disadvantages, so it is important to carefully consider which one best suits your needs.

Once you have decided on a business structure, the next step is to prepare the necessary documents for incorporation. This includes drafting articles of incorporation, which outline the purpose of your business, its share structure, and the rights and responsibilities of shareholders. You will also need to appoint directors and decide on the number of shares to be issued.

After preparing the necessary documents, the next step is to file them with the appropriate government agency. In Canada, this is typically done through the provincial or territorial corporate registry. Along with the articles of incorporation, you will need to submit a filing fee. Once your documents are filed, they will be reviewed by the government, and if everything is in order, your business will be officially incorporated.

Once your business is incorporated, the next step is to obtain any necessary licenses and permits. The requirements vary depending on the type of business and the location, so it is important to research and comply with all applicable regulations. This may include obtaining a business license, registering for goods and services tax (GST), and obtaining any industry-specific permits.

After obtaining the necessary licenses and permits, the next step is to set up a business bank account. This will help you keep your personal and business finances separate, which is important for legal and tax purposes. You will need to provide the bank with your articles of incorporation, along with any other required documentation.

The next step in the process is to establish a system for record-keeping and accounting. This includes setting up a bookkeeping system, keeping track of income and expenses, and filing regular tax returns. It is important to maintain accurate and up-to-date records to ensure compliance with tax laws and to make informed business decisions.

Finally, once your business is up and running, it is important to regularly review and update your corporate documents. This includes holding annual general meetings, updating your articles of incorporation as needed, and filing any required reports with the government. It is also important to stay informed about changes in tax laws and regulations that may affect your business.

Incorporating a business in Canada may seem like a complex process, but by following these eight steps, you can ensure that your business is set up for success. From choosing a name to maintaining accurate records, each step is crucial in establishing a strong foundation for your business. By understanding the basics of business incorporation in Canada, you can confidently navigate the process and focus on growing your business.

Step-by-Step Guide to Registering a Business in Canada

Starting a business in Canada can be an exciting and rewarding venture. However, before you can begin operating, it is essential to incorporate your business. Incorporation provides numerous benefits, including limited liability protection and potential tax advantages. In this comprehensive guide, we will walk you through the eight steps to incorporate a business in Canada.

Step 1: Choose a Business Name

The first step in incorporating your business is selecting a unique and memorable name. Ensure that your chosen name complies with the naming guidelines set by the Canadian government. It should not be misleading or too similar to an existing business name.

Step 2: Conduct a Name Search

Once you have chosen a name, conduct a name search to ensure its availability. This can be done through the Canadian government’s online database. If the name is already in use, you will need to choose a different one.

Step 3: Determine the Business Structure

Next, determine the structure of your business. The most common options in Canada are sole proprietorship, partnership, and corporation. Each structure has its own advantages and disadvantages, so it is crucial to choose the one that best suits your needs.

Step 4: Prepare the Articles of Incorporation

To incorporate your business, you will need to prepare the Articles of Incorporation. This document outlines important details about your business, such as its name, address, and share structure. It must be filed with the appropriate provincial or territorial government agency along with the required fees.

Step 5: Appoint Directors and Officers

As part of the incorporation process, you will need to appoint directors and officers for your business. Directors are responsible for managing the company’s affairs, while officers handle day-to-day operations. Ensure that the individuals you appoint are qualified and willing to take on these roles.

Step 6: Obtain Necessary Permits and Licenses

Depending on the nature of your business, you may need to obtain permits and licenses to operate legally. Research the specific requirements for your industry and location to ensure compliance. Failing to obtain the necessary permits and licenses can result in fines or even the closure of your business.

Step 7: Register for Taxes

Once your business is incorporated, you will need to register for various taxes, such as the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST). Registering for taxes ensures that you can collect and remit the appropriate amounts to the government.

Step 8: Create a Shareholders’ Agreement

If your business has multiple shareholders, it is advisable to create a shareholders’ agreement. This agreement outlines the rights and responsibilities of each shareholder and helps prevent disputes in the future. It is a crucial document that can protect the interests of all parties involved.

Incorporating a business in Canada may seem like a complex process, but by following these eight steps, you can navigate the process smoothly. Remember to choose a unique business name, prepare the necessary documents, and comply with all legal requirements. By incorporating your business, you can enjoy the benefits of limited liability protection and potential tax advantages. Good luck on your journey to entrepreneurship!

Choosing the Right Business Structure for Incorporation in Canada

Choosing the Right Business Structure for Incorporation in Canada

When it comes to incorporating a business in Canada, one of the most important decisions you will need to make is choosing the right business structure. The business structure you choose will have significant implications for your business’s legal and financial obligations, as well as its tax liabilities. In this section, we will guide you through the process of selecting the appropriate business structure for your incorporation in Canada.

1. Understand the Different Business Structures

Before you can make an informed decision, it is crucial to understand the various business structures available in Canada. The most common options include sole proprietorship, partnership, and corporation. Each structure has its own advantages and disadvantages, so it is essential to evaluate them carefully.

2. Consider Your Business Goals and Needs

When choosing a business structure, it is essential to consider your business goals and needs. Are you planning to expand your business in the future? Do you want to protect your personal assets from business liabilities? Understanding your long-term objectives will help you determine which structure aligns best with your goals.

3. Evaluate Liability and Risk

Liability and risk are significant factors to consider when selecting a business structure. Sole proprietorships and partnerships offer less protection for personal assets, as the business and its owners are considered one entity. On the other hand, incorporating as a corporation provides limited liability protection, separating personal and business assets.

4. Assess Tax Implications

Tax considerations are another crucial aspect of choosing a business structure. Sole proprietorships and partnerships are not separate taxable entities, meaning that business income is reported on the owner’s personal tax return. In contrast, corporations are taxed separately, potentially resulting in lower tax rates and more tax planning opportunities.

5. Examine Ownership and Control

Ownership and control are important considerations, especially if you plan to have multiple owners or investors. Sole proprietorships and partnerships offer simplicity and flexibility in terms of ownership and decision-making. However, corporations allow for the issuance of shares, making it easier to attract investors and transfer ownership.

6. Understand Reporting and Compliance Requirements

Different business structures have varying reporting and compliance requirements. Sole proprietorships and partnerships have fewer formalities, while corporations must comply with more extensive reporting obligations, such as filing annual financial statements and holding regular shareholder meetings. Consider the administrative burden associated with each structure before making your decision.

7. Seek Professional Advice

Choosing the right business structure can be complex, and seeking professional advice is highly recommended. An accountant or lawyer with expertise in business incorporation can provide valuable guidance based on your specific circumstances and goals. They can help you navigate the legal and financial aspects of each structure and ensure compliance with all necessary regulations.

8. Review and Update as Needed

Lastly, it is important to review and update your chosen business structure as your business evolves. As your needs change or your business grows, you may find that a different structure better suits your goals. Regularly reassessing your business structure will help ensure that you are maximizing your business’s potential and minimizing any potential risks.

In conclusion, choosing the right business structure is a critical step in the process of incorporating a business in Canada. By understanding the different structures, considering your goals and needs, evaluating liability and risk, assessing tax implications, examining ownership and control, understanding reporting and compliance requirements, seeking professional advice, and regularly reviewing and updating your structure, you can make an informed decision that sets your business up for success.

Essential Documents and Information Required for Business Incorporation in Canada

Incorporating a business in Canada can be a complex process, but with the right information and guidance, it can be a smooth and successful endeavor. One of the first steps in this process is gathering all the essential documents and information required for business incorporation. This article will provide a comprehensive guide to help you navigate through this crucial step.

The first document you will need is the Articles of Incorporation. This document outlines the basic information about your business, such as its name, address, and purpose. It also includes details about the share structure and the number of directors. It is important to ensure that the name you choose for your business is unique and not already registered by another company.

Next, you will need to provide a NUANS report. This report is a name search that confirms the availability of your chosen business name. It is essential to conduct this search to avoid any potential conflicts or legal issues down the line. The NUANS report can be obtained from a registered search house or an online service provider.

In addition to the Articles of Incorporation and the NUANS report, you will also need to provide a completed Form 1 – Initial Return. This form includes information about the directors and officers of the corporation, as well as the registered office address. It is important to ensure that all the information provided is accurate and up to date.

Another crucial document is the Consent to Act as a Director. This document is required for each director of the corporation and confirms their willingness to act in this role. It is important to note that at least 25% of the directors must be Canadian residents.

Furthermore, you will need to provide a completed Form 2 – Notice of Registered Office and Directors. This form includes the address of the registered office and the names and addresses of the directors. It is important to have a physical address in Canada for your registered office, as this is where official documents will be sent.

Additionally, you will need to provide a completed Form 6 – Notice of Change of Directors or Notice of Change of Address. This form is required if there are any changes to the directors or the registered office address after the initial incorporation. It is important to keep your corporate information up to date to comply with legal requirements.

Moreover, you will need to provide a completed Form 3 – Notice of Directors. This form includes the names and addresses of the directors and must be filed within 15 days of the initial incorporation. It is important to ensure that all the information provided is accurate and up to date.

Lastly, you will need to provide a completed Form 22 – Initial Registered Office Address and First Board of Directors. This form includes the address of the registered office and the names and addresses of the directors. It is important to have a physical address in Canada for your registered office, as this is where official documents will be sent.

In conclusion, incorporating a business in Canada requires gathering all the essential documents and information required for business incorporation. These documents include the Articles of Incorporation, the NUANS report, various forms such as the Initial Return, Consent to Act as a Director, Notice of Registered Office and Directors, Notice of Change of Directors or Notice of Change of Address, Notice of Directors, and Initial Registered Office Address and First Board of Directors. By ensuring that you have all the necessary documents and information, you can proceed with the incorporation process smoothly and efficiently.

Navigating the Legal Requirements for Incorporating a Business in Canada

Incorporating a business in Canada can be a complex process, but with the right guidance, it can be a smooth and successful endeavor. Navigating the legal requirements for incorporating a business in Canada is crucial to ensure compliance with the law and to protect your business interests. This comprehensive guide will take you through the eight essential steps to incorporate a business in Canada.

Step 1: Choose a Business Name

The first step in incorporating a business in Canada is to choose a unique and distinctive name for your company. It is important to ensure that the name you select is not already in use by another business. You can conduct a name search through the Canadian Intellectual Property Office (CIPO) to check for any existing trademarks or business names that may conflict with your chosen name.

Step 2: Determine the Business Structure

Next, you need to determine the structure of your business. In Canada, the most common business structures are sole proprietorship, partnership, and corporation. Each structure has its own advantages and disadvantages, so it is important to carefully consider which one best suits your business goals and needs.

Step 3: Register Your Business

Once you have chosen a name and determined the business structure, you need to register your business with the appropriate government authorities. In most provinces and territories, you will need to register your business with the provincial or territorial government. However, if you plan to operate your business in multiple provinces or territories, you may need to register with the federal government as well.

Step 4: Obtain a Business Number

After registering your business, you will need to obtain a Business Number (BN) from the Canada Revenue Agency (CRA). The BN is a unique identifier that is used for tax purposes and is required for various business activities, such as filing tax returns and opening a business bank account.

Step 5: Apply for Permits and Licenses

Depending on the nature of your business, you may need to obtain permits and licenses from various government agencies. These permits and licenses ensure that your business operates in compliance with applicable laws and regulations. It is important to research and identify the specific permits and licenses that are required for your industry and location.

Step 6: Draft Articles of Incorporation

If you have chosen to incorporate your business, you will need to draft Articles of Incorporation. These articles outline the key details of your corporation, such as its name, registered office address, and share structure. It is advisable to seek legal advice when drafting these articles to ensure they comply with the requirements of the applicable corporate legislation.

Step 7: File Articles of Incorporation

Once the Articles of Incorporation have been drafted, they need to be filed with the appropriate government authority. In most provinces and territories, this is done through the provincial or territorial corporate registry. Filing the Articles of Incorporation officially establishes your corporation as a legal entity.

Step 8: Create Corporate Bylaws and Shareholder Agreements

Finally, it is important to create corporate bylaws and shareholder agreements to govern the internal operations of your corporation. These documents outline the rights and responsibilities of shareholders, directors, and officers, as well as the procedures for decision-making and dispute resolution. Seeking legal advice when drafting these documents can help ensure they are comprehensive and enforceable.

Incorporating a business in Canada requires careful attention to detail and compliance with legal requirements. By following these eight steps, you can navigate the process successfully and establish a solid foundation for your business. Remember to seek professional advice when necessary to ensure that your business is set up for long-term success.

Tax Considerations for Incorporating a Business in Canada

When incorporating a business in Canada, there are several tax considerations that need to be taken into account. Understanding these considerations is crucial to ensure compliance with the Canadian tax laws and to optimize the tax benefits available to incorporated businesses. In this section, we will discuss eight important steps to consider when incorporating a business in Canada, with a focus on tax considerations.

The first step is to determine the appropriate business structure for your company. In Canada, the most common business structures are sole proprietorships, partnerships, and corporations. Each structure has its own tax implications, so it is important to carefully consider which structure best suits your business needs.

Once you have decided on the business structure, the next step is to register your business with the appropriate government authorities. This includes obtaining a business number, registering for the Goods and Services Tax (GST) or Harmonized Sales Tax (HST), and registering for payroll deductions if you plan to have employees.

After registering your business, it is important to understand the tax obligations that come with incorporation. This includes filing annual corporate tax returns, remitting payroll deductions, and collecting and remitting GST/HST. It is crucial to stay on top of these obligations to avoid penalties and interest charges.

Another important consideration is the small business deduction. This deduction allows eligible Canadian-controlled private corporations to reduce their federal corporate tax rate on the first $500,000 of active business income. To qualify for this deduction, certain criteria must be met, such as having more than 50% of the business’s assets used in an active business carried on primarily in Canada.

In addition to the small business deduction, there are other tax incentives available to incorporated businesses. These include the scientific research and experimental development (SR&ED) tax credit, which provides tax incentives for businesses engaged in research and development activities, and various provincial tax credits and incentives.

It is also important to consider the tax implications of paying yourself as a business owner. Depending on the business structure, you may be able to pay yourself a salary, receive dividends, or a combination of both. Each method has different tax implications, so it is important to consult with a tax professional to determine the most tax-efficient way to pay yourself.

Furthermore, it is important to keep accurate and organized records of your business transactions. This includes maintaining proper accounting records, keeping track of expenses, and retaining supporting documentation. These records are essential for preparing accurate tax returns and for responding to any tax audits or inquiries from the Canada Revenue Agency (CRA).

Lastly, it is highly recommended to seek professional advice from a tax accountant or tax lawyer when incorporating a business in Canada. They can provide guidance on the specific tax considerations relevant to your business and help you navigate the complex tax laws and regulations.

In conclusion, incorporating a business in Canada involves several tax considerations that need to be carefully addressed. From choosing the right business structure to understanding tax obligations and taking advantage of available tax incentives, it is important to be well-informed and seek professional advice. By following these eight steps and staying compliant with the Canadian tax laws, you can set your business up for success and maximize its tax benefits.

Hiring Professionals to Assist with the Business Incorporation Process in Canada

Hiring Professionals to Assist with the Business Incorporation Process in Canada

When it comes to incorporating a business in Canada, there are several steps involved. From choosing a business name to filing the necessary paperwork, the process can be complex and time-consuming. That’s why many entrepreneurs choose to hire professionals to assist them with the incorporation process. In this section, we will discuss the importance of hiring professionals and provide a comprehensive guide on how to find the right experts for your business.

First and foremost, hiring professionals can save you time and effort. Incorporating a business requires a deep understanding of legal and financial matters, and professionals who specialize in this area can navigate the process more efficiently. They can help you gather the necessary documents, complete the required forms, and ensure that everything is filed correctly and on time. By delegating these tasks to professionals, you can focus on other aspects of your business, such as developing your product or service.

One of the key professionals you may need to hire is a lawyer. A lawyer can provide legal advice and guidance throughout the incorporation process. They can help you choose the right business structure, such as a sole proprietorship, partnership, or corporation, based on your specific needs and goals. Additionally, a lawyer can review contracts, draft shareholder agreements, and ensure that your business complies with all legal requirements.

Another professional you may want to consider hiring is an accountant. An accountant can assist you with financial matters, such as preparing financial statements, creating a budget, and managing your taxes. They can also help you understand the financial implications of different business structures and guide you in making informed decisions.

To find the right professionals for your business, start by asking for recommendations from trusted sources, such as friends, family, or fellow entrepreneurs. You can also consult professional associations or industry-specific organizations for referrals. Once you have a list of potential candidates, take the time to research their qualifications, experience, and reputation. Look for professionals who have expertise in business incorporation and a track record of success.

When interviewing potential professionals, ask about their fees and billing structure. Some professionals charge an hourly rate, while others may offer a flat fee for specific services. It’s important to understand their pricing structure upfront to avoid any surprises later on. Additionally, inquire about their availability and communication style. You want to work with professionals who are responsive and accessible, as you may have questions or need assistance throughout the incorporation process.

Before making a final decision, consider meeting with a few professionals in person or via video conference. This will give you an opportunity to assess their professionalism, expertise, and compatibility with your business goals. Trust your instincts and choose professionals who you feel comfortable working with and who understand your vision for your business.

In conclusion, hiring professionals to assist with the business incorporation process in Canada can be a wise investment. They can save you time, provide valuable advice, and ensure that your business is set up for success. By following the steps outlined in this guide, you can find the right professionals who will guide you through the incorporation process and help you achieve your entrepreneurial dreams.

Common Mistakes to Avoid When Incorporating a Business in Canada

Common Mistakes to Avoid When Incorporating a Business in Canada

Incorporating a business in Canada can be a complex process, but it is an important step towards establishing a legal entity that can protect your personal assets and provide various tax benefits. However, there are several common mistakes that entrepreneurs often make when incorporating their businesses. In this section, we will discuss these mistakes and provide guidance on how to avoid them.

One of the most common mistakes is not conducting thorough research before incorporating. It is crucial to understand the legal requirements and regulations specific to your industry and province. Failing to do so can lead to costly delays and potential legal issues down the line. Take the time to consult with professionals, such as lawyers or accountants, who specialize in business incorporation to ensure you have all the necessary information.

Another mistake to avoid is choosing the wrong business structure. Canada offers several options, including sole proprietorship, partnership, and corporation. Each structure has its own advantages and disadvantages, so it is essential to carefully consider your business goals and consult with experts to determine the most suitable structure for your needs. Making the wrong choice can result in unnecessary taxes or legal complications.

Not having a clear shareholder agreement is another common mistake. A shareholder agreement outlines the rights and responsibilities of each shareholder and helps prevent conflicts and disputes in the future. It is crucial to have this agreement in place from the beginning to ensure everyone is on the same page and to protect the interests of all parties involved.

Failing to properly document and maintain corporate records is another mistake that can have serious consequences. It is essential to keep accurate records of all corporate activities, including meetings, resolutions, and financial transactions. These records are not only required by law but also serve as evidence of the company’s operations and decision-making processes. Neglecting this aspect can lead to legal and financial complications in the future.

Many entrepreneurs also make the mistake of not obtaining the necessary permits and licenses. Depending on your industry and location, there may be specific permits or licenses required to operate legally. Failing to obtain these can result in fines, penalties, or even the closure of your business. Research the requirements for your industry and ensure you have all the necessary permits and licenses before starting operations.

Another common mistake is not properly protecting intellectual property. Intellectual property, such as trademarks, copyrights, and patents, can be valuable assets for your business. Failing to protect them can leave your business vulnerable to infringement and loss of competitive advantage. Consult with an intellectual property lawyer to understand how to protect your intellectual property and avoid potential legal issues.

Underestimating the importance of tax planning is another mistake that entrepreneurs often make. Incorporating a business can provide various tax benefits, but it is crucial to understand and comply with the tax regulations. Failing to do so can result in penalties, audits, and additional taxes. Consult with a tax professional to ensure you are taking advantage of all available tax benefits and complying with the tax laws.

Lastly, not having a solid business plan is a mistake that can hinder the success of your incorporated business. A business plan outlines your goals, strategies, and financial projections, providing a roadmap for your company’s growth. It is essential to have a well-thought-out business plan to attract investors, secure financing, and guide your business decisions.

In conclusion, incorporating a business in Canada is a significant step towards establishing a legal entity with various benefits. However, it is crucial to avoid common mistakes that can lead to legal and financial complications. Thorough research, consulting with professionals, choosing the right business structure, having clear agreements, maintaining proper records, obtaining necessary permits and licenses, protecting intellectual property, tax planning, and having a solid business plan are all essential aspects to consider when incorporating a business in Canada. By avoiding these mistakes and taking the necessary steps, you can set your business up for success.

Benefits and Advantages of Incorporating a Business in Canada

Benefits and Advantages of Incorporating a Business in Canada

Incorporating a business in Canada offers numerous benefits and advantages that can help entrepreneurs establish a strong foundation for their ventures. From limited liability protection to tax advantages, incorporating a business provides a range of opportunities for growth and success.

One of the primary benefits of incorporating a business in Canada is the limited liability protection it offers. When a business is incorporated, it becomes a separate legal entity, distinct from its owners. This means that the owners, also known as shareholders, are not personally liable for the debts and obligations of the corporation. This protection shields personal assets, such as homes and savings, from being seized to satisfy business debts.

In addition to limited liability protection, incorporating a business in Canada also provides credibility and professionalism. A corporation is seen as a more established and trustworthy entity compared to a sole proprietorship or partnership. This can be particularly advantageous when dealing with suppliers, customers, and potential investors who may be more inclined to do business with a corporation.

Another advantage of incorporating a business in Canada is the potential for tax savings. Corporations are subject to a lower tax rate on their income compared to individuals. Additionally, corporations have more flexibility in managing their tax obligations through various deductions and credits that are not available to sole proprietors or partnerships. This can result in significant tax savings for the business and its owners.

Incorporating a business also allows for easier access to capital. A corporation can issue shares to raise funds from investors, which can be used to finance expansion, research and development, or other business initiatives. This ability to attract investment can be crucial for businesses looking to grow and compete in the market.

Furthermore, incorporating a business in Canada provides continuity and succession planning. Unlike sole proprietorships or partnerships, corporations have perpetual existence, meaning that the business can continue to operate even if the original owners or shareholders are no longer involved. This allows for smoother transitions in ownership and management, ensuring the long-term viability of the business.

Incorporating a business also opens up opportunities for employee benefits and incentives. Corporations can offer employee stock options, pension plans, and other benefits that can help attract and retain top talent. These incentives can enhance employee morale and productivity, contributing to the overall success of the business.

Additionally, incorporating a business in Canada can provide access to government grants, loans, and other forms of financial assistance. Many government programs are specifically designed to support incorporated businesses, offering funding for research and development, export initiatives, and other strategic projects. Taking advantage of these resources can give businesses a competitive edge and help them thrive in the Canadian market.

In conclusion, incorporating a business in Canada offers a wide range of benefits and advantages. From limited liability protection to tax savings, credibility, and access to capital, incorporating provides a solid foundation for business growth and success. Additionally, it allows for continuity, employee incentives, and access to government support. Entrepreneurs looking to establish a strong presence in Canada should consider the advantages of incorporating their businesses. By doing so, they can position themselves for long-term success in the Canadian market.

Post-Incorporation Obligations and Responsibilities for Canadian Businesses

Post-Incorporation Obligations and Responsibilities for Canadian Businesses

Once you have successfully incorporated your business in Canada, there are several important obligations and responsibilities that you must fulfill to ensure compliance with the law and maintain the smooth operation of your company. In this comprehensive guide, we will outline eight essential steps that every Canadian business owner should take after incorporating their company.

1. Obtain a Business Number and Register for Taxes

The first step after incorporation is to obtain a Business Number (BN) from the Canada Revenue Agency (CRA). This unique identifier is necessary for various tax-related activities, such as filing tax returns and remitting payroll deductions. Additionally, you will need to register for the appropriate taxes, such as the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST), depending on your business activities and location.

2. Open a Business Bank Account

Separating your personal and business finances is crucial for legal and accounting purposes. Opening a dedicated business bank account will help you keep track of your company’s income and expenses, making it easier to file taxes and manage your finances effectively. Be sure to choose a reputable financial institution that offers suitable business banking services.

3. Register for Provincial Sales Tax (PST), if applicable

In some provinces, such as British Columbia, Manitoba, and Saskatchewan, businesses may be required to register for Provincial Sales Tax (PST) in addition to the federal GST/HST. If your business operates in one of these provinces and sells taxable goods or services, it is essential to register for PST and comply with the associated reporting and remittance requirements.

4. Obtain Necessary Licenses and Permits

Depending on the nature of your business, you may need to obtain specific licenses and permits to operate legally in Canada. These requirements vary by industry and location, so it is crucial to research and identify the permits and licenses relevant to your business. Common examples include municipal business licenses, health and safety permits, and professional certifications.

5. Register for Workplace Safety Insurance

If you plan to hire employees, you must register for Workplace Safety Insurance (WSI) coverage. This insurance protects both workers and employers in the event of workplace accidents or injuries. Each province in Canada has its own WSI program, so make sure to register with the appropriate provincial authority.

6. Comply with Employment Standards

As an employer, you have certain obligations under federal and provincial employment standards legislation. These obligations include providing fair wages, maintaining safe working conditions, and adhering to regulations regarding hours of work, overtime, and vacation entitlements. Familiarize yourself with the employment standards in your province and ensure compliance to avoid legal issues.

7. Keep Accurate Financial Records

Maintaining accurate financial records is crucial for both legal and operational purposes. It is essential to keep track of all income, expenses, and financial transactions related to your business. This documentation will be invaluable when filing taxes, preparing financial statements, and making informed business decisions. Consider using accounting software or hiring a professional bookkeeper to ensure accuracy and efficiency.

8. File Annual Returns and Financial Statements

Finally, as a corporation, you are required to file annual returns and financial statements with the appropriate government authorities. These documents provide a snapshot of your company’s financial health and ensure transparency and accountability. Failure to file these reports on time can result in penalties and potential legal consequences, so it is crucial to stay organized and meet all filing deadlines.

By following these eight steps, you can fulfill your post-incorporation obligations and responsibilities as a Canadian business owner. Remember to stay informed about any changes in regulations or requirements that may affect your business, and seek professional advice when necessary. With proper compliance and attention to detail, you can set your business up for success in the Canadian market.

Q&A

1. What is the first step to incorporate a business in Canada?

The first step is to choose a unique business name and conduct a name search to ensure its availability.

2. What is the second step?

The second step is to determine the business structure, such as a sole proprietorship, partnership, or corporation.

3. What is the third step?

The third step is to appoint directors and determine their roles and responsibilities.

4. What is the fourth step?

The fourth step is to prepare the articles of incorporation, which outline the company’s purpose, share structure, and other key details.

5. What is the fifth step?

The fifth step is to file the articles of incorporation with the appropriate provincial or territorial government agency.

6. What is the sixth step?

The sixth step is to obtain necessary permits, licenses, and registrations specific to the business activities.

7. What is the seventh step?

The seventh step is to create corporate bylaws, which establish the internal rules and procedures for the company.

8. What is the eighth and final step?

The eighth and final step is to obtain a business number and register for applicable taxes, such as the Goods and Services Tax (GST) or Harmonized Sales Tax (HST).

9. Are there any ongoing requirements after incorporation?

Yes, there are ongoing requirements such as filing annual reports, maintaining corporate records, and fulfilling tax obligations.

10. Can I incorporate a business on my own or do I need professional assistance?

While it is possible to incorporate a business on your own, seeking professional assistance, such as from a lawyer or accountant, is recommended to ensure compliance with all legal requirements.

Conclusion

In conclusion, the 8 Steps to Incorporate a Business in Canada provide a comprehensive guide for individuals or entrepreneurs looking to establish a business in the country. These steps include conducting a name search, preparing the articles of incorporation, appointing directors, filing the necessary documents, obtaining necessary permits and licenses, setting up a corporate records book, obtaining a business number, and registering for applicable taxes. By following these steps, individuals can navigate the process of incorporating a business in Canada effectively and ensure compliance with legal requirements.